Think You’re Overpaying In Property Taxes? How A Tax Grievance Could Save You Thousands

September 1, 2025

Key Takeaways:

- Why Texans File Tax Grievances: Homeowners often file when they notice inflated valuations, inaccurate property details, or unfair comparisons to upgraded homes. Protesting creates a path to correct those issues and lower your annual tax bill.

- Signs That Your Property Is Overvalued: Start by reviewing your appraisal notice, then compare your home to recent sales in your neighborhood. Adjust for differences in square footage, condition, or features to see if your value stands out from the average.

- Tax-Saving Strategies for Homeowners: Exemptions like Homestead, Over-65, or Disabled Veteran can significantly reduce your taxable value. Combining these with a well-documented protest helps keep property taxes at bay.

For countless Texans, property tax season stirs up an uneasy question: Am I paying more than my fair share? Eye-popping assessments arrive in the mail, sometimes with figures that leave homeowners and business owners scratching their heads. Each year, thousands quietly accept these numbers and write the check, not realizing there’s an opportunity to challenge the system and put money back in their pockets.

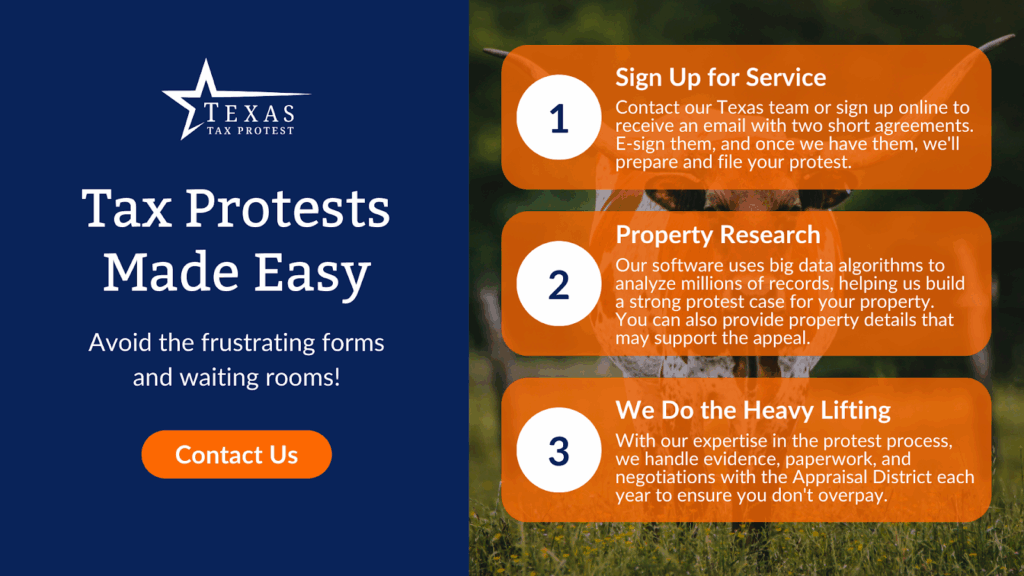

Our team at Texas Tax Protest is here to simplify the process. We pair local expertise with smart technology and personalized guidance to help you take control of your tax bill. This guide walks through how a tax grievance works and what steps you can take to uncover meaningful savings, without needing to become a property tax expert overnight.

What Is A Tax Grievance?

A tax grievance is a formal way to challenge your property’s assessed value. Every year, appraisal districts across Texas assign a number to your home or commercial property that determines how much you’ll owe in taxes. That number should reflect your property’s actual market value, but in many cases, it doesn’t.

Why Texas Homeowners Choose To File A Tax Grievance

For many homeowners, receiving an appraisal notice sparks confusion and frustration. One year, the valuation seems fair, and the next it jumps tens of thousands of dollars without warning. Here are some common reasons why homeowners decide to protest:

- Inaccurate square footage: Your county’s appraisal district might list your home as 2,800 square feet when it’s 2,500. With an average price per square foot of $200 in your neighborhood, that 300-square-foot error could add $60,000 in assessed value—and hundreds in unnecessary taxes.

- Missing or outdated features: Some assessments assume upgrades that were never made. For example, if a nearby comp sold for $450,000 with a brand-new kitchen and finished basement, but your home hasn’t been updated in over a decade, subtracting the estimated upgrade value can help balance the comparison.

- Deferred maintenance or repair issues: Cracked foundations, roof damage, or aging systems affect your property’s market value. Photographs and repair estimates can show that your home wouldn’t sell for as much as a neighboring one in better condition.

- Unfair comparisons to larger or remodeled properties: A comp with an extra bathroom or a larger lot should be adjusted before being used in your assessment. If a nearby home has 500 more square feet and sold for $500,000, subtracting the added value for the larger size (at $200 per square foot, that’s $100,000) gives a more accurate comp for your protest.

- Significant property changes: Removing a structure, converting a garage, or dealing with damage from a storm can all impact a property’s value. These changes often don’t get factored in unless they’re brought to the appraisal district’s attention.

