Property Tax Freeze for Seniors in Texas: Rules, Benefits, and Eligibility

October 5, 2025

Key Takeaways:

- Pros and Cons of Tax Deferrals and Tax Freezes: Tax deferrals delay payment until the property is sold or inherited, which can create a large balance over time. A freeze locks in school district taxes at the amount owed the first year of eligibility.

- Eligibility Basics for the Senior Property Tax Freeze: Eligibility requires being 65+, owning your primary residence, and officially applying for the Over-65 exemption, with potential additional benefits for disabled homeowners.

- Combining the Freeze with Disabled Homeowner Benefits: The property tax freeze and Over-65 exemption can work in tandem with existing homestead exemptions, offering compounded tax relief and stability.

As the rising costs of property taxes become dire, many Texas seniors are finding ways to juggle their fixed retirement incomes. Thankfully, the state recognizes these challenges and offers a property tax freeze for homeowners aged 65 and older.

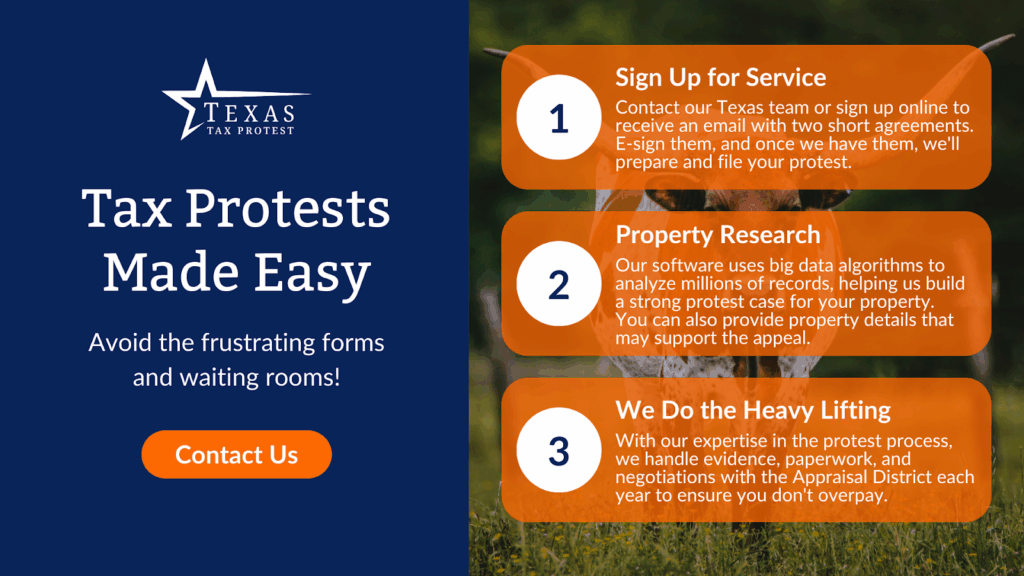

The process can feel complicated when you’re new to Texas property tax laws. That’s why our team at Texas Tax Protest steps in with both expertise and a people-first approach. We guide seniors through every exemption and savings opportunity, including the senior property tax freeze that can lock in your school district property taxes and bring stability to your household budget. In the sections ahead, we’ll explain what the senior tax freeze means, who qualifies, and how to make the most of this benefit.

Eligibility Basics for the Senior Property Tax Freeze

Turning 65 brings more than just a birthday cake, as it could bring a significant break on your property taxes. In Texas, the senior property tax freeze (often called the “Over-65 Homestead Exemption freeze”) aims to lock in the school district portion of your property taxes, preventing annual increases in that part of your bill. Here’s what’s needed to qualify:

- Age Requirement: You must be 65 years old or older during the tax year you’re applying. The freeze kicks in on your 65th birthday, even if you turn 65 late in the year.

- Primary Residence: The property must be your principal home, not a second house or investment property. One freeze per homestead.

- Exemption Application: Officially applying for the Over-65 exemption is a must. Bring proof of age (like a driver’s license showing your property address) when you submit your application to the appraisal district.

