Property Tax For New Construction: What Texas Homeowners Need To Know

September 6, 2025

Key Takeaways:

- Assessment Date Matters: Property taxes on new construction are based on the status of the structure as of January 1, not when it’s finished or occupied.

- Improvement and Land Are Valued Separately: Appraisers calculate the value of both land and improvements independently, which affects the total taxable amount.

- You Can Protest New Construction Values: Even partially built structures can be overassessed, and property owners have the legal right to challenge those valuations with proper documentation.

Texas has some of the most active and complex property tax systems in the country, with tens of billions of dollars in property value reassessed annually. Few states see as much fluctuation in taxable values year over year, especially when it comes to newly constructed homes and buildings. Staying informed isn’t optional; it’s essential if you want to avoid unnecessary tax liability.

At Texas Tax Protest, we’ve worked with thousands of property owners across the state to challenge unfair assessments and correct inaccurate records, including those tied to new construction. We understand how appraisal districts approach partially completed structures, how they apply market adjustments, and where mistakes most often occur. Property owners often don’t realize just how early taxes can increase, or how many errors go unchallenged.

In this piece, we’ll break down how new construction is taxed in Texas, when assessments begin, and what you can do to reduce inflated valuations.

Understanding Property Taxes On New Construction In Texas

Building a new home or commercial property in Texas comes with more than construction costs, it also triggers changes in how your property is taxed. To avoid surprises and plan ahead, it’s important to understand how new construction is evaluated for property tax purposes:

How New Construction Is Defined For Tax Purposes

Appraisal districts define new construction as any new improvement added to the land. This includes homes, commercial buildings, garages, and other permanent structures. Once construction begins and value is added to the property, it becomes subject to taxation based on that added value.

The January 1 Assessment Date

Texas law uses January 1 as the official date to determine the status of a property for tax purposes. If a structure is under construction at that time, the district will assess its market value based on the percentage completed. Even a partially built home can raise your property’s taxable value for that year.

Land Value Vs. Improvement Value

Property taxes are based on two components: the value of the land and the value of any improvements. A vacant lot will be assessed only for land, but once construction starts, the improvement value begins to factor in. The higher the completion percentage, the higher the assessed value typically becomes.

When Does New Construction Get Assessed For Property Taxes?

Construction timelines don’t always line up with the tax calendar, which can create confusion about when taxes actually increase. Knowing how and when new construction is assessed helps homeowners and builders plan for the financial impact:

Assessment Is Based On The January 1 Status

Texas appraisal districts determine property value as of January 1 each year. If construction is underway at that time, the structure will be assessed based on its level of completion. This means even a foundation or framed structure may add to the overall taxable value.

Mid-Year Construction Doesn’t Delay Taxation

Building after January 1 doesn’t delay taxation indefinitely. The next January 1 assessment will reflect whatever progress has been made by then. For example, a home started in March and completed by December will likely be assessed at or near full market value the following year.

Permit Activity May Trigger Inspection

While January 1 is the legal assessment date, appraisal districts monitor permit filings and construction activity year-round. Some send field appraisers or use aerial imagery to track progress. This means your construction project may be on their radar before you’re even finished.

How Are Property Taxes Calculated For Newly Built Homes Or Buildings?

Understanding how appraisal districts calculate the value of new construction can help prevent surprises when your tax bill arrives. The process involves more than just looking at sales prices — specific formulas and data points are used to estimate fair market value:

Market Value Includes Both Land And Improvements

Appraisers look at what your property would sell for as of January 1. This includes the land and any structures on it, even if they’re not complete. Both parts are valued separately and then combined to form the total appraised value.

Comparable Sales Are Adjusted With Specific Math

Comparable properties, or “comps,” are often used to estimate value. But the process goes beyond just picking similar homes. Adjustments are made based on square footage, age, location, and construction quality to account for differences. These adjustments are calculated using standard formulas to create a more accurate comparison.

