Texas Voters Approve Historic Property Tax Relief Through Constitutional Amendments

December 11, 2025

Key Takeaways:

- Homestead Relief: The amendment increases the school tax exemption for primary residences from $40,000 to $100,000, reducing taxable home values.

- New Appraisal Cap: Non-homestead properties under $5 million are now limited to a 20% annual increase in appraised value for tax purposes.

- Ongoing Action Needed: Despite the relief, property owners must still review and protest their valuations to manage their property tax bills effectively.

Property taxes in Texas have long been a point of frustration for homeowners and business owners alike. Rising appraisals and unpredictable tax bills have pushed many to demand change at the legislative level. In response, Texas voters recently passed a historic set of constitutional amendments aimed at delivering meaningful property tax relief. These changes are more than political headlines, they directly affect how your property taxes are calculated and what you may owe in the years ahead.

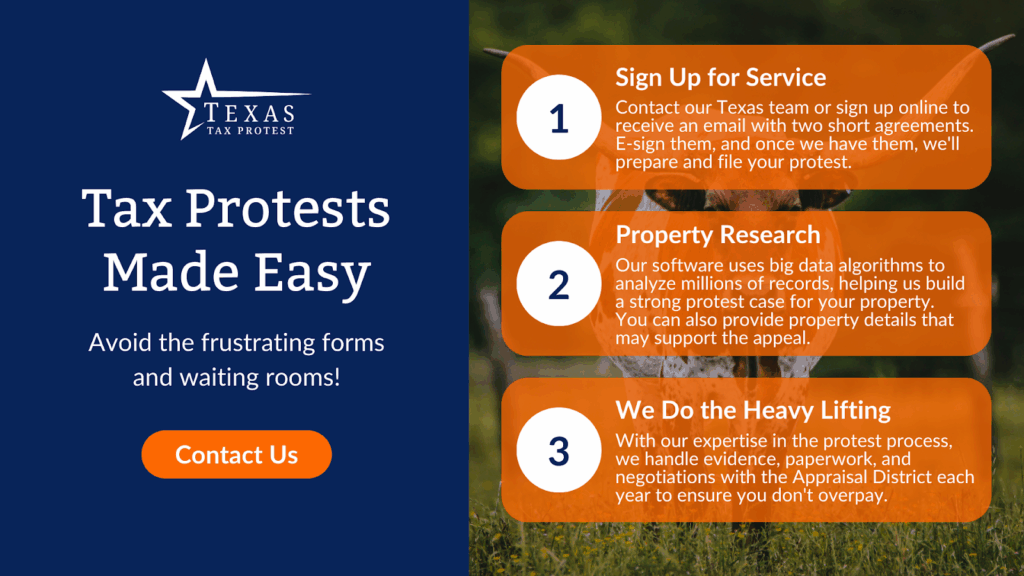

At Texas Tax Protest, we’ve helped Texans save over $85 million in property taxes by focusing on what really matters: accurate valuations, deep market research, and real local support. With more than a decade of experience and advanced technology built specifically for the Texas market, we don’t just follow tax law changes, we help property owners navigate them with precision. You’ll always work with Texas-based professionals who know the difference between county policy and state law, and who are here to help you challenge inflated values with data that makes a difference.

A Landmark Vote: What Texans Approved At The Ballot Box

In a major decision this election cycle, Texas voters approved a set of constitutional amendments that deliver substantial property tax relief across the state. This outcome reflects growing public concern over rising property taxes and the financial pressure they place on homeowners and small business owners alike.

At the center of the vote was Proposition 4, a carefully structured amendment package that modifies how school property taxes are calculated, expands homestead exemptions, and implements new limitations on appraisal increases. Voter turnout signaled strong support, confirming that Texans are ready for a shift in how property tax burdens are managed.

The passage of these amendments isn’t just a policy update. It marks a historic turning point in how Texas approaches property tax reform at the constitutional level, directly impacting the way taxable values and school funding are balanced for years to come.

