San Antonio Housing Market Insights For Buyers And Sellers

September 7, 2025

Key Takeaways:

- Market Shifts: San Antonio’s housing market is adjusting from post-pandemic highs, affecting pricing, inventory, and time on market.

- Assessment Awareness: Fluctuations in property value don’t always match appraisals, opening the door to legitimate protest opportunities.

- Tax Impact: Buying or selling a home can significantly affect future property tax obligations, especially when exemptions change.

The San Antonio housing market has become one of the most closely watched in Texas, as rising property values, fluctuating inventory, and changing buyer behavior continue to shape the landscape. For buyers and sellers alike, understanding how the local market is moving isn’t just helpful—it’s critical. From home prices to time on market, every data point has the potential to influence decisions and, just as importantly, affect how much property owners are taxed.

At Texas Tax Protest, we’ve seen firsthand how shifts in the market often lead to over-assessments by appraisal districts. With deep experience in Texas property tax law, we help property owners navigate those assessments and make informed decisions. In this piece, we’ll explore current trends in the San Antonio housing market and what they mean for buyers, sellers, and taxpayers looking to manage their property tax burden more effectively.

Understanding The San Antonio Housing Market Today

The San Antonio housing market has shifted from the rapid pace seen in recent years, and both buyers and sellers are adjusting to new realities. Staying informed about current trends can help homeowners make smarter decisions, especially when those trends affect property tax assessments and appeals:

Market Conditions Are Shifting

Home prices in San Antonio have cooled slightly but remain higher than they were just a few years ago. Sellers are seeing longer days on market, while buyers are approaching with more caution and negotiation power.

Inventory Trends And Buyer Behavior

More homes are coming onto the market in areas just outside the city, though overall inventory remains somewhat tight. Many homeowners are choosing not to sell, holding onto lower mortgage rates from previous years.

Why The Market Matters For Taxpayers

Appraisal districts rely on comparable sales to determine a property’s market value, but those sales may not reflect current conditions. To build a strong protest, property owners should consider how adjustments are made for lot size, condition, and location, not just sale price alone.

Commercial Market Trends In San Antonio

While residential sales have slowed, parts of San Antonio’s commercial market remain active especially in the industrial and multifamily sectors. Rising construction costs and demand for rental space are influencing valuations, which in turn affect property taxes for commercial owners. Understanding vacancy rates, cap rates, and lease terms is essential when preparing to challenge a commercial assessment.

Is It A Good Time To Buy Or Sell In San Antonio?

Timing plays a critical role in any real estate decision, especially in a market that’s still finding its balance. While there’s no one-size-fits-all answer, understanding current conditions can help property owners approach buying or selling more strategically:

Buyers Are Gaining More Leverage

Higher interest rates have slowed competition among buyers, reducing bidding wars that were common just a year or two ago. With more inventory and slightly softer prices, buyers have room to negotiate and avoid overpaying.

Sellers Must Be More Competitive

Homes that are priced accurately and show well still sell, but overpricing can lead to extended listing times. Sellers may need to make improvements or price adjustments to attract today’s more cautious buyer pool.

Timing Also Impacts Property Tax Assessments

The timing of a property sale can affect how it’s used in appraisal district valuation models. A sale that closes late in the year may be excluded from the next assessment cycle. Understanding this helps property owners anticipate changes and prepare for possible protests.

How Housing Market Trends Affect Your Property Taxes

Changes in the housing market don’t just affect buying and selling, they can directly influence how much you owe in property taxes. Understanding the link between market activity and assessed value can help you spot over-assessments and take the right steps to correct them:

Appraised Values Are Tied To Market Sales

County appraisal districts use recent sales of similar properties to estimate your home’s value. When the market is rising, assessments tend to increase, sometimes aggressively. But when prices soften, those same assessments may not adjust as quickly.

Comps Are Not Just About Price

Property owners often search for lower-priced comparable sales, but raw price alone isn’t enough. Adjustments are made for differences in square footage, lot size, condition, age, and even location within the same neighborhood.

