Why Your Property’s Market Value And Assessed Value Aren’t The Same (And Why It Matters)

August 31, 2025

Key Takeaways:

- Difference Between Market and Assessed Value: Market value reflects what buyers are willing to pay based on current trends and comps. Assessed value is calculated by the appraisal district using mass data models to determine your property tax bill.

- Factors Considered in Determining and Calculating Values: Appraisers look at square footage, property condition, location, and recent sales. Adjustments are made for differences like renovations, lot size, or missing features using local pricing benchmarks.

- Strategies to Reduce Your Property’s Assessed Value: Review your property record, document repairs, apply for exemptions, and use accurate comps to build a strong case. Texas Tax Protest can handle the protest process from start to finish on your behalf.

The “market value” of your property and the “assessed value” on your notice may sound interchangeable, but they each play a unique role in determining how much tax you might pay, and misunderstanding them is one of the most common (and costly) mistakes we see.

At Texas Tax Protest, we spend our days helping Texans decode this alphabet soup of property values because knowing the difference could mean hundreds or even thousands of dollars in savings each year.

In this article, we’ll explain how the numbers on your tax notice are calculated, why those numbers diverge, and what you can do to make sure your property is being valued fairly. Along the way, we’ll bust a few myths, offer practical tips, and show how a smarter protest strategy can keep more money in your pocket. Texas property tax laws can be complicated, but with the right know-how, you can tip the odds in your favor.

Market Value Vs. Assessed Value: Key Differences Explained

Knowing how your property’s market value and assessed value are calculated can make a big difference when reviewing your tax notice. These two figures sound similar but serve different purposes, and they don’t always match.

What Is Market Value?

Think of “market value” as what a ready buyer would pay for your property in today’s open market. This number can shift with the seasons, surge if your neighbor renovates their kitchen, or dip when mortgage rates climb. Ultimately, it reflects the real-time pulse of your local real estate scene.

Market value is shaped by recent sales of similar properties, also known as comps, but comps are rarely identical. Adjustments are made for square footage, condition, lot size, and features like garages, updated kitchens, or outdoor spaces. For example, if your home is 200 square feet smaller than a nearby sale, the price of that comp might be reduced by a few thousand dollars to match your home’s size.

What Is Assessed Value And Who Sets It?

“Assessed value,” on the other hand, serves a different purpose. It’s the figure local tax authorities use to calculate your annual property taxes. Appraisal districts base this value on a mix of data, estimated using mass appraisal techniques rather than a custom, on-site inspection of each home. From there, they’ll look at comps, factor in the size, age, condition, and amenities of your property, and then make mathematical adjustments.

Overall, the gap between market and assessed values appears because the appraisal process is designed for administrative fairness, not necessarily pinpoint accuracy. Assessed values may trail hot market trends or lag behind significant property improvements. Local caps, exemptions, and timing also play a big role; for example, Texas law limits how fast an assessed value can increase year to year on a homestead, even if the market is exploding.

Factors Considered In Determining Market Values

Market value isn’t just a number pulled from thin air—it’s a carefully calculated figure shaped by real-world factors. Appraisers, real estate professionals, and even property tax authorities look at a variety of elements when pinning down what your property could reasonably sell for on the open market.

Comparable Sales

One cornerstone of market value is the recent sale price of similar properties in your area. But “similar” doesn’t mean “identical.” Adjustments come into play for differences in square footage, condition, updates, lot size, amenities, or location nuances like school districts and neighborhood appeal. For example, if the kitchen in your neighbor’s house was just renovated and yours wasn’t, the sale price of their home would be adjusted downward to estimate what your home might fetch with an older kitchen.

Property Condition And Upgrades

The general state of your home has a direct impact on its perceived market value. Recent upgrades—like a remodeled bathroom, a new roof, or energy-efficient windows—tend to boost value. On the flip side, deferred maintenance, outdated features, or visible damage can diminish market value compared to similar homes in better condition.

Local Real Estate Trends

Broader real estate trends don’t get ignored. An upswing in buyer demand, shifts in interest rates, or changes in the local job market all influence how much buyers are willing to pay. Appraisers and agents look to current data, not only for individual comp sales but also for how the overall market is behaving.

Lot And Location Variables

Two identical homes can have wildly different values based on their surroundings. Factors like proximity to highways, desirable schools, shopping, parks, or even water features can tip the scales. Busy street? Potential buyers may subtract value. Quiet cul-de-sac? That could mean a premium.

Mathematical Adjustments

To fine-tune market value, experts apply dollar adjustments for key differences between your property and the selected comps. For instance, if your home has an extra bathroom compared to a recent comparable sale, the appraiser might add a calculated dollar amount based on local bathroom value trends. Similarly, a smaller backyard or an older HVAC system could mean subtracting value.

How Assessed Value Gets Calculated

Appraisal districts follow a layered process to estimate your property’s taxable value. That number becomes the basis for your annual property tax bill. While it might seem unclear at first, assessed value calculations follow a system rooted in data and math. Here’s how it typically comes together:

- Start with the basics: Appraisers consider your home’s square footage, lot size, age, and overall condition.

- Use recent sales: They review comparable home sales in your area. These comps act as a starting point, though no two properties are identical.

- Apply adjustments: Appraisers subtract or add value based on specific features. For example, if a nearby home sold for $450,000 with a renovated kitchen and yours hasn’t been updated, they might remove $20,000 from the comp to reflect the difference.

- Factor in upgrades or limitations: Add-ons like a pool or extra garage bay can raise value. Smaller lots, dated interiors, or missing features may lead to downward adjustments.

- Run the numbers: Mathematical formulas turn those adjusted comps into a working estimate of what your home might sell for—then that number becomes the foundation for your assessed value.

- Apply legal limits and exemptions: Texas law caps annual increases at 10% for homesteaded properties. Qualifying exemptions for seniors, veterans, and others may also reduce the final figure.

The result isn’t always equal to your market value. Assessed values often trail behind market shifts, especially in fast-moving neighborhoods. That’s why reviewing your notice each year can help you spot inflated valuations before they cost you.

Strategies To Reduce Your Property’s Assessed Value

Lowering your property tax bill starts with targeting your assessed value. While market value sets the stage, the assessed value is what your county uses to calculate taxes. Here’s how to approach a potential reduction with confidence:

1. Gather Accurate Comparable Sales

Begin by researching recent sales of similar properties in your area. