What Happens If the Appraisal Is Higher Than Your Offer?

July 27, 2025

Key Takeaways:

- Why Appraisals Sometimes Outpace Offers: Appraisals often reflect past sales, property features, and market shifts that can push the value above what you agreed to pay.

- How a High Appraisal Affects Your Loan and Equity: Lenders still base your loan on the purchase price, but a higher appraisal can unlock early equity and smoother financing.

- What Buyers Can Do and When to Call for Backup: Use the appraisal as leverage during closing. If your assessed value starts creeping up, a property tax protest can help bring it back down.

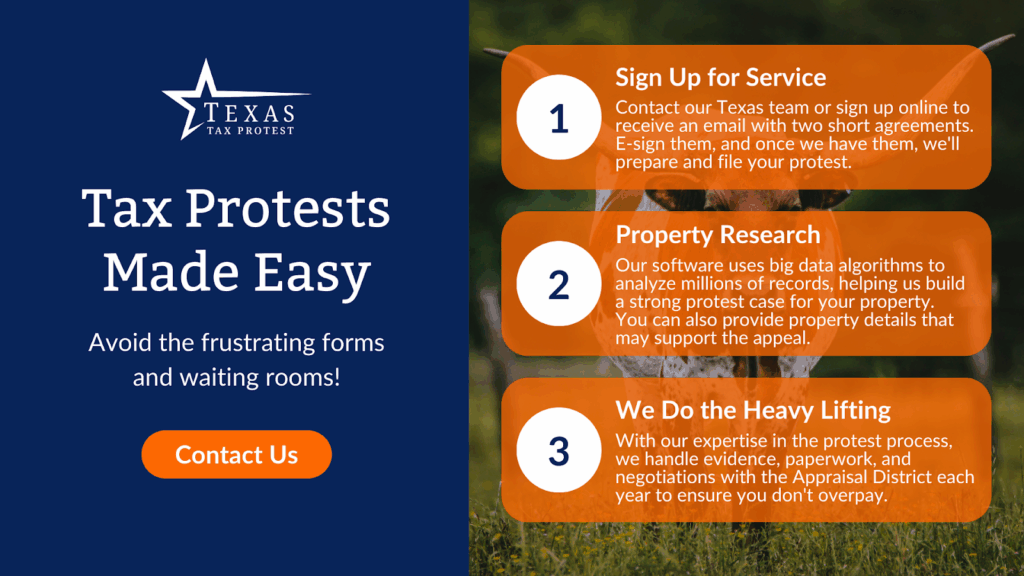

Texas homebuyers often expect the appraisal to match their purchase price, or land somewhere close, so when the appraised value comes in above their offer, it can raise more questions than answers. While a higher appraisal may seem like a win, it can shape how your property is taxed. Our team at Texas Tax Protest works directly with homeowners to uncover where valuation errors happen and push back when those numbers inflate your tax bill.

In the sections below, we’ll break down why appraisals often exceed offer prices, how that affects financing and tax obligations, and which steps can help you stay ahead of avoidable costs.

Reasons Why an Appraisal Might Exceed Your Offer

Homebuyers are often surprised when an independent appraisal comes in higher than what they’ve agreed to pay for a property. Below are the most common reasons this happens, along with examples that help clarify how those numbers come together.

Recent Sales Might Reflect an Earlier Market

Appraisers use comps from recent home sales to estimate your property’s value. These comps usually reflect deals closed several weeks ago. For example, if homes in your area sold for $340,000 in March and you secured an agreement in April for $320,000, the appraiser might still lean on those higher sales as benchmarks. That $20,000 gap doesn’t necessarily reflect your home’s actual condition—it shows a lag between sales data and current offers.

Some Sellers Accept Lower Offers

Not every deal reflects market value. A seller moving for a new job or dealing with a life event may accept a lower price to close quickly – appraisers, however, base value on fair market transactions, not personal motivations. So even if your offer was accepted under unique circumstances, the appraiser may value the home closer to what other buyers were willing to pay in unrelated sales.

