Texas Property Tax Relief Bills: Key Updates And Potential Savings

September 15, 2025

Key Takeaways:

- Legislation Impact: New bills offer more protections and transparency, but don’t guarantee lower taxes unless homeowners act.

- Savings Potential: Homeowners may benefit from increased exemptions and limits on valuation increases when filing a protest.

- Expert Support: Working with experienced professionals helps interpret local district behavior and build stronger protest cases.

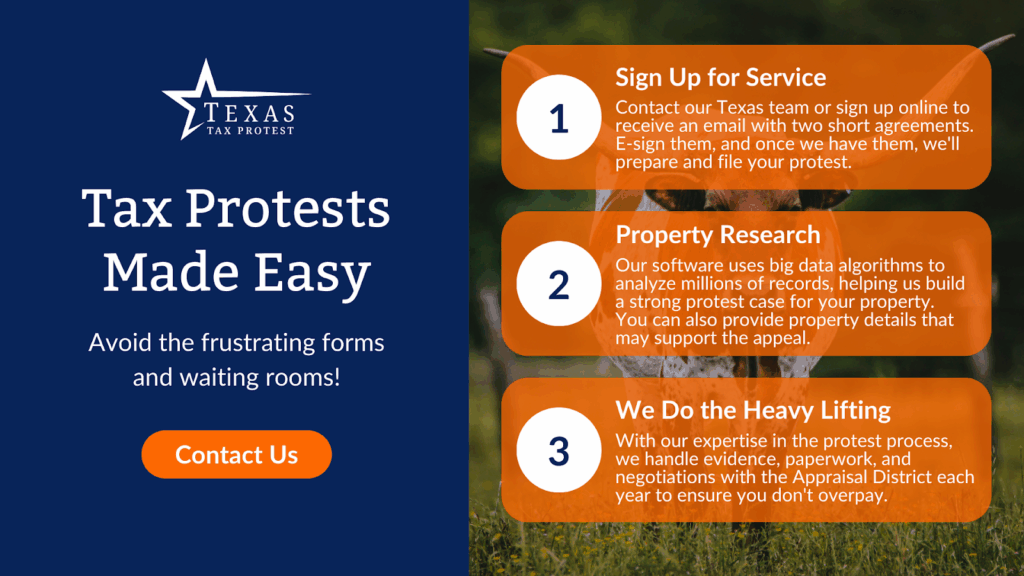

With over $85 million in property tax savings delivered to Texas homeowners and more than a decade of protest experience across appraisal districts, including TAD, we don’t just understand the system. We challenge it. Texas Tax Protest combines local expertise with powerful data tools to help homeowners fight back against unfair valuations, year after year.

Property taxes in Texas are more than just a line item on your annual statement, they’re a major, recurring cost that can strain household budgets and reduce the long-term value of your investment. And because Texas doesn’t have a state income tax, property taxes carry even more weight in how our communities are funded. That’s why when legislation changes, it matters, especially for those of us who monitor and protest these assessments every day.

Recent updates to Texas property tax relief bills aren’t just political headlines. They represent a shift in how property is assessed, taxed, and challenged. Whether you’re a seasoned homeowner or navigating your first appraisal protest, understanding these changes could directly influence how much you pay next year.

In this piece, we’ll break down the latest Texas property tax relief bills, key updates you should know, and how these changes could lead to real savings on your next tax bill.

Overview Of Recent Texas Property Tax Relief Bills

In response to growing concerns from property owners, Texas legislators have passed several tax relief bills aimed at curbing the rate of tax increases and improving transparency in the appraisal process.

One of the most impactful moves came with Senate Bill 2, which caps how much local governments can increase property tax revenue without voter approval. This bill was designed to slow aggressive tax hikes and give property owners a stronger voice in local taxation.

Another notable change is Senate Bill 12, which expanded homestead exemptions for elderly and disabled Texans. While not all homeowners qualify, the bill signals a broader effort by the state to address the affordability crisis caused by rising property taxes.