Once approved, the freeze limits your school district’s tax amount. Take note that taxes may decrease if your home’s assessed value drops, but increases are capped unless you make significant improvements, such as an addition or major remodel. Buying a new home after age 65 lets you transfer your freeze to the new homestead, though the amount may adjust proportionally.

How the Senior Freeze Differs from the Over-65 Exemption

In Texas, seniors can access meaningful property tax relief, but the options can sometimes feel unclear. Two of the most common tools, the Senior Freeze or “tax ceiling” and the Over-65 Exemption, work in different ways. Regardless, both are designed to ease the tax burden for homeowners aged 65 and older.

The Over-65 Exemption reduces the taxable value of a home. When someone turns 65, they can apply to subtract a set amount from the value used to calculate school district property taxes. That adjustment often removes thousands of dollars from the taxable amount, leading directly to smaller annual tax bills. The exemption takes effect as soon as eligibility is confirmed.

The Senior Freeze locks in the school district portion of the tax bill. After a homeowner turns 65 and applies, the amount paid in school district property taxes is frozen at the level of the first year the exemption is granted. Even if the home’s appraised value rises or tax rates increase later, the school district portion of the bill will not grow as long as the homeowner continues to live in the property. This freeze applies only to school district taxes, which are often the largest share of the bill, but it does not extend to city, county, or special district taxes.

Combining the Freeze with Disabled Homeowner Benefits

For Texans who qualify for the senior property tax freeze, a natural question comes up: how does it interact with the disabled homeowner exemption? State law allows residents who are both 65 or older and disabled to use both benefits together, creating significant savings on yearly property tax bills. The “freeze” isn’t only about locking in your school district taxes at the amount you owed when turning 65 or becoming disabled. These two statuses can stack, and here’s how it works:

- The senior freeze locks in the school taxes at the lower of the two eligible years, either the year you turned 65, or the year you were certified as disabled.

- You’ll receive the additional exemption for disabled homeowners, which further reduces your property’s taxable value.

For example, suppose you turned 65 in 2022 and received a disabled status in 2023. Texas law allows your school district tax ceiling to reset to the lower amount from either year. That protection, combined with the disabled exemption, can lead to substantial long-term relief.

To activate both, you’ll need to submit the required forms and documentation to your county appraisal district. Most counties accept verification from the Social Security Administration to confirm disability status. Once approved, the ceiling and exemption work together to create a stronger layer of protection against rising property taxes.

Tax Deferral vs Tax Freeze: Pros and Cons

Seniors looking to manage their property tax burdens in Texas often hear about both tax deferral and tax freeze options. While these two approaches can help reduce immediate financial strain, they work very differently and come with distinct pros and cons.

Property Tax Freeze: Stability and Predictability

A property tax freeze locks in the amount of school district property taxes you pay each year once you reach eligibility (generally age 65 or disabled). Even if property values climb or tax rates go up, your school district tax bill remains constant from that point forward unless you improve your home significantly.

Pros:

- Budgeting is easier: You know exactly what to expect year after year.

- No repayment down the line:The frozen amount stays put, with no additional debt accruing.

- Automatic inheritance of freeze: Your surviving spouse may continue to benefit if they meet certain criteria.

Cons:

- Only applies to school district taxes: City or county taxes can still increase.

- Doesn’t reduce the base amount: If your taxes are already high at the time of the freeze, you’ll keep paying that larger bill.

Property Tax Deferral: Immediate Relief, Long-Term Payback

A property tax deferral allows seniors (age 65+) and disabled homeowners to postpone paying current and future property taxes until the home changes ownership or is no longer the owner’s principal residence. Taxes postponed under this option accrue 5% interest per year, with payment due when the property is sold or transferred.

Pros:

- Instant cash-flow relief: You aren’t required to pay property taxes each year, freeing up money for other necessities.

- Flexible timeline: You can claim a deferral even if your tax bill is overdue.

