Protest Your Dallas Property Taxes with Texas Tax Protest

November 10, 2025

Lower Your Dallas Property Taxes with Expert Help

Property taxes in Dallas can have a substantial impact on homeowners and businesses. The good news is that these taxes can often be lowered through a successful protest. With deep local expertise and a track record of results, Texas Tax Protest is here to help you navigate Dallas’ property tax system. Our team understands the unique factors influencing property assessments in this county and works tirelessly to ensure you only pay your fair share.

Understand Your Dallas Property Taxes

Breaking Down Property Taxes in Dallas

Dallas, one of the largest counties in Texas, applies property taxes based on the assessed value of your property. The county’s average property tax rate varies depending on specific jurisdictions, such as school districts, city taxes, and special assessments. These taxes contribute to essential public services but can be a significant burden if your property is overvalued.

Key Information for Dallas Property Owners:

- Average Property Tax Rate: While the exact rate can vary, Dallas homeowners generally see rates around 1.71%, one of the highest in the state.

- Assessment Process: The Dallas Central Appraisal District (DCAD) appraises property values annually as of January 1st of each tax year.

- Important Deadlines: Property owners must file a protest by May 15th or within 30 days of receiving their notice of appraised value, whichever comes later.

Why It Matters

Inaccurate valuations can result in paying more than your fair share of taxes. By engaging with Texas Tax Protest, you can be confident that every detail of your property’s valuation is thoroughly examined.

Why Choose Texas Tax Protest for Your Dallas Property Tax Appeal?

Local Expertise, Maximum Savings

Navigating Dallas’ property tax protest process can be complex, but you don’t have to do it alone. Texas Tax Protest specializes in helping property owners secure the best possible outcomes by leveraging extensive local knowledge and a data-driven approach.

How We Help:

- Comprehensive Review: To build a compelling case, our team analyzes your property’s assessed value using sales data, property condition reports, and market trends.

- Document Preparation: We handle all necessary paperwork, including filing forms and submitting evidence to the Dallas Central Appraisal District (DCAD).

- Representation at Hearings: We represent you during hearings with the Appraisal Review Board (ARB), presenting evidence and advocating for a fair valuation.

Key Advantages of Hiring Us:

- Local Knowledge: We understand Dallas’ nuances, including how DCAD values properties.

- Proven Track Record: Our clients consistently achieve reductions in their assessed values.

- Hassle-Free Process: Let us handle the details so you can focus on what matters most.

Dallas Tax Rates

| County | Median Home Value | Median Annual Property Tax Payment | Average Effective Property Tax Rate |

|---|---|---|---|

| Dallas | $276,620 | $4,794 | 1.71% |

See How We’ve Helped Dallas Homeowners Save

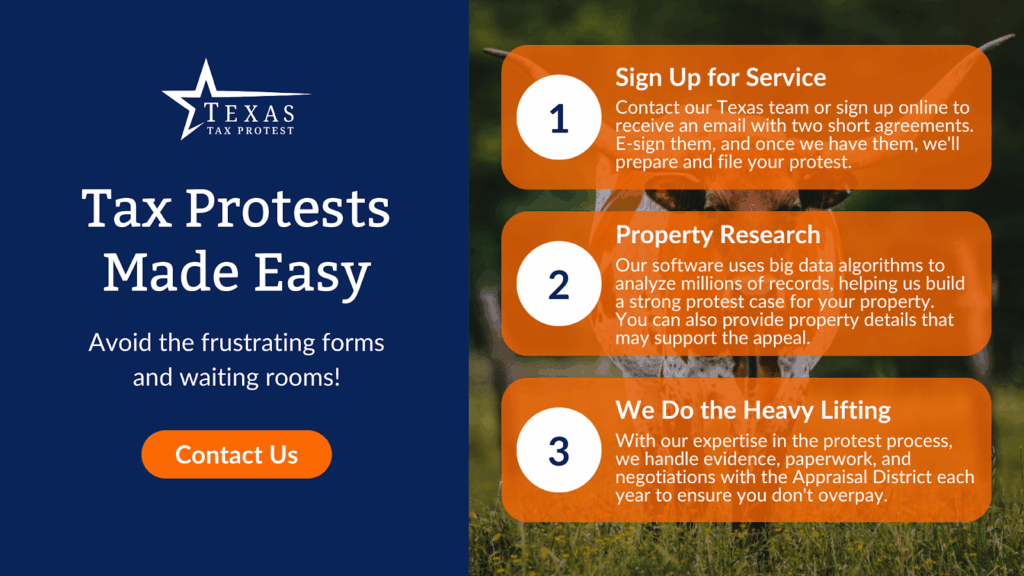

The Dallas Property Tax Protest Process – Step-by-Step

Protesting Your Property Taxes Made Simple

Here’s how the property tax protest process works in Dallas:

- Review Your Appraisal Notice

Carefully examine the notice of appraised value sent by DCAD. If you believe it is inaccurate, gather supporting data. - File Your Protest

Submit a written protest to DCAD by the May 15th deadline or within 30 days of receiving your appraisal notice. This can typically be done online, by mail, or in person. - Gather Evidence

Collect data to support your case, such as comparable sales, photos, and appraisals. The more evidence you provide, the stronger your case. - Attend the ARB Hearing

The Appraisal Review Board (ARB) will schedule a hearing where you can present your evidence. Texas Tax Protest can represent you during this critical step to ensure your case is well-presented. - Await the Decision

After you present your case, the ARB will issue a determination. If you’re satisfied, great! If not, further options, such as arbitration or litigation, are available.

Need Assistance? At any point in the process, Texas Tax Protest is here to help. Our experts can guide you through each step and handle all the details.

Speak to a Real Texan Property Expert and Learn More About Your Specific Property

Take the guesswork out of property tax protests. Texas Tax Protest brings expertise, data, and local knowledge to help ensure your property is fairly assessed. Ready to learn more?