Completion Percentage Impacts Final Valuation

For construction that isn’t fully complete, the appraiser will estimate the percentage finished by January 1. That percentage is then applied to the expected full value of the improvement. For example, if the total home is expected to be worth $500,000 when finished and it’s 50% complete, the appraised improvement value might be set around $250,000, plus land value. Texas Tax Protest can help you understand how this value was calculated and identify any inaccuracies in the appraisal.

Common Mistakes That Lead To Higher Tax Bills

Many property owners unintentionally drive up their tax bills by overlooking key details during or after construction. Recognizing these common missteps can help reduce the chances of an inflated valuation:

Not Reviewing The Initial Notice Of Value

Appraisal districts send out a Notice of Appraised Value each spring. Some owners assume the amount is correct and don’t question it. Failing to review this notice carefully can lead to missed opportunities to correct inaccurate assessments.

Letting Inaccurate Property Details Go Uncorrected

Appraisal districts rely on construction permits, inspections, and field visits to gather data. If the square footage, number of rooms, or finish quality is listed incorrectly, the value could be overstated. Small errors in property records often lead to inflated assessments.

Skipping The Protest Process

Homeowners sometimes assume there’s nothing they can do once the appraisal arrives. But every property owner in Texas has the right to protest. Missing the protest deadline or failing to submit supporting evidence can result in paying more than necessary.

Can You Protest A New Construction Assessment?

Yes, new construction assessments can be protested just like any other property valuation. If you believe the appraisal district overestimated the value of your property, you have the right to challenge it:

New Construction Is Subject To The Same Protest Rights

The Texas Property Tax Code allows all property owners to protest their appraised values each year. This includes properties with ongoing or recently completed construction. Even if the home or building wasn’t finished on January 1, you can still challenge how the percentage of completion or market value was calculated.

Evidence Can Include Construction Contracts And Photos

Successful protests depend on clear and relevant documentation. For new construction, this might include signed builder contracts, invoices, construction timelines, and progress photos that show the status as of January 1. These materials can support your case if the district’s estimate doesn’t match the actual work completed.

Timing Matters

Appraisal notices are typically sent out in the spring, and the protest deadline is usually in May. If you’re unsure how your assessment was calculated, Texas Tax Protest can help you understand where to start.

Strategies To Reduce Property Taxes On New Construction

Reducing your property tax burden on new construction starts with understanding how the system works and using the right documentation. With the right approach, you can often lower an overestimated value:

Use Accurate Comparables With Proper Adjustments

Not all “comps” are created equal. It’s important to find recently sold properties that are similar in size, condition, location, and construction quality. Adjustments must be made for any differences using standardized methods — for example, subtracting value for square footage differences or finish level. Raw data alone is not enough without the math to support it.

Document Construction Status Clearly

If your structure was incomplete as of January 1, be ready to prove it. Photos, dated contractor invoices, permits, and construction schedules can help establish the true percentage of completion. This helps challenge valuations that assume your project was further along than it really was.

Verify Appraisal District Records

Mistakes in property characteristics are more common than people realize. Double-check the district’s data on your square footage, number of bathrooms, garage size, and building materials. Even small corrections can lead to a noticeable tax reduction if the original information was overstated. Texas Tax Protest can help review these records and assist in filing necessary updates with the appraisal district.