How To Determine If Your Property Is Overvalued

High property taxes often start with inflated valuations. When your assessment feels out of step with your home’s condition or the market around you, it might be time to take a closer look. The good news? You don’t need a finance degree or a team of real estate experts to spot potential overvaluation. Here’s how to break it down:

Review Your Notice Of Appraised Value

Each spring, your local appraisal district sends a Notice of Appraised Value by mail. This document lists your property’s proposed market value for the current tax year. You’ll typically receive it sometime between March and April, although dates may vary by county. The number you’re looking for appears near the top of the notice and reflects what the district believes your home could sell for on January 1 of that year. Review this number carefully. Look for sudden increases from the previous year or any discrepancies in the listed details.

Collect Comparable Properties

To figure out whether your appraised value is fair, compare your property to others that recently sold in your area. Start by searching public real estate platforms like Zillow, Redfin, or Realtor.com. Many county appraisal districts also offer searchable databases of recent sales. Focus on properties that sold within the past 12 months and are located within your neighborhood or subdivision.

The goal is to find homes that closely match your square footage, lot size, number of bedrooms and bathrooms, construction year, and general condition. A good comp isn’t just nearby—it mirrors your home’s key features. Pay close attention to sale dates, since the closer the transaction is to January 1, the more relevant it will be to your protest.

Make The Right Adjustments

Don’t just line up sale prices and call it a day. Mathematical adjustments are key: factor in differences such as square footage, lot size, number of bedrooms, renovations, or the presence of a pool. For example, if your house is 200 square feet smaller than a nearby comp, subtract a reasonable amount based on the average price per square foot in your area. If you lack a feature that’s present in a comp like an upgraded kitchen, deduct value to level the playing field.

Watch Out For Outliers

Some sales look like comps on paper but skew the average in practice. For example, a property that sold far below market value due to a distressed sale or a cash-only offer might create a misleading baseline. On the flip side, a home with extensive upgrades or a unique location, such as a corner lot or waterfront view, may sell higher than the typical home in your area.

Stick with three to five reliable comps that fall within a reasonable price range. Cross-reference each with your home and verify that the differences are minimal or at least quantifiable. The more consistent your set of comps, the more persuasive your protest will be.

Compare And Question

Once you’ve gathered and adjusted your comps, line them up against the appraised value listed in your notice. If your math shows your home’s market value should be significantly lower, say, $350,000 instead of the district’s $390,000, there’s a strong case to file a grievance.

Additionally, keep screenshots, sales records, and a summary of your adjustments. These will help you build a solid presentation when it’s time to submit your protest or speak to an appraiser. Accuracy and organization matter more than formality here. Showing your work with confidence helps reinforce why your proposed value deserves serious consideration.

Other Tax-Saving Strategies For Texas Homeowners

Reducing your property tax burden isn’t limited to protests alone. Texas homeowners have several tools to cut down their annual costs, from targeted exemptions to strategic reassessments. Learning how to use these options can lead to long-term savings and fewer surprises each spring.

Tax Exemptions That Can Lower Your Property’s Taxable Value

One of the most accessible ways to reduce your tax bill is through exemptions. These lower the portion of your home’s value that can be taxed, leading to measurable savings year after year. While most people start with the Homestead Exemption, Texas offers a range of exemptions tailored to different circumstances. Here are some of the most common exemptions available:

- Homestead Exemption: Available to homeowners who use the property as their primary residence. This exemption reduces the taxable value of your home, which lowers your annual property tax.

- Over-65 Exemption: Homeowners aged 65 or older can apply for an additional exemption that provides further tax relief on top of the Homestead Exemption.

- Disabled Person Exemption: Texans with a qualifying disability may receive the same level of exemption as seniors, which applies to both school and some local taxing districts.

- Veteran Exemptions: Several levels of exemptions exist for veterans, including partial exemptions for disabled veterans and full exemptions for 100% disabled or unemployable veterans.

- Surviving Spouse Exemption: Surviving spouses of disabled veterans, service members killed in action, or first responders may qualify for continued or additional exemptions based on their partner’s service.

How Protesting Property Taxes Helps You Save Each Year

Protesting your property taxes gives you more than a temporary fix. It builds a consistent, long-term strategy that protects your finances as your property value and tax rates shift over time. When done correctly, filing a protest can lead to measurable savings each year, and here’s why:

- Inflated valuations directly raise your tax bill: Appraisal districts estimate what your property is worth, but their data isn’t always up to date. Protesting allows you to correct those numbers using recent sales and accurate square footage. For example, lowering your assessed value by $35,000 at a 2.5% tax rate could reduce your bill by nearly $900 for the year.

- Property tax bills compound over time: When a high valuation goes unchallenged, it becomes the starting point for future increases. Filing each year helps prevent a snowball effect where your taxes rise based on old, inaccurate data.

- Minor errors can lead to major savings: Something as small as an extra 100 square feet listed in county records can inflate your value by $15,000 or more. That kind of mistake is easy to miss unless you’re actively checking your appraisal each year.

