Protest Your Austin Property Taxes with Texas Tax Protest

November 10, 2025

Property taxes in Austin can pose a significant financial challenge for homeowners and businesses. However, your property’s assessed value isn’t carved in stone. At Texas Tax Protest, we specialize in assisting Austin property owners in reducing their tax burdens through effective protests. Our licensed tax professionals bring deep local expertise and a proven track record to ensure you pay only your fair share.

Understand Your Austin Property Taxes

Breaking Down Property Taxes in Austin

Austin property taxes are determined based on the assessed value of your property. These taxes support local schools, infrastructure, emergency services, and other vital community services. An overestimated property assessment, however, can lead to unnecessarily high tax bills.

Key Information for Austin Property Owners:

- Average Property Tax Rate: Austin property owners typically face an effective tax rate of approximately 1.51%—a rate that, while competitive statewide, can still substantially impact your finances.

- Assessment Process: The Travis Central Appraisal District (TCAD) evaluates property values annually as of January 1st.

- Important Deadlines: File your protest by May 15th or within 30 days of receiving your appraisal notice, whichever is later.

Why It Matters:

An inaccurate property valuation can result in an inflated tax bill. Partnering with Texas Tax Protest ensures your property is fairly assessed, so you’re not overpaying.

Why Choose Texas Tax Protest for Your Austin Property Tax Appeal?

Local Expertise, Maximum Results

Navigating Austin’s property tax system can be complex. Texas Tax Protest streamlines the process with intimate knowledge of TCAD’s practices and an unwavering commitment to securing the best outcomes for you.

How We Help:

- Comprehensive Property Analysis: We assess your property’s valuation using up-to-date market data, comparable sales, and detailed condition reports.

- Stress-Free Paperwork: We manage all submissions and filings with TCAD, saving you time and effort.

- Professional Representation: Our team advocates for you at Appraisal Review Board (ARB) hearings, crafting a persuasive case for a reduced assessment.

Key Advantages of Hiring Us:

- Proven Results: We’ve effectively helped thousands of Texas property owners lower their taxes.

- Simplified Process: We handle every aspect of the protest, ensuring you’re never left in the dark.

- Local Expertise: We know TCAD’s valuation methods inside and out, enabling us to challenge inaccuracies efficiently.

Austin Tax Rates

| County | Median Home Value | Median Annual Property Tax Payment | Average Effective Property Tax Rate |

|---|---|---|---|

| Austin-Travis | $237,942 | $2,796 | 1.51% |

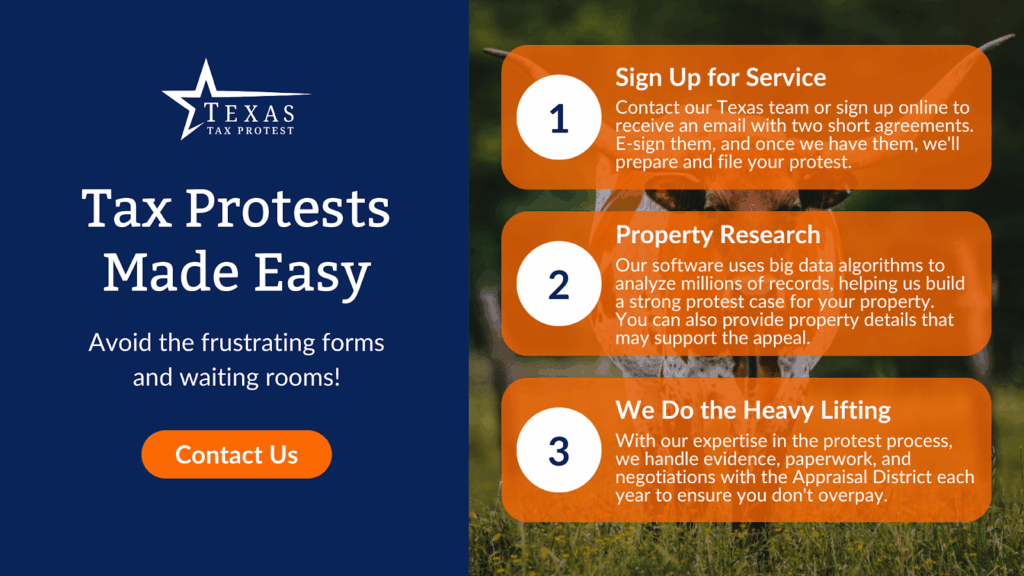

The Austin Property Tax Protest Process – Step-by-Step

Protesting Your Property Taxes Made Simple

- Review Your Appraisal Notice

Examine the appraisal notice issued by TCAD. If you believe the valuation is incorrect, it’s time to take action. - File Your Protest

Submit a written protest to TCAD by May 15th or within 30 days of receiving your appraisal notice. Protests can be filed online, by mail, or in person. - Gather Evidence

To build your case, compile supporting documentation such as recent comparable sales, photographs, and detailed property condition reports. - Attend the ARB Hearing

The Appraisal Review Board (ARB) will schedule a hearing for you to present your evidence. Texas Tax Protest can represent you to ensure your arguments are clearly heard and effectively presented. - Await the Decision

After a thorough review, the ARB will issue a decision. If the outcome isn’t favorable, additional avenues such as arbitration or litigation may be available.

Need Help?

Texas Tax Protest is here to guide you every step of the way. From document preparation to representing you at hearings, we make protesting your Austin property taxes straightforward and effective.

See How We’ve Helped Austin Homeowners

Speak to a Real Texan Property Expert

Don’t let an overinflated appraisal weigh you down. With Texas Tax Protest, you gain access to local expertise, precise market data, and professional representation, ensuring your property taxes are fair and accurate.