Most recently, legislation passed in 2023 and 2024 introduced measures to:

- Increase the homestead exemption cap for school districts

- Provide additional school funding to reduce reliance on local property taxes

- Expand appraisal board training to standardize practices across counties

Each of these bills contributes to a more balanced property tax system, but only if homeowners know how to respond.

You don’t need to read every line of legislation to take advantage of these changes. Talk to a Texas-based expert who can guide you on how recent bills might apply to your specific situation.

Key Updates Homeowners Should Know

Understanding the latest changes in Texas property tax relief legislation can help you avoid overpaying when your appraisal notice arrives. Here are some of the most important updates that could directly affect homeowners like you:

Increased Homestead Exemptions

Recent bills raised the standard homestead exemption for school taxes, offering more protection for primary residences. If you already have a homestead exemption on file, this adjustment could reduce your taxable value automatically, no extra paperwork required in most cases.

Limits On Appraisal Increases

Some counties now apply stricter limits on how much a property’s assessed value can rise year-over-year. This is particularly beneficial for homeowners in fast-growing areas where market values can spike significantly. However, these limits may not apply if you’ve recently purchased your home or made major improvements.

Transparency In Appraisal Methods

New legislation pushes appraisal districts to improve transparency in how they determine property values. While this doesn’t mean you’ll agree with the result, it gives you more leverage when challenging inflated valuations. That includes the ability to request and analyze comparable sales data, where adjustments must be made based on factors like square footage, condition, and lot size.

At Texas Tax Protest, we don’t just look at surface-level comps. We apply precise mathematical adjustments to ensure comparisons are accurate and relevant to your property, so you’re not stuck with a bad valuation just because it’s “similar.”

Want to know if your county has adopted these updates? Connect with our Texas-based team to learn what applies in your area, including TAD and other major appraisal districts.

How These Bills Could Impact Your Property Tax Bill

The true value of these property tax relief bills lies in how they influence your bottom line. Whether you’re a long-time homeowner or have recently purchased your property, these legislative changes could have a meaningful impact on what you owe.

Lower Assessed Values = Lower Tax Bills

With increased homestead exemptions and stricter appraisal guidelines, there’s a greater chance that your assessed value could come in lower, if you know how to respond strategically. These bills don’t automatically guarantee savings, but they do open the door to a fairer evaluation when you file a protest.

More Opportunities To Challenge Appraisals

Thanks to improved transparency and appraisal board training, homeowners now have more information at their fingertips. That means better data to work with when preparing a protest, and more consistency in how appraisal districts must justify their assessments.

Voter-Approved Tax Rate Caps

When taxing authorities want to increase rates beyond a set threshold, they now need voter approval. This puts more control in the hands of property owners and can limit sudden, steep hikes in future tax bills.

Why Timing Matters

The appraisal calendar moves quickly. If you wait too long, you may miss the window to take advantage of the relief options available to you. Staying proactive is key.

If your appraisal notice doesn’t reflect the protections offered under recent bills, it’s time to act. Explore how our property tax services can help you respond with confidence.

How To Maximize Your Savings With A Professional Protest

Legislation can open the door to potential savings, but actually reducing your property tax bill takes more than knowing the rules. It takes experience, data, and a strategic approach to protesting your valuation.

Data-Driven Analysis, Not Guesswork

At Texas Tax Protest, we use proprietary software powered by big data to compare your property to similar homes, making precise adjustments for square footage, year built, condition, and location. It’s not just about finding comps; it’s about building a case with mathematical accuracy that holds up to scrutiny.

Personalized Support From Real People

This isn’t a self-serve portal or a chatbot. When you work with us, you’re working with real Texans, professionals who know local market trends and appraisal district behavior. Whether you’re in TAD or any other county, our team understands how to navigate each district’s nuances.

