Is It Possible to Avoid Property Taxes? States to Consider

July 28, 2025

Key Takeaways:

- No State Offers a Property Tax Escape Hatch: While some states have lower rates, all rely on property taxes in some form. Homeowners can still reduce their tax bills through exemptions and accurate valuations.

- Low-Tax States Come with Tradeoffs: Places like Hawaii, Alabama, and Louisiana keep property taxes low by using alternative funding models. However, limited tax revenue can impact public services, infrastructure, and long-term home values.

- Proactive Steps Can Lead to Real Savings: Applying for exemptions, correcting errors in property records, and protesting inflated assessments are practical ways to lower your property tax bill without crossing any legal lines.

Property taxes are a yearly reality for most homeowners, whether you live in a sprawling Dallas suburb, a downtown Austin high-rise, or a quiet corner of El Paso. As home values rise, so do the bills, prompting many to search for states where property taxes might disappear altogether. A quick Google search reveals lists, rumors, and clickbait headlines claiming that “property tax-free” states exist.

In truth, every state collects property taxes in some form. Still, some states offer much lower rates, exemption-heavy systems, or funding models that ease the burden. That’s why “states with no property tax” is more myth than reality, but regardless, this assumption is a useful starting point for learning how rates work.

In this blog, we’ll clarify common misconceptions, explore states with no property tax load, and explain how our team at Texas Tax Protest helps homeowners understand exemptions and assessments in Texas.

Can You Actually Avoid Paying Property Taxes?

Property taxes may seem like a given, another expense that arrives each year, regardless of how your home performs or what’s happening in the market. Across the country, these taxes are a major funding source for local services such as public schools, fire departments, law enforcement, and infrastructure projects.

While certain states are rumored to eliminate property taxes, none have. In reality, states like Hawaii, Alabama, and Louisiana rank among the lowest in the country for average property tax rates, often thanks to unique funding formulas or generous exemption systems. However, even in these low-tax states, some form of property taxation remains to support county and municipal budgets.

There are legitimate options for homeowners hoping to cut down on yearly costs. Local exemptions, such as those for homesteads, seniors, or veterans, can reduce taxable value. While you can’t outright avoid property taxes, exploring every exemption and challenging unfair assessments is the closest most can get to keeping more money in your pocket.

States with Low Property Tax Rates

Property tax rates can make a meaningful difference in long-term affordability for anyone weighing a move or simply comparing costs. Some states consistently rank among the lowest in the nation, thanks to distinct funding models, caps on assessments, or local policies that ease the burden for homeowners.

Where Are Property Taxes Lowest?

Property taxes vary widely across the country, shaped by state laws, local priorities, and budget needs. In certain states, homeowners see substantially lower annual tax bills due to how assessments are structured and which services receive primary funding.

Hawaii continues to lead the pack for lowest property tax rates, with a median effective rate under 0.3%. Although property values tend to be higher, the low rate helps keep annual costs more manageable. Alabama and Louisiana follow closely, with average rates just above 0.3%. These states often combine lower home values with systems that lighten the tax load for primary residences.

In the West, Colorado and Wyoming maintain rates under 0.6% while funding essential local services. Several Midwestern states, including Indiana and Kentucky, have also carved out reputations for affordability through state-level tax caps and homestead exemptions that lower the taxable portion of a property’s assessed value. These states don’t eliminate property taxes but structure them in ways that give homeowners more breathing room. That’s why comparing state averages can be a helpful starting point when weighing long-term affordability.

Why Texas Property Taxes Are Higher

Texas ranks among the states with the country’s highest effective property tax rates. In many countries, average rates exceed 1.5%, and some even push closer to 2%. However, one of the biggest drivers behind this higher burden is the absence of a state income tax.

Since Texas doesn’t collect income tax, cities, counties, and school districts rely more heavily on property taxes to balance their budgets. That local structure allows each taxing entity to set rates independently, resulting in a cumulative bill that can grow quickly. While Texas law does include exemptions for homeowners, seniors, and veterans, these only go so far when values rise sharply across a county.

At Texas Tax Protest, our team helps property owners account for these factors through thoughtful valuation reviews and exemption strategies. We don’t just check the basics—we dig into condition, square footage, and age to calculate mathematical adjustments that can strengthen your case.

Pros and Cons of Living in Low Property Tax States

For many homeowners, states with low property tax rates seem like a dream. Less money going to local governments means more left in your pocket, or so it appears at first glance. In reality, the tradeoffs can run deeper than expected. Here’s what to weigh when considering a move to one of these tax-light states.