Inside The Amendments: Key Tax Changes You Should Know

The property tax relief package passed by Texas voters isn’t one single fix. It’s a combination of targeted amendments aimed at reducing the tax burden on both homeowners and business owners. Here’s what’s inside the legislation and why it matters:

Homestead Exemption Raised To $100,000

One of the most impactful updates is the increase of the homestead exemption from $40,000 to $100,000. This change directly reduces the taxable value of a homeowner’s primary residence, lowering school property taxes for millions. The increase in exemption applies to all eligible homeowners and is a major step in long-term affordability.

School Tax Rate Compression

The amendments require school districts to reduce their property tax rates, also known as compression. Since school taxes make up a large part of most tax bills, this change has immediate benefits for taxpayers. The state will make up the difference in funding to ensure that local schools remain financially supported.

New Appraisal Growth Cap On Non-Homestead Properties

For commercial and non-homestead residential properties valued under $5 million, annual appraisal increases are now capped at 20 percent. This limit helps business owners and investors avoid sudden spikes in property valuations, offering more predictability in planning. The cap applies across the state and is a key part of the broader relief effort.

The Numbers Behind The Relief: What It Means For Homeowners

Tax policy often sounds abstract until you see how it plays out in actual dollars. With these new amendments in place, many Texas homeowners will notice a meaningful difference in their annual property tax bills. Here’s how the numbers translate into real-world savings:

Homestead Exemption Savings Example

Under the new $100,000 exemption, a homeowner with a property valued at $350,000 for school tax purposes would now be taxed on $250,000 instead of $310,000. If the local school tax rate is $1.00 per $100 of valuation, that’s a $600 annual savings compared to the previous exemption amount. This change alone makes a significant difference in household budgets.

Tax Rate Compression Adds More Value

In addition to exemption savings, school tax rate compression compounds the benefit. If the district’s tax rate is reduced by even a few cents per $100 of valuation, that amount is multiplied across the taxable value. Homeowners may see hundreds of dollars in additional savings each year depending on their property’s value and the local rate change.

Projected Impact Across Texas

According to state estimates, the combined effect of the increased exemption and tax rate compression could save the average Texas homeowner over $1,200 annually. These numbers will vary based on property values and local rates, but the direction is clear. The amendments are designed to bring relief that is both immediate and sustainable.

Reining In Appraisals: How The New Cap Affects Future Increases

While exemption increases and rate compression offer short-term relief, appraisal limits are designed to address long-term tax pressure. The new 20 percent cap on appraised value growth for certain properties creates a barrier against steep annual spikes. Here’s what this means for property owners moving forward:

Who The Cap Applies To

The cap applies to non-homestead real property valued at $5 million or less. This includes commercial buildings, rental homes, and other income-producing properties that are not a primary residence. It does not apply to raw land or properties under active development.

How The Cap Works

Each year, the appraisal district can raise the assessed value of an eligible property, but it cannot exceed a 20 percent increase from the prior year’s appraised value. For example, if a property was valued at $1 million last year, the new value cannot exceed $1.2 million this year, regardless of market conditions. This protects property owners from aggressive reassessments that could inflate tax bills unexpectedly.

Limitations And Considerations

This cap does not freeze values, and it does not apply to homesteads, which are already protected under a separate 10 percent cap. Additionally, the cap does not limit the actual market value of a property, just how quickly the appraisal district can increase the assessed value used for taxation. Property owners still need to review their notices each year to check for errors or inflated values.

Why It’s Not Just About The Ballot, It’s About The Protest Process

Legislative changes can improve the system, but they don’t replace the need for property owners to actively manage their tax valuations. Even with new exemptions, rate reductions, and appraisal caps, inflated property values can still lead to higher tax bills. That’s where the protest process continues to play a critical role:

Annual Reviews Are Still Necessary

The appraisal district assigns a market value to your property each year, and that value directly affects your tax bill. If the value is overstated, you may end up paying more than your fair share. Homeowners and business owners should carefully review their notices and protest when discrepancies arise.

Comps Aren’t Just About Location

When preparing a protest, it’s not enough to find a nearby sale. At Texas Tax Protest, we account for adjustments between comparable properties using actual mathematical formulas. That includes differences in square footage, year built, condition, lot size, and any special features that can affect value. This approach goes beyond surface comparisons and strengthens your case.