A Lag In Data Can Work Against You

Assessment values are typically based on sales from the previous calendar year. This lag can create a gap between your current market value and what the appraisal district reports. In declining or stabilizing markets, that gap may offer grounds for a protest.

How Mass Appraisal Models Work

Appraisal districts don’t evaluate each property individually. Instead, they use mass appraisal models to estimate value based on broad market trends and characteristics shared among many properties. While efficient, this approach often overlooks property-specific issues like deferred maintenance or location-specific drawbacks, leading to assessments that don’t always reflect true market value, something Texas Tax Protest frequently encounters when guiding property owners through the protest process.

Key Tax Considerations For Homebuyers In San Antonio

Buying a home in San Antonio involves more than just the mortgage payment. Property taxes can add significantly to long-term costs, so understanding what to expect and how Texas tax laws work can help you avoid surprises after closing:

Don’t Rely Solely On The Listed Tax Amount

The property’s current tax bill may reflect exemptions the seller qualified for, such as a homestead exemption. Once ownership transfers, those exemptions are removed until the new owner applies and qualifies.

The First Year Can Be Unpredictable

In the year you buy a home, the appraisal district may continue to tax the property based on the previous owner’s assessed value. The following year, however, the value often resets based on your purchase price, potentially resulting in a higher tax bill.

Homestead And Other Exemptions Can Help

After buying a primary residence, homeowners should file for a homestead exemption, which can reduce the taxable value of the property. Additional exemptions may apply based on age, disability, or veteran status.

Selling Your Home? What You Should Know About Tax Assessments

Selling a home in San Antonio means more than just preparing for showings and negotiating offers, your property tax assessment may also play a role. Understanding how your assessed value fits into the bigger picture can help you anticipate questions and avoid complications during the sale:

Buyers May Question The Assessed Value

A noticeable difference between the appraised value and listing price can raise concerns for buyers, especially if the assessed value seems too low. Some buyers use this as leverage during negotiations, while others may be surprised by higher taxes in the following year.

Recent Sales Can Influence Next Year’s Valuation

Your final sale price could be used by the appraisal district as a comparable sale in the next assessment cycle. If the price is significantly higher than your current assessed value, nearby property owners, including the buyer, may see increased valuations.

Disputes Don’t End At Closing

Even after the sale, incorrect assessment records (like square footage, lot size, or improvements) may continue to affect the property’s taxable value. Addressing inaccuracies before selling helps avoid issues for both parties.