Pros

- Lower Monthly Housing Costs: Reduced or nonexistent property taxes mean monthly housing costs decrease. That’s especially appealing for retirees, first-time buyers, or anyone looking to stretch their dollar. In states with low property taxes, a significant chunk of annual expenses simply doesn’t exist, letting you save or invest elsewhere.

- Increased Buying Power: Low property taxes can make homeownership more accessible, since carrying costs drop and lenders may factor in lower taxes when calculating your borrowing power. In some cases, this enables buyers to consider properties in better neighborhoods or larger homes than they might otherwise afford.

- More Attractive Investment Potential: For investors, low property taxes can translate to higher net rental yields and an easier time holding onto properties during lean years. It removes a layer of unpredictability, making long-term forecasting less stressful.

Cons

- Other Taxes or Fees Often Fill the Gap: States still need to fund schools, roads, and emergency services. Many states lean more heavily on income or sales taxes to make up for low property tax revenues, or they might stack on additional local fees. The “low tax” advantage can disappear if those other bills get too steep.

- Public Services May See Less Investment: Reduced funding from property taxes can mean less investment in public schools, parks, or infrastructure. The quality gap might not be noticeable but can surface over time, sometimes in the form of longer response times for emergency services or aging public amenities.

- Home Values Could Be Affected Over Time: In some low property tax states, lagging investment in community resources may affect home values. Good schools, safe neighborhoods, and well-maintained roads are powerful draws for future buyers—if those are lacking due to funding constraints, resale potential could be impacted.

Smart Strategies for Lowering Your Property Tax Bill

Here’s how to start trimming your taxable value and keeping more of your money where it belongs.

1. Apply for Exemptions That Reflect Your Situation

Exemptions are one of the most direct ways to lower your taxable value. Homestead exemptions are available for primary residences in many areas, while additional programs exist for seniors, veterans, and people with disabilities. These programs vary by state and local jurisdiction, so reviewing what’s available in your area can be a solid first move.

2. Review Your Property Tax Assessment

Local appraisal districts use comps to estimate your property’s value and determine your tax bill. But comps aren’t always apples-to-apples. Adjustments are made for factors like square footage, age, condition, and lot size, so if your home was valued higher than recent, similar sales, you may have a case for a lower assessment.

3. Double-Check for Mistakes

Errors in property details, such as the recorded square footage or number of bedrooms, can inflate your tax bill. Comb through your assessment notice and records for accuracy, and flag any mistakes with your local office. Even minor discrepancies can translate into significant savings over time.

4. File a Formal Protest

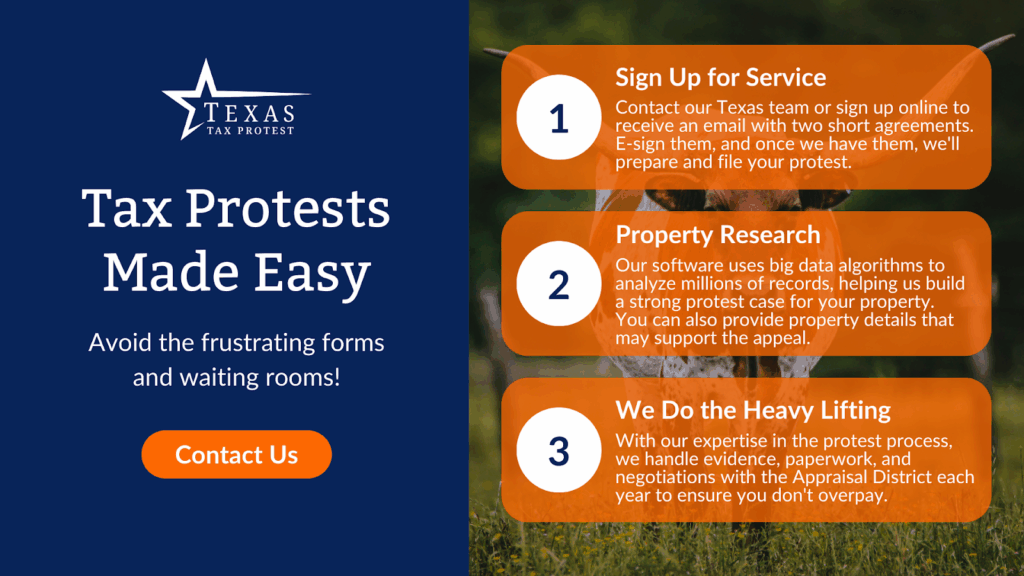

Each year, there’s a window to dispute your property valuation. Start by gathering supporting evidence: photos, recent sales data, repair estimates, or examples of similar properties assessed at a lower value. Make sure to account for any necessary adjustments that appraisers typically use, like differences in age, amenities, or location within a neighborhood. Our team at Texas Tax Protest reviews every variable to help build a clear, data-backed case.

