Does A Fence Increase Property Taxes? Here’s What Homeowners Should Expect

November 3, 2025

Key Takeaways:

- Tax Impact Varies: Not all fences lead to higher taxes — the effect depends on location, materials, and how common fences are in your neighborhood.

- Valuation Is Relative: Appraisers use sales data and adjust for features like fences based on how your home compares to others that recently sold.

- Maintenance vs. Improvement: Replacing an existing fence with a similar one is usually not considered an improvement that increases taxable value.

Adding a fence to your property can be a practical decision — it offers privacy, improves security, and may even boost curb appeal. But for Texas homeowners, there’s often one lingering question before the posts go in: Will this raise my property taxes? Like many aspects of real estate valuation, the answer isn’t always straightforward. The type of fence, where you live, and how it compares to neighboring properties all play a role in how the appraisal district might treat the change.

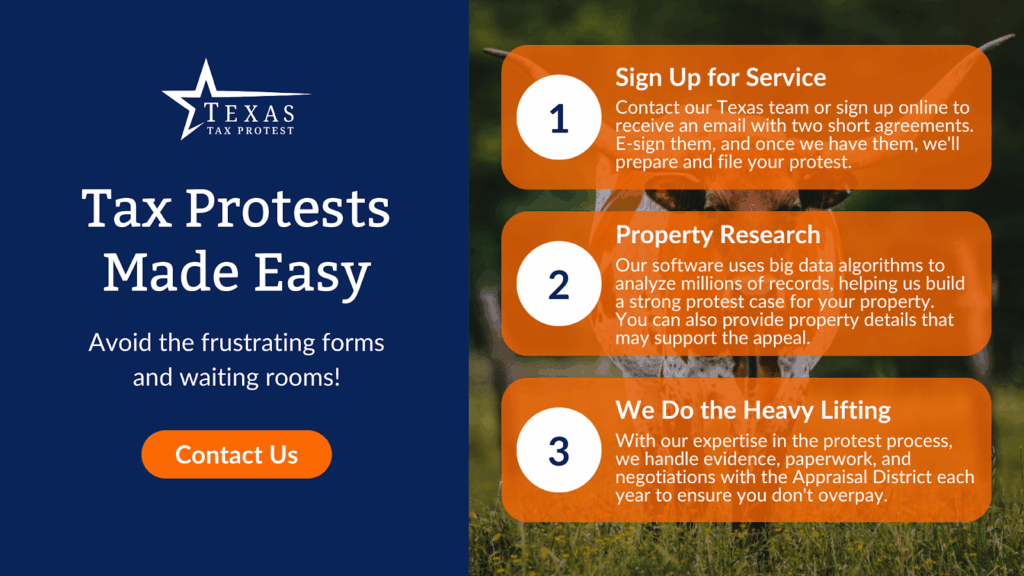

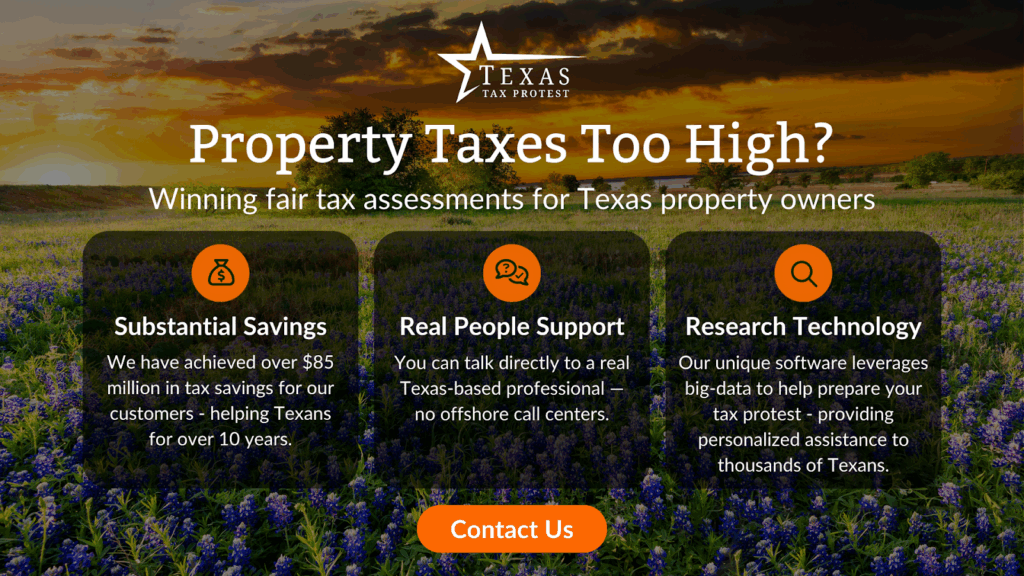

At Texas Tax Protest, we work exclusively on property tax appeals. That’s all we do — and we’ve helped thousands of Texans challenge their property valuations using real sales data, accurate adjustments, and an in-depth understanding of how appraisal districts make their decisions. We don’t offer exemptions, quotes, or gimmicks — just a focused, data-backed process for handling protests the right way.

In this piece, we’ll break down what homeowners can expect when adding a fence, how it might affect your tax valuation, and what actually matters to appraisers in Texas.

Why Property Improvements Like Fences Matter To Tax Appraisers

When you make improvements to your property — whether it’s a new deck, a renovated kitchen, or a freshly installed fence — the appraisal district takes note. These changes can affect how your property is assessed, and in turn, how much you pay in property taxes.

A fence might seem like a simple addition, but to an appraiser, it’s part of the overall value of your property. Improvements that are considered permanent, structural, or contribute to the utility or appeal of the land can potentially raise your appraised value.

The key factor? Whether the improvement is viewed as increasing the market value of your property. That’s what determines if it may impact your taxes — not just that it exists, but that it changes how your property compares to others in the area.

Property taxes shouldn’t feel confusing or out of your control. Discover the steps we take to challenge unfair assessments—clearly, transparently, and with you in mind. Take the first look today.

How A Fence Might Affect Your Property Valuation

Not all fences are treated equally in the eyes of the appraisal district. A chain-link fence around a backyard isn’t viewed the same way as a custom masonry wall with decorative ironwork. What matters is how the fence contributes to the overall desirability and functionality of the property.