Feature Adjustments Matter

Appraisers adjust for physical differences between your home and nearby comps. These include square footage, age, lot size, renovations, or upgrades. For example, say a similar home nearby sold for $350,000 with a newly remodeled kitchen, but yours needs a full update. The appraiser might subtract $10,000 to $15,000 from the comp’s value before applying it to your appraisal.

On the other hand, if your home has a larger yard or extra bedroom that is not reflected in comps, those features could increase the appraised value even if your offer didn’t account for them.

Location and Appeal Play a Role

Two homes can look identical on paper but sit on very different lots. One might back up to a greenbelt, while another faces a busy intersection. Appraisers take those factors into account when evaluating desirability. Values tend to rise in neighborhoods where location or views add measurable appeal.

Market Pressure Can Drive Values Up

A limited housing supply can push appraisals up even during slower buying periods. When fewer listings are available and recent sales show bidding activity, appraisers often reflect that momentum in their valuations. That means a home priced at $310,000 could appraise for $325,000, based on nearby sales where demand was high and competition intense.

How a High Appraisal Can Shape Your Mortgage and Your Next Steps

A home appraisal that lands above your offer might sound like a win, but it carries implications worth unpacking. From loan terms to long-term planning, here’s how lenders handle high appraisals and where buyers should keep an eye on the fine print.

Lenders Focus on the Lower Number

Most lenders base your mortgage on the appraised value or the agreed-upon price, whichever is lower. A high appraisal does not change your down payment or loan amount. Say you’ve offered $300,000 on a home, but the appraiser values it at $320,000. The lender calculates your loan-to-value ratio using the $300,000 price, not the higher appraised number. If you’re putting 10% down, your out-of-pocket cost stays at $30,000, even though the property is technically worth more.

This gap between offer and appraisal is considered instant equity. While that equity won’t reduce your mortgage payment, it can strengthen your position if you decide to refinance later or apply for a home equity line of credit. Some buyers also view it as a sign that they’ve negotiated well or avoided overpaying. However, from a lender’s perspective, this high appraisal lowers their risk by confirming that the property is worth more than they’re lending.

Higher Appraisals Can Still Lead to Surprises

Although the loan process tends to move forward without friction, a high appraisal may create other ripple effects. For example, local appraisal districts in Texas review sales activity to adjust values for property tax purposes. A recent high appraisal – even one unrelated to a tax assessment—might encourage the county to look closer.

Another challenge can emerge if the high appraisal doesn’t reflect your home’s true condition. Maybe your purchase price was lower due to needed repairs, but those factors didn’t appear clearly in the report. In that case, you could face future tax assessments that seem misaligned with what you paid and what the home was worth in context.

Our team at Texas Tax Protest regularly helps homeowners flag those mismatches. We break down how comps were selected, adjustments were calculated, and where the county may have leaned too heavily on inflated appraisal data when setting your valuation.

How to Move Forward Comfortably as a Buyer

A higher appraisal can strengthen your position as a buyer. It confirms the home is worth more than the amount you’ve agreed to pay, which opens the door to several strategies.

Negotiate Repairs or Credits

Many sellers view a strong appraisal as validation of their asking price. At the same time, buyers can use that higher number to request repairs, credit for upgrades, or flexibility on closing costs. The gap between the appraised value and the offer leaves space for both parties to find a middle ground that benefits everyone involved.

Secure Your Loan With Fewer Obstacles

Lenders tend to respond favorably to high appraisals. Since they base the loan on the lower purchase price or appraised value, a higher number often means the loan-to-value ratio improves. For example, your down payment remains the same on a $300,000 offer with a $320,000 appraisal, but you gain $20,000 in instant equity. That equity could make future refinancing or loan restructuring more accessible.

Save Your Appraisal Documents

After closing, keep your appraisal report and related correspondence safe. These records often come in handy when applying for refinancing, tracking market performance, or selling later. They also provide a helpful benchmark if property valuations rise too quickly.