5. Track Local Policy Changes

Tax rates can shift based on decisions made by city, county, or school district. Following changes at the city, county, or school district level not only helps you anticipate your tax bill, but can give you a heads-up on upcoming deadlines or new relief programs. Applying these strategies does take some legwork, but being proactive about your property taxes can be a game-changer for your budget.

Final Thoughts

Property taxes can be complex, particularly when home values rise and budgets feel tight. While no state offers completely tax-free homeownership, acting on them can lead to real savings. Across the country, property tax rates and exemption programs vary widely. Learning how these systems work gives you the tools to take control of your assessment, rather than feeling at the mercy of it. The process may seem complicated in Texas, but homeowners and commercial property owners have more leverage than they think.

At Texas Tax Protest, our team believes that a fair valuation is a right, not a luxury. We combine hands-on support with data-driven strategies to help clients analyze comparable sales, identify critical differences, and pursue the lowest legally allowable taxable value. Our reviews go deeper than just square footage or location. Instead, we factor in age, condition, layout, and other valuation criteria that influence how your property is assessed.

Read more:

- When Is the Time to Protest Your Property Taxes in Texas?

- Delinquent Taxes: What Happens If You Don’t Pay on Time?

- Tax Sale: What It Means and How to Prevent Losing Your Property

Frequently Asked Questions About Property Taxes and States with No Property Tax

Does owning a home in a different state affect property taxes?

Absolutely. Property taxes are set at the state and local level, so owning a home in another state means you’ll be subject to that state’s specific property tax laws, rates, and exemptions. For example, property owners in Texas must follow Texas property tax rules, while those in states like Florida or Nevada will encounter different regulations and assessment methods. Each state – and often, each county – can have unique exemptions and procedures.

Can renovations increase my property tax liability?

Yes, many renovations can increase your property tax liability. When you improve your property, the county appraisal district may re-evaluate your home’s market value. These enhancements typically increase your home’s assessed value, potentially resulting in higher taxes. However, not all renovations weigh the same. For example, cosmetic updates often have a more minor impact than significant additions.

What is the difference between property tax and real estate tax?

While often used interchangeably, property tax is a broader term. Real estate tax specifically refers to taxes levied on land and buildings. Property tax can also include taxes on personal property, such as vehicles or business equipment, depending on the jurisdiction. In Texas, homeowners typically deal with real estate tax, which funds local services like schools, fire departments, and infrastructure.

What factors contribute to the property tax rate in a given area?

Several factors shape property tax rates: local government budgets for schools, police, and public services; the total value of taxable property in the area; and approved voter initiatives like bonds. Texas, for instance, allows individual cities, counties, and school districts to set their rates, resulting in varied tax burdens across the state. Assessments based on recent comparable sales, property condition, and neighborhood trends feed into your final tax amount.

Does renting instead of owning affect property tax responsibility?

Yes, renting changes your direct responsibility. Owners pay property taxes directly to the county appraisal district, while renters do not pay property taxes to the county themselves. However, landlords factor their property tax costs into the rent they charge tenants, so renters still indirectly contribute to covering those taxes.

Can living in a mobile home reduce my property tax?

Living in a mobile home can result in lower property taxes, but only if the mobile home is classified as personal (not real) property and remains unanchored on leased land. Tax rates and treatment differ greatly: anchored or permanently affixed mobile homes usually fall under real estate tax rules. In contrast, unanchored homes might be taxed as personal property or through a special registration fee.

Can I dispute my property tax assessment?

Of course! Texas homeowners and commercial property owners can protest their annual property tax assessment. The protest process involves gathering recent, relevant, comparable sales, making detailed mathematical adjustments for differences such as lot size, built date, or renovations, and creating a case to show that your property’s value should be lower. Texas Tax Protest streamlines this process and brings data analysis and seasoned advocacy to each protest, helping clarify and potentially reduce your assessed value.