Understanding the Texas Property Tax Appeal Process

August 20, 2025

Texas homeowners face an unprecedented challenge: skyrocketing property taxes that strain household budgets and threaten long-term financial stability. As property values continue to climb across the state, many residents are burdened with tax assessments that may not accurately reflect their property’s actual market value. The good news? You have the right to appeal these assessments and potentially reduce your tax burden.

Property taxes represent one of the most significant annual expenses for Texas homeowners, and their steady increase stems from various factors beyond individual control. Local governments rely on these taxes to fund essential services like schools, emergency response, and infrastructure maintenance. However, this doesn’t mean you should pay more than your fair share. At Texas Tax Protest, we’re committed to helping property owners navigate the complex appeal process and secure equitable assessments that reflect actual market value.

Why Property Taxes Keep Rising in Texas

Property tax increases in Texas result from a perfect storm of market conditions and local government funding needs. Strong population growth, economic development, and limited housing inventory have driven property values higher across the state. Meanwhile, local municipalities depend on property tax revenue to maintain and expand public services for growing communities.

These rising taxes have real consequences for Texas families and businesses. Many homeowners, especially those on fixed incomes, face difficult choices between maintaining their properties and meeting other essential expenses. Recent data shows that Texas property taxes have grown at nearly three times the rate of household income over the past decade, creating an unsustainable burden for many residents.

The Power of Strategic Appeals

Successfully appealing your property tax assessment requires more than just filling out forms—it demands a data-driven approach backed by solid evidence and expert analysis. Texas law provides multiple strategies for challenging evaluations, each with strengths depending on your situation. Understanding these approaches can significantly improve your chances of securing a fair valuation.

Let’s explore the four primary methods for appealing your property tax assessment:

Sales Comparison (Market) Approach

The sales comparison approach is often the most straightforward method for residential properties. This strategy involves analyzing recent sales of comparable properties in your area to demonstrate that your assessment exceeds market value. Successfully implementing this approach requires:

- Identifying truly comparable properties sold within the past year

- Making appropriate adjustments for differences in size, condition, and features

- Presenting clear evidence showing why your property’s assessed value should be reduced

Income Approach

For income-producing properties, the income approach can be particularly effective. This method evaluates your property’s value based on its potential to generate income, considering:

- Current and projected rental income

- Operating expenses and vacancy rates

- Market capitalization rates

- Net operating income calculations

Cost Approach

The cost approach estimates what it would cost to rebuild your property from scratch, less depreciation, plus land value. This method can be beneficial for:

- Newer properties

- Special-use properties

- Properties with unique features or construction methods

This approach requires a detailed analysis of the following:

- Current construction costs

- Physical depreciation factors

- Functional obsolescence

- External obsolescence affecting property value

Uniform and Equal Approach

Texas law requires that properties be taxed uniformly and equally at 100% market value. This approach compares your property’s assessed value with similar properties in your area. Success with this strategy involves:

- Identifying a representative sample of comparable properties

- Analyzing assessment ratios

- Demonstrating inequitable treatment in your assessment

Making Your Appeal Work

To maximize your chances of success, follow these essential steps:

First, carefully review your appraisal notice as soon as it arrives. Note any discrepancies in property details, such as square footage, number of rooms, or property condition. Gather relevant documentation for your chosen appeal strategy, including recent sales data, income statements, or construction cost estimates.

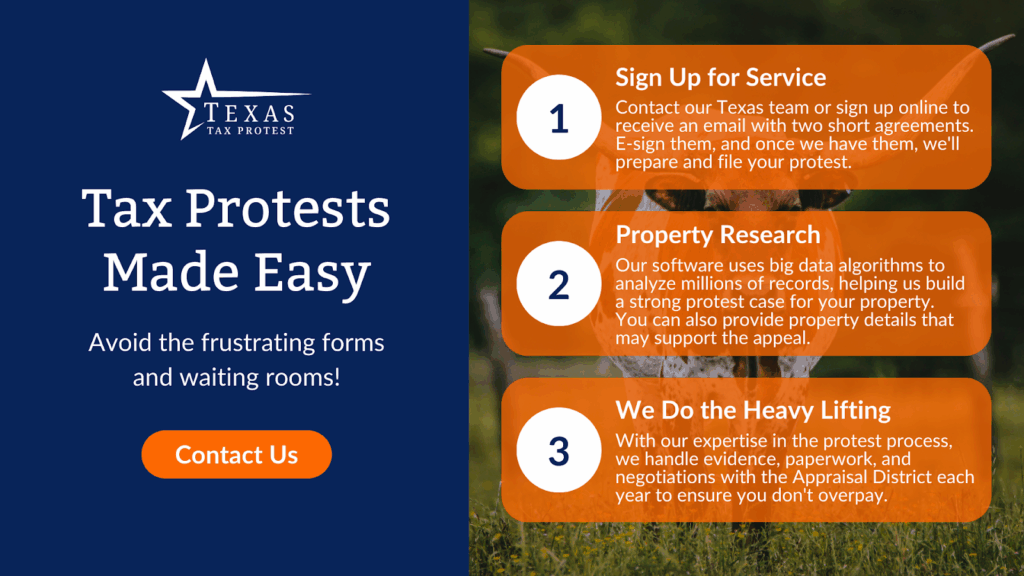

While property owners can handle appeals independently, professional representation often leads to better outcomes. Texas Tax Protest’s licensed professionals bring:

- Deep understanding of local market conditions

- Access to comprehensive property databases

- Experience in presenting compelling evidence to review boards

- Strategic expertise in selecting the most effective appeal approach

Taking Action

Understanding these appeal strategies is your first step toward ensuring fair property taxation. In today’s rapidly changing market, it’s more important than ever to challenge assessments that don’t reflect actual market value. Every dollar saved through a successful appeal means more money in your pocket for years.

Ready to explore your appeal options? Contact Texas Tax Protest for a free, personalized evaluation of your property tax assessment. Our team of experts will analyze your situation, recommend the most effective appeal strategy, and guide you through every step of the process.