- A protest creates a chance to highlight repairs or damage: Appraisers often assume a home is in average condition. Documenting cracked foundations, roof issues, or outdated interiors gives you a chance to show the true state of the property, often leading to a more realistic valuation.

Steps To File A Property Tax Grievance In Texas

Feeling that your Texas property tax bill doesn’t reflect reality? Filing a tax grievance offers a straightforward way to challenge your property’s assessed value. Here’s how that process typically unfolds, demystified into clear steps:

Review Your Notice Of Appraised Value

This notice usually arrives in your mailbox between March and April. It lists the county’s appraised value for your property and serves as your starting point. Scan the details carefully. Look for major value increases or errors in square footage, building type, or exemptions that didn’t carry over.

Look Up Comparable Properties

Search for recently sold homes in your area that are similar in size, age, and condition. Public real estate platforms and county appraisal websites can help you find comps. Once you’ve found matches, adjust for differences using simple math. For instance, subtract the value of a comp’s upgraded kitchen if your home hasn’t been renovated.

Complete A Notice Of Protest Form

This form is available through your local appraisal district. You’ll need to submit it by the deadline, either May 15 or 30 days after your appraisal notice was mailed. Be sure to mark your reason for protesting, usually due to an overstated market value or unequal comparison with nearby properties.

Gather Evidence That Supports Your Case

Organize your findings clearly. That might include adjusted comps, photos of needed repairs, contractor estimates, or proof of storm damage. The more precise your materials, the easier it becomes to present a strong argument.

Attend The Appraisal Review Board (ARB) Hearing

If your case doesn’t settle informally with the appraiser, you’ll be scheduled for a formal hearing. This is your chance to walk through your math, highlight comps, and share photos or documentation. The ARB will listen, ask questions, and then decide on a final valuation. If the outcome lowers your valuation, your tax bill will reflect the change. If you disagree with the result, you may still pursue arbitration or a court appeal, but most cases are resolved at the hearing level.

Let Our Team At Texas Tax Protest Handle It For You

Filing on your own takes time, research, and confidence in front of the ARB. Our team streamlines the entire process, finding comps, preparing the documentation, and presenting your case, so you can focus on your life while we work toward a fair assessment on your behalf.

Final Thoughts

Most Texans know when something feels off, especially when a tax bill suddenly spikes without a clear reason. High appraised values, mismatched comps, or outdated property details are common red flags that signal it’s time to take a closer look. Filing a tax grievance gives you the chance to correct the record.

Our team at Texas Tax Protest is here to take that pressure off your plate. We handle the research, gather the data, and advocate for a fair valuation so your property taxes stay grounded in reality. When the numbers don’t add up, you don’t have to accept them. You’ve got tools, timelines, and a team ready to make the process clear and worthwhile. If you need help, contact us today to get started.

Read more:

- Texas Property Tax Rates Explained: What Every Homeowner Should Know

- Texas Property Tax Rates by City: Where Does Your Area Rank?

- Texas Disaster Declarations and How They Impact Your Property Taxes

Frequently Asked Questions About Tax Grievances

What happens if my tax grievance is denied?

If the ARB denies your grievance, you still have options. You can take your case further by either requesting binding arbitration, pursuing a lawsuit in district court, or seeking a review by the State Office of Administrative Hearings (for certain property types). Each path has its own deadlines and requirements, so acting quickly matters.

What role does the assessor play in my tax grievance?

The assessor, or appraisal district, is responsible for determining your property’s market value each year. During a grievance, the assessor’s office will present how they calculated your value and may negotiate or defend their assessment either informally or before the ARB. Their job: make the case for their numbers. Your job: present clear, compelling evidence why your property is overvalued.

What’s the difference between a tax grievance and a tax exemption?

A tax grievance aims to lower your property’s taxable value by challenging the assessment itself, while a tax exemption reduces how much of your property’s value is taxable. Homestead, senior, veteran, and disabled exemptions each target specific groups or circumstances, and can be pursued alongside a grievance for added savings.

What if my property is in a declining market; can I still file a grievance?

Of course! Properties in neighborhoods with falling values often end up over-assessed, especially if the county’s data is slow to adjust to real-time market changes. A tax grievance allows you to present sales data, appraisal reports, and comparable properties, complete with mathematical adjustments for differences like square footage, age, upgrades, or lot size, to show what your home would truly sell for in this market.

Do changes in property value affect my tax grievance?

They do, and they can work to your advantage. Rising or falling property values, nearby sales, new construction, or even shifts in neighborhood amenities all influence how your property should be assessed. The more data and context you can bring, especially adjusted comparable sales, the stronger your grievance will be.

How long does it take to resolve a tax grievance?

Most grievances are resolved within a few months, typically between late spring and summer. You’ll usually first attend an informal meeting with the appraisal district, followed (if necessary) by a formal ARB hearing. More complex cases that head to arbitration or court can take longer, so be prepared for varying timelines. In every case, staying engaged and responsive will help speed up the process.