Cons:

- Accruing interest: The unpaid tax bill isn’t forgiven, but rather it grows at a set rate.

- Estate implications: Heirs of the estate must settle the tax bill (and interest) if you move, sell, or pass away.

Effect of Home Improvements on a Frozen Tax Ceiling

Securing a property tax freeze as a senior in Texas creates lasting stability. Once your school district taxes stop climbing, you gain the peace of mind that your largest property tax bill will stay under control. But if you’re eyeing a bathroom remodel or planning to finally build that sunroom, you’re probably wondering: How do home improvements impact a frozen tax ceiling?

Under Texas law, the freeze applies to the home’s value at the time you first qualify. Ordinary upkeep, such as repainting, repairing the roof, or replacing old windows, doesn’t disturb the freeze. These projects are considered maintenance, not added value.

As for structural upgrades, the picture changes. Adding square footage, finishing an attic, or building an extension creates what appraisal districts call “new value.” That portion of value does not remain under the original ceiling. When improvements raise the appraised value, the tax ceiling for school district taxes is recalculated. The adjustment applies only to the added portion.

For instance, if your home was valued at $200,000 when the freeze began and you later add a $50,000 extension, only the new addition is subject to increased taxes. The rest of your property remains locked under the original frozen amount. In short, routine repairs leave the freeze untouched, while significant additions trigger a partial reset.

Final Thoughts

Property taxes in Texas can feel complex, yet the senior property tax freeze creates a measure of stability that many homeowners deeply value. This exemption protects against rising school district taxes, offering peace of mind and the confidence that homeownership can remain affordable throughout retirement.

Texas Tax Protest is passionate about helping seniors, homeowners, veterans, and commercial property owners uncover every legal path to property tax savings. Our expertise in Texas property tax laws, combined with a people-first approach and powerful technology, means clients get a clear, straightforward path toward maximizing their savings.

Read More:

- How Local School Districts and Governments Impact Your Property Taxes

- Texas Property Tax Relief Bills: Key Updates And Potential Savings

- What Really Happens During a Property Tax Protest Hearing?

Frequently Asked Questions About the Property Tax Freeze for Seniors in Texas

What is the property tax freeze for seniors in Texas?

The property tax freeze for seniors is a special exemption that locks in the amount of school district property taxes homeowners pay once they turn 65. While property values might rise, the capped school taxes remain the same, shielding seniors from significant increases as long as they own the home.

Who qualifies for the senior property tax freeze in Texas?

Homeowners who are 65 or older and occupy their home as their primary residence qualify for the tax freeze. The exemption is tied to your homestead property, meaning the home where you live most of the time, not investment or vacation properties.

At what age can I apply for the senior tax freeze?

You become eligible the day you turn 65. The freeze can be applied retroactively to your birthday, so it pays to apply as soon as possible after your 65th birthday.

Is the tax freeze automatic once I turn 65?

No, the tax freeze is not automatic. You’ll need to apply with your local county appraisal district to receive this benefit. Missing this step means you could miss out on valuable savings.

What happens to the freeze if I move to a new home?

If you relocate within Texas and buy another home to use as your primary residence, you can transfer your tax ceiling. The new school district will adjust your tax ceiling based on the ratio of your old home’s frozen taxes to its value, ensuring your savings travel with you, although some mathematical adjustments do happen to account for differences between the properties’ values.

Does the freeze apply to rental or investment properties?

No, the freeze applies only to your principal residence. That means homes you do not live in, like rentals or vacation homes, are not eligible.

Are there income or asset limits to qualify?

No income or asset restrictions exist for the senior tax freeze in Texas. Qualification is strictly based on age (65 or older) and your property being your primary residence.

Are there exceptions where the school district taxes still increase?

The freeze locks in the dollar amount of school district taxes, but if you make significant home improvements, those improvements can add to the part of your taxable value subject to school taxes, which could slightly increase your bill. Additionally, the freeze does not apply to city, county, or other special taxing entities.