In general, a fence may slightly increase your property’s appraised value if it’s considered a permanent improvement that enhances privacy, security, or curb appeal. But it’s rarely a major driver of value on its own. Appraisers often view fences as supporting features rather than primary upgrades — especially in areas where fencing is common.

The material, construction quality, and visibility of the fence all factor into how much value — if any — gets added. A modest backyard fence in a neighborhood where every home has one? It may not move the needle much at all.

Do All Fences Increase Property Taxes? It Depends

The short answer: not necessarily. A fence can lead to a higher property valuation, but it doesn’t always.

Appraisal districts look at property characteristics to decide if an improvement has changed the value. A fence might be logged in the appraisal record, but that alone doesn’t mean your taxes will increase. The question is whether the fence contributes meaningful value based on what’s typical for your neighborhood and market.

For example:

- If you build a high-end security fence in an area where most homes don’t have one, that could be viewed as an upgrade.

- On the other hand, a standard wooden fence in a subdivision where every lot is fenced might be considered routine — and may have little to no impact on valuation.

So while it’s possible a new fence could influence your tax bill, it’s not a guarantee. The context of your neighborhood and how your property compares to others plays a major role.

What Appraisers Actually Consider When Valuing A Fence

When it comes to fences, appraisal districts focus less on the fact that one exists — and more on how it contributes to the property’s overall market appeal. They’re not assigning a line-item dollar value to the fence alone. Instead, they’re looking at whether it changes how your home stacks up against recent sales in the area.

Key factors that may be considered include:

- Material and Construction: A vinyl privacy fence or stone wall may carry more weight than a basic chain-link or wood panel.

- Visibility: A front-facing fence is more likely to catch an appraiser’s attention than one in a rear yard that’s common to every home on the block.

- Neighborhood Norms: If fences are standard in your neighborhood, yours may not stand out as a value-adding feature.

It’s also important to note that appraisal districts often rely on aerial imagery or permit data to track changes — not in-depth inspections. So while a new fence might be noticed, it’s still evaluated as part of the total property package, not in isolation.

Unsure if you qualify for a protest or just need a second opinion? Our team’s here to listen and offer guidance that makes sense for your property. Get in touch today to start the conversation.

Understanding How Comparable Sales Influence Your Taxable Value

The value of your home isn’t calculated in a vacuum — it’s shaped by the sale prices of similar properties nearby, also known as comps (comparable sales). When a fence is factored into your appraisal, it’s usually because it contributes to how your home compares to others that have recently sold.