New Caps Don’t Guarantee Accuracy

A 20 percent limit on increases may sound protective, but if the starting point is too high, the cap only slows future growth. That’s why reviewing your valuation every year remains essential, regardless of legislative changes. The protest process is still your most direct and effective tool for controlling your property tax burden.

How Texas Tax Protest Supports Property Owners In This New Landscape

The passing of constitutional amendments may provide structural relief, but that doesn’t mean property owners should go it alone. Navigating property valuations, understanding new rules, and building a solid protest requires more than just reading your tax notice. Texas Tax Protest helps fill that gap with experience, tools, and support tailored to the realities of Texas property taxation:

A Track Record Of Savings

Over the past decade, Texas Tax Protest has helped property owners save more than $85 million on their property taxes. This impact is the result of consistent data analysis, in-depth research, and a hands-on approach to building effective protests. We understand what drives valuations across Texas counties and use that insight to challenge excessive appraisals.

Advanced Research, Real Support

Our proprietary software combines large-scale data analysis with local market knowledge to evaluate each case. But we don’t rely on automation alone. Clients get direct support from real Texas-based professionals, not overseas call centers. You’ll speak with someone who knows the appraisal districts and understands how to apply the new rules to your specific situation.

Take The Next Step

Whether you’re responding to a high valuation or preparing for next year’s tax cycle, we’re ready to help. Learn how Texas Tax Protest can support your property tax protest by visiting our contact page. The earlier you start, the better prepared you’ll be.

Final Thoughts

The approval of Texas’s property tax relief amendments reflects a strong public demand for change. Homeowners and business owners alike have been vocal about the rising cost of property ownership, and the ballot box delivered a meaningful response. These amendments offer real financial relief and greater protections for the future, especially through homestead exemption increases, school tax rate compression, and appraisal caps.

However, these measures don’t eliminate the need for vigilance. Appraisal values can still be inaccurate, and tax bills may remain higher than they should be without proper oversight. Property owners must continue reviewing their valuations and consider filing a protest when the numbers don’t align with the actual market value of their property. The changes in law help, but they do not replace personal action.

Texas Tax Protest is here to support that effort, not just during tax season but as the broader tax environment evolves. The landscape may be shifting, but the fundamentals of keeping your property taxes in check remain the same: know your rights, understand your data, and protest when necessary.

Read Also:

- Texas Leaders Finalize Property Tax Relief Deal for Residents and Companies

- Texas Property Tax Relief Bills: Key Updates And Potential Savings

- Texas Property Tax Relief: What Homeowners Need to Know

Frequently Asked Questions About Texas Tax Relief Amendment

What is the main goal of the Texas tax relief amendment?

The primary goal is to provide property tax relief by reducing the financial burden on property owners while maintaining adequate funding for public schools.

Does the amendment change how appraisals are conducted?

No, the amendment doesn’t change the appraisal methodology used by appraisal districts. It only introduces limits on how much certain property values can increase year to year.

Are renters affected by the Texas tax relief amendment?

Renters do not receive direct property tax reductions, but landlords with capped appraisal growth may be less likely to pass on significant tax increases through rent hikes.

Is there a separate application needed to benefit from the new homestead exemption?

If a homeowner has already applied and qualified for the homestead exemption, the increased amount is applied automatically. No new application is typically required.

Does this amendment affect property taxes at the city or county level?

No, the amendment specifically targets school district taxes, which are a large part of the total property tax bill. City and county tax policies remain separate.

How are appraisal caps different from tax rate reductions?

Appraisal caps limit how fast the taxable value can increase each year, while tax rate reductions lower the percentage used to calculate what you owe on that value.

Can newly purchased properties take advantage of the new appraisal cap?

The 20 percent appraisal cap does not apply to the first year of ownership. It begins the following tax year after the property has been assessed under the new owner.

Will these changes stay in place permanently?

Because they were passed as constitutional amendments, they remain in effect unless repealed or altered by future voter-approved amendments.

Are business properties included in the tax relief amendment?

Yes, non-homestead properties under $5 million, including commercial properties, are eligible for the new 20 percent appraisal cap.

What happens if school funding needs increase in the future?

The state of Texas is expected to cover funding gaps caused by lower school tax collections, but future legislative sessions could revisit funding formulas as needed.