Consistent Success, Year After Year

With over $85 million in tax savings secured for our clients, we’ve helped thousands of homeowners challenge unfair valuations and put real money back in their pockets. It’s not about one-time wins, it’s about long-term tax strategy.

Don’t leave potential savings on the table. Let’s talk about your property and how recent legislative changes could strengthen your protest.

Don’t Navigate This Alone: Get Help From Real Texans

Understanding Texas property tax relief bills is one thing, putting them to work for your property is another. The process is technical, time-sensitive, and often confusing, especially when appraisal districts don’t make things easy.

That’s where we come in.

At Texas Tax Protest, we offer more than just paperwork processing. Our Texas-based team provides hands-on support, walking you through each step of the protest process. You’ll never be routed to an offshore call center or left wondering who’s handling your case. When you call, you talk to real people who live and work right here in Texas.

Whether you’re located in Harris County, Travis County, TAD, or elsewhere, we’re familiar with the way each district operates. That means we know where to look for inconsistencies, how to challenge inflated appraisals, and how to present your case with clarity and precision.

If the latest bills have opened up new opportunities to reduce your taxes, we’ll help you find them, and act on them. Start the conversation with our expert team today.

Final Thoughts

Property tax relief in Texas isn’t just a headline—it’s a real opportunity for homeowners to take back control of their tax bills. But that opportunity only turns into savings when you understand the laws, know how they apply to your situation, and take strategic action.

The recent bills passed in Texas reflect a clear trend: lawmakers are responding to the financial pressure homeowners are feeling. With increased homestead exemptions, capped revenue growth, and greater appraisal transparency, there’s more reason than ever to challenge an unfair valuation.

Still, legislative change doesn’t guarantee lower taxes. You need a partner who understands the fine print and fights for every adjustment you’re entitled to.

At Texas Tax Protest, we’ve helped Texans save over $85 million—and we’re just getting started. Let’s see what this year’s changes could mean for your property, and how we can help you stay ahead of the curve.

Read also:

- How to Protest Your Texas Property Taxes: A Step-by-Step Guide

- Reassessment Explained: How It Affects Your Property Taxes

- What Happens If You Don’t Pay Property Taxes in Texas

Frequently Asked Questions About Texas Property Tax Relief Bills

What is the purpose of Texas property tax relief bills?

The primary purpose is to reduce the financial burden on homeowners by limiting tax increases, increasing exemptions, and improving transparency in the appraisal process.

Do these bills apply to commercial properties or just residential homes?

While some provisions may impact commercial properties, the majority of recent Texas tax relief legislation is focused on residential homeowners, especially those with homestead exemptions.

Are tax relief bills passed at the state or local level?

Most property tax relief measures are passed at the state level, but their implementation can vary by local taxing entities, which still control appraisal and tax rates.

Can renters benefit from property tax relief bills in Texas?

Not directly. Renters don’t pay property taxes themselves, but property tax savings for landlords could theoretically reduce pressure to raise rents, though this is not guaranteed.

How often are new tax relief bills proposed or passed in Texas?

Typically, tax relief bills are proposed during each legislative session, which occurs every two years. However, urgent issues may trigger special sessions or updates.

Do I need to reapply for a homestead exemption when a bill changes the rules?

No. If you’re already qualified and your exemption is on file, increases to the exemption amount usually apply automatically.

What role do school districts play in property tax bills?

School taxes make up the largest portion of most Texas property tax bills. Many relief bills target school tax rates or exemptions to provide the most widespread benefit.

How do these bills affect appraisal districts like TAD?

They influence how appraisal districts operate by requiring more transparency, adjusting how increases are capped, and setting new rules around protests and valuation methods.

What happens if my appraisal doesn’t reflect changes from recent relief bills?

You have the right to protest your valuation. Filing a protest is often the only way to ensure your property is assessed fairly under current law.

Are there deadlines tied to property tax relief implementation?

Yes. Most changes go into effect at the start of a new tax year, but deadlines to protest or file exemptions vary by county and must be monitored closely.