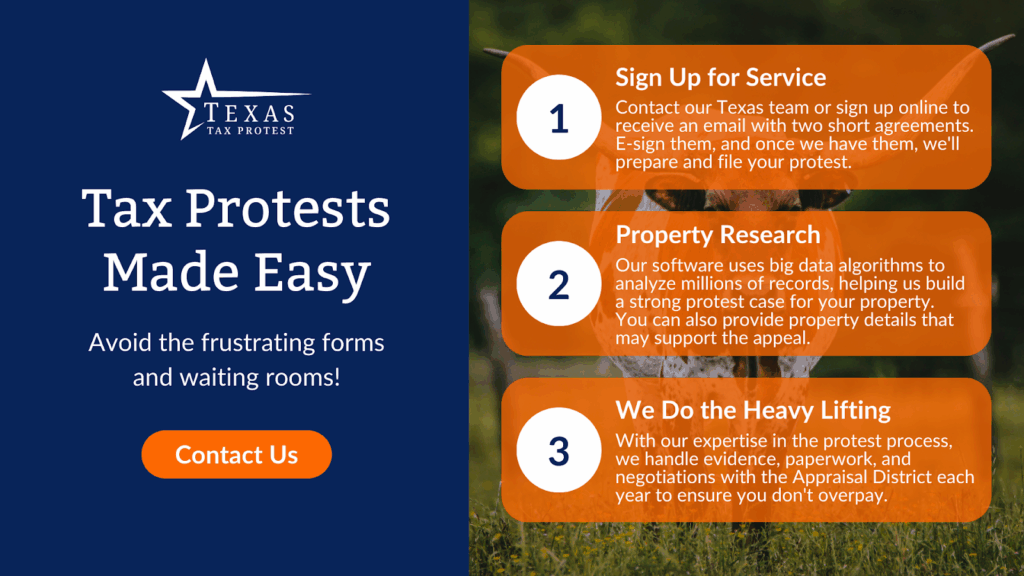

Why Work With Texas Tax Protest?

Navigating property tax rules for new construction can be frustrating, especially when valuations feel too high or inaccurate. Texas Tax Protest focuses specifically on helping property owners in Texas push back against overassessments and inaccurate data.

Local Knowledge Of County Appraisal Practices

Every appraisal district in Texas operates a bit differently. Texas Tax Protest understands how districts like TAD in Tarrant County approach new construction assessments. This local insight can make a difference in building a stronger, more relevant protest case.

Data-Driven Approach To Protests

Rather than relying on generic comparisons, Texas Tax Protest uses detailed property data and adjusts comparables with precise calculations. This helps create a clear, fact-based case when challenging inflated values on partially completed or newly finished structures.

Support Without The Noise

There’s no guesswork involved when you work with a team that focuses solely on property tax protests. Texas Tax Protest helps clients correct errors, interpret values, and apply tax code rules to their unique situation. Their process is built to simplify what often feels like a complex system.

Final Thoughts

New construction can trigger a higher tax burden sooner than many property owners expect. Even partially completed structures are often assessed and taxed, which makes it essential to understand how appraisal districts calculate value and where mistakes can happen. Reviewing your property data, verifying the percentage of completion, and submitting a protest when needed can help avoid overpaying.

Texas Tax Protest brings deep experience in navigating these challenges, especially in counties like Tarrant where local practices can vary. By focusing on accurate data and calculated adjustments, they help Texas property owners push back on inflated assessments and take a more informed approach to property taxes.

Frequently Asked Questions About Property Tax For New Construction

Do I have to pay property taxes on a lot before construction begins?

Yes. Property taxes apply to vacant land even if no construction has started. The appraisal district will assess the land based on its location, size, and local market trends.

Can I apply for a homestead exemption if my home isn’t finished yet?

No. The home must be completed and used as your primary residence as of January 1 to qualify. If it’s still under construction, you’ll need to wait until the next tax year to apply.

What happens if my contractor delays the project — will that lower my taxes?

It could, depending on the timing. If less of the structure is complete on January 1 due to delays, the improvement value may be lower for that tax year.

Are property taxes higher for new construction compared to existing homes?

Not automatically. New builds can be taxed higher if their market value is greater due to updated features or materials, but it depends on how the appraiser values them compared to similar properties.

Can I protest the land value separately from the construction value?

Yes. Land and improvements are listed as separate values, and you’re allowed to protest either one if you believe the appraisal is incorrect.

Will finishing out interior spaces later affect future appraisals?

Yes. When unfinished areas are completed after the initial appraisal, the added value is reflected in future assessments and could increase your property tax bill.