Why Hire a Professional to Help Protest Your Texas Property Taxes?

August 25, 2025

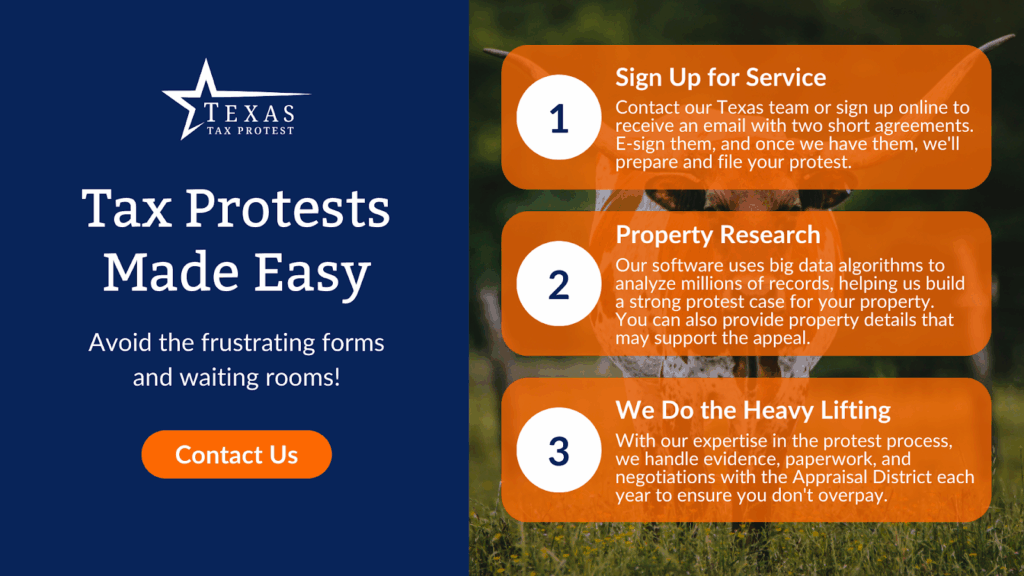

When property tax appraisal season hits in Texas, many homeowners are left wondering whether their assessed value is accurate and whether they should take action. While Texas law gives homeowners the right to protest their property tax assessments, navigating the process alone can be time-consuming and confusing. That’s where working with a professional—like Texas Tax Protest—can make a significant difference.

If you’re on the fence about whether to go it alone or seek expert help, here’s what you need to know about the benefits of hiring a professional to protest your Texas property taxes.

You Can Protest on Your Own—But Should You?

The Texas property tax system allows any homeowner to file a protest independently. The process typically involves submitting a protest form, gathering evidence, attending informal or formal hearings, and negotiating with the appraisal district.

But just because you can handle the protest yourself doesn’t mean it’s the best choice—especially when significant savings may be on the line. The complexities of valuation methods, local regulations, and negotiation strategies can quickly overwhelm even well-prepared homeowners.

That’s why so many Texans turn to professionals who understand the ins and outs of the system and can advocate effectively on their behalf.

The Benefits of Hiring a Tax Professional

Working with a property tax expert offers several advantages—especially when you partner with a firm like Texas Tax Protest.

Proven Results: Substantial Savings

Texas Tax Protest has helped homeowners across the state save over $85 million in property taxes. With more than 10 years of experience, we know what it takes to reduce inflated appraisals and secure real financial relief for our clients.

Professional firms understand how to analyze appraisal district data, spot inconsistencies, and build compelling cases. This experience often translates directly into bigger savings than homeowners could achieve on their own.

Access to Advanced Research Tools

Texas Tax Protest uses proprietary software that leverages big-data analysis to evaluate comparable sales, market trends, and inequities in appraisal values. This means your protest isn’t based on guesswork—it’s backed by personalized, data-driven insights that increase your chances of success.

For homeowners, collecting and interpreting this kind of information can be difficult and time-consuming. With a professional, it’s all handled for you.

Local Expertise Matters

Every county appraisal district in Texas operates a little differently. From evidence standards to hearing procedures, local knowledge can give you a major edge.

Texas Tax Protest brings real Texas-based support to every case. You’ll speak directly with someone who understands the local landscape—not an offshore call center. We’ve spent years building relationships with appraisal districts and navigating their unique rules and expectations.

Time Savings and Convenience

Preparing a strong protest takes time. Between paperwork, research, and hearings, the process can stretch over weeks or months. Many homeowners simply don’t have the bandwidth to manage it all effectively—especially if they’re unsure where to start.

A professional handles all this for you, freeing up your time and minimizing stress. You won’t need to chase down comparables or worry about deadlines—we take care of every step, from filing to final resolution.

No Guesswork or Surprises

Many homeowners are hesitant to protest because they don’t know what to expect or fear making a mistake. A professional brings clarity and structure to the process, helping you avoid common pitfalls and make confident decisions.

DIY vs. Professional: What’s the Real Difference?

Let’s compare:

| Do-It-Yourself | Texas Tax Protest | |

| Time Investment: | High—requires research, filing, and hearings | Low—handled by experienced professionals |

| Knowledge: | Self-taught or based on online resources | Backed by 10+ years of local experience |

| Tools: | Limited to what you can find or afford | Proprietary software using big-data analysis |

| Risk: | Higher chance of underprepared protest | Professional representation with proven results |

| Support: | None—you’re on your own | Real, Texas-based experts you can talk to |

For many homeowners, the difference in outcome can more than justify the choice to hire a professional—especially if your property taxes make up a large portion of your annual expenses.

What’s at Stake?

In Texas, rising home values have led to higher property tax bills across the board. Even a modest reduction in your appraised value can lead to hundreds—or even thousands—of dollars in savings. More importantly, a successful protest can affect future years as well, helping to keep your tax burden in check over time.

When you partner with Texas Tax Protest, you’re investing in peace of mind, experienced advocacy, and a much stronger chance of success.

Maximize Your Savings with Expert Help

Hiring a professional to protest your Texas property taxes isn’t just about convenience—it’s about getting results. From data-driven preparation to local insight and proven negotiation strategies, working with an expert like Texas Tax Protest gives you the strongest chance of securing the savings you deserve.

Reach out to Texas Tax Protest to discuss your property and learn how we can help. Whether you’re new to protesting or a seasoned homeowner looking for support, we’re here to guide you every step of the way.