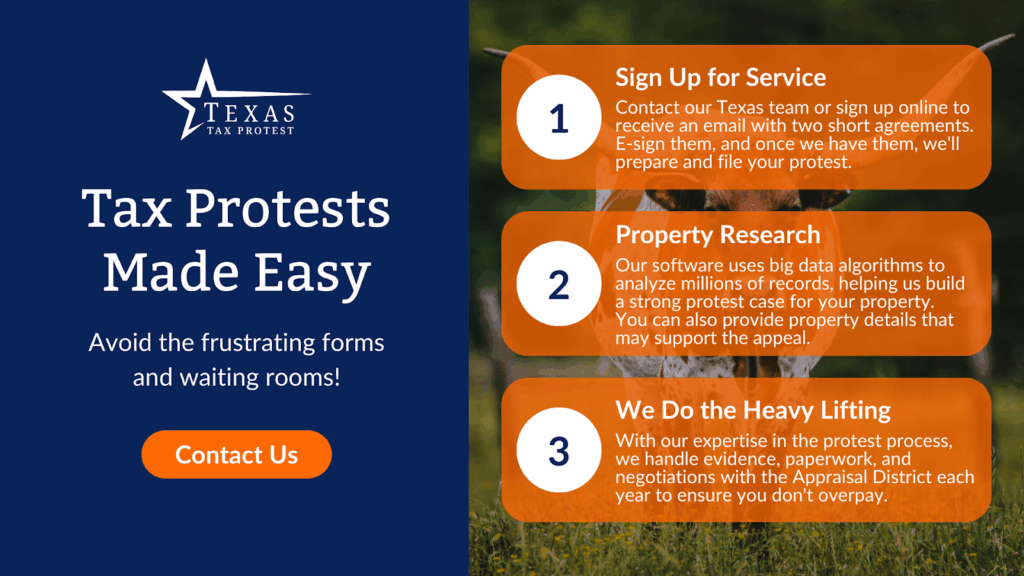

How To Protest Your Property Tax Assessment In Texas

If your property has been overvalued by the appraisal district, filing a protest may lead to a reduction in your taxable value. The process involves preparation, timing, and a strong understanding of how the district evaluates properties. Resources like Texas Tax Protest can help property owners understand what types of evidence are most effective and how to navigate common issues in the protest process.

Know The Deadline And Protest Window

Most counties in Texas, including Bexar, set a May 15th deadline to file a property tax protest—or 30 days after the notice is delivered, whichever is later. Missing this deadline can limit your options, so it’s important to act promptly once notices are mailed.

Support Your Case With Adjusted Comparables

Submitting comparable sales is common, but effective protests also require showing how those comps differ from your property. Adjustments for square footage, condition, location, and amenities are key, just citing a lower-priced sale rarely carries weight without context.

Highlight Errors In The Appraisal Record

Many properties are assessed based on outdated or inaccurate details. Incorrect square footage, missing exemptions, or unrecorded depreciation can all impact value. Identifying and correcting these records strengthens your position during a protest.

What To Expect In A Hearing

If you choose to protest, your case may be heard by the Appraisal Review Board (ARB), either in person or online. You’ll have the chance to present evidence, this can include adjusted comps, photos showing property condition, contractor estimates for repairs, or documentation showing neighborhood market trends. Being prepared and organized often makes a significant difference in the outcome.

Final Thoughts

Navigating the San Antonio housing market requires more than just watching home prices, it also means understanding how shifts in the market affect your property tax responsibilities. For both homeowners and commercial property owners, staying informed about assessed values, local sales trends, and protest opportunities is essential.

As values continue to shift, property owners have every reason to review their appraisal records annually and take action when valuations don’t align with market realities. Whether you’re buying, selling, or simply holding your property, understanding how Texas property tax assessments work puts you in a stronger position to protect your investment.

Texas Tax Protest is here to help you stay informed and empowered, not with promises, but with real knowledge of Texas property tax law and a clear approach to navigating the process.

Frequently Asked Questions About San Antonio Housing Market

What is driving population growth in the San Antonio housing market?

San Antonio continues to attract new residents due to its lower cost of living, expanding job market in healthcare and cybersecurity, and a steady influx of military families. These factors increase housing demand and shape long-term market trends.

How do school district boundaries affect home values in San Antonio?

Homes located within top-rated school districts like Alamo Heights or Northside ISD often maintain higher property values. These boundaries can influence buyer decisions and long-term appreciation potential.

Are investors still active in the San Antonio housing market?

Yes, investor activity remains steady in specific pockets of the city, especially in areas with strong rental demand. However, tighter lending and higher interest rates have made some investors more selective.

How does new construction impact existing home values in San Antonio?

An increase in new construction can create more competition for existing homes, especially in developing neighborhoods. This sometimes slows price appreciation for older properties nearby.

What should second-home buyers know about property taxes in San Antonio?

Second homes are not eligible for homestead exemptions, which means higher taxable values and no protection from annual appraisal increases under the 10% cap rule.

Is the San Antonio housing market expected to remain stable in 2025?

Most forecasts suggest moderate growth in prices and stable demand, assuming interest rates don’t spike. Job growth and population trends continue to support overall market resilience.

How does property zoning affect home value in San Antonio?

Zoning regulations can impact everything from future development potential to resale value. Homes in mixed-use or rezoned areas may experience faster appreciation or, in some cases, more difficulty selling depending on neighborhood changes.

Are property tax rates in San Antonio the same across all neighborhoods?

No, property tax rates vary depending on the combination of city, county, school district, and special district taxes in each area. Two homes with identical values in different neighborhoods may have different annual tax bills.