How Property Tax Protests Can Offset the Impact

A higher appraisal sometimes reflects upgrades, unique amenities, or location perks that boost a property’s market value. In others, it might miss key context, like needed repairs or seller concessions that lowered your offer. If the county uses that higher valuation to justify an increase in your assessed value, you may have grounds to push back.

Our team at Texas Tax Protest steps in to do the heavy lifting. We review comps, check how adjustments were applied, and build a case that shows where the county may have overestimated. For example, if the county raised your assessed value based on nearby homes with remodeled kitchens or larger lots, we ensure those differences are accounted for. Staying ahead of these changes keeps your tax bill in check without adding stress to your plate.

Final Thoughts

Appraisals that come in above your offer can change more than you expect. They may not raise your purchase price or tax bill immediately, but they often influence future assessments and set the tone for how your property is valued moving forward.

Our team at Texas Tax Protest helps Texas homeowners and investors sort through those numbers before they become a larger tax burden. Sale prices, appraisal values, and nearby comps all interact to shape what you owe. When the county pulls data that overlooks key differences, our team runs the math and corrects the record. Keep your paperwork, review your comps, and stay alert to changes in your assessed value. And when something doesn’t add up, we’re ready to take it from there.

Read more:

- The True Cost Of Homeownership: It’s More Than Just Your Mortgage

- Texas vs. California Property Taxes: Which State Hits Your Wallet Harder?

- Home Equity Loan vs. HELOC: Breaking Down The Pros, Cons, And Use Cases

Frequently Asked Questions: What If Appraisal Is Higher Than Offer?

Do I have to inform the seller about a higher appraisal?

You’re not required to share the appraisal amount with the seller, especially if you’re the buyer. The appraisal report is ordered by your lender and is used mainly to confirm that the home is worth the amount you’ve agreed to pay. Unless there’s an agreement in your contract to disclose this information, the appraisal can remain between you, your lender, and your real estate agent.

Will a higher appraisal affect my loan-to-value ratio?

Absolutely. If the appraisal exceeds your offer price, your loan-to-value (LTV) ratio improves. The lender now sees their risk as lower – the property is worth more than you borrow. This stronger position can open up more favorable loan terms and potentially lower interest rates.

Can a higher appraisal affect my property taxes?

Yes, a higher appraisal could impact your property taxes in Texas. While the purchase price is a factor, local appraisal districts determine tax values by conducting annual assessments based on market trends and comparable sales. If your property is appraised higher, remember that county appraisers use complex adjustments between comparable sales.

Does a higher appraisal mean I have instant equity?

In many cases, yes. A higher appraisal means buying for less than the home’s appraised market value. That difference can be considered instant equity. However, this equity is on paper unless you sell or refinance the property. Local markets and assessor revaluations can influence the real, long-term benefit.

Can a high appraisal affect future refinancing options?

A high appraisal now can work to your advantage later. When you decide to refinance, lenders will look at your equity stake and the property’s current value. If your home appraised higher at purchase and it holds or increases in value, you may qualify for better refinancing options, lower rates, or even cash-out opportunities.

Should I expect the seller to raise the price after a high appraisal?

Once the contract is signed, most sellers cannot raise the price unilaterally because of a high appraisal. Texas purchase contracts usually lock in the offer amount. Still, some sellers may reconsider accepting lower offers if high appraisals become a market trend.

How does a high appraisal influence the real estate market?

High appraisals can set a new benchmark for home values in a neighborhood. When appraisers adjust between sales comparisons, they look at features such as updates, lot size, and age of the property, using mathematical formulas to arrive at fair market values. Over time, several high appraisals can lead to rising property values and impact tax assessments for everyone in the area.

Can the seller back out of a contract if the appraisal is too high?

Generally, sellers can’t back out of a signed contract because the appraisal exceeds the purchase price. Unless a specific clause allows the seller an out in this situation, they are typically bound to the agreed terms. Always review your contract with a knowledgeable professional to understand your rights.