But appraisers don’t just pick three nearby sales and call it even. They make mathematical adjustments between properties to account for differences — including fences. For example, if a comparable home sold for $300,000 and had no fence, but your property has a quality fence, the appraisal model might adjust your value upward slightly to reflect that added feature.

These adjustments aren’t arbitrary. Appraisal districts use standardized models based on market data, so if fences in your area are shown to add resale value, that’s where the adjustment comes in. If they don’t — or if they’re common to every home — the impact may be negligible.

This is why it’s so important to look beyond surface comparisons. A neighbor’s sale price might seem low, but if their property lacked features like fencing, those differences are accounted for mathematically.

What Texas Homeowners Should Know About Fence Additions And Protests

In Texas, property owners have the right to protest their appraised value — and sometimes, that includes challenging how improvements like fences are being considered. But not every fence warrants a protest.

If you believe a fence caused your valuation to increase unfairly, the key is to look at comparable properties. Are there homes nearby with similar fencing that were valued lower? Have appraisers added value where it’s not supported by market data? These are the kinds of patterns that can form the basis of a protest.

What’s critical is not just pointing to sale prices, but understanding the adjustments made between those comps. A successful protest often hinges on identifying where those adjustments don’t line up with the local market or with appraisal district standards.

Also keep in mind: simply adding a fence doesn’t always result in a protestable increase. But if the valuation change seems disproportionate — especially when compared to similar homes — it’s worth reviewing the appraisal in more detail.

Already a client? Log in to review your protest details and see what’s next in the process. We make it easy to stay connected and in control of your case.

Final Thoughts

Installing a fence can improve your property’s privacy, security, and appearance — but its impact on your property taxes depends on how it’s perceived in the broader market. Most fences, especially those that are common in a neighborhood, have minimal influence on appraised value. High-end or uncommon fencing, on the other hand, may trigger a small adjustment.

Appraisal districts don’t assign value to fences in isolation. Instead, they look at your home as part of a group of comparable properties, using mathematical models and sales data to determine whether features like a fence affect overall value. That’s why context — the type of fence, where it’s placed, and how typical it is in your area — matters more than the improvement itself.

For Texas homeowners, knowing how fences fit into the appraisal process helps set realistic expectations. And if your property value does change after installing one, it’s worth reviewing the comps used — not just the improvement made.

Read More:

- How Local School Districts and Governments Impact Your Property Taxes

- Texas Property Tax Relief Bills: Key Updates And Potential Savings

- What Really Happens During a Property Tax Protest Hearing?

Frequently Asked Questions About Property Taxes

Can the county appraiser see my fence if I didn’t pull a permit?

Yes. Many appraisal districts use aerial photography, drive-bys, or third-party data sources to track visible property changes, including fences — even if no permit was filed.

Are permits required for building a fence in Texas?

Permit requirements vary by city or county. Some areas require permits for fences over a certain height or for specific materials, while others don’t require one at all.

Does replacing an old fence with a similar one affect my taxes?

Typically, no. Replacing a fence with the same type and quality is usually considered maintenance rather than an improvement that increases value.

Will a fence increase my land value or just the improvement value?

If a fence is considered to add value, it’s usually reflected in the improvement value of your property — not the land value.

Can I ask the appraisal district to remove a fence from my record?

If the fence no longer exists or was inaccurately recorded, you can request a correction. You’ll likely need to provide documentation or photographic evidence.

Does the location of the fence on my lot matter for taxes?

It can. A decorative fence in the front yard may draw more attention from appraisers than a basic privacy fence around the backyard, especially if it changes curb appeal.

Are there any tax exemptions available for fencing in Texas?

No, Texas does not offer property tax exemptions specifically for fencing, regardless of purpose or material.

If I install a fence for livestock, does that affect taxes differently?

Not directly. Agricultural or open-space valuation rules are separate from fencing and depend more on land use. However, proper fencing might support your ag-use qualification.

How do appraisers know what kind of fence I installed?

They rely on visual inspections, satellite imagery, or permit databases. If a specific type of fence isn’t visible or documented, it might not be accounted for at all.

Do fences impact taxes differently in rural vs. suburban areas?

Yes. In rural areas, fences are often functional and expected, so they may carry little to no added value. In suburban settings, they can be viewed as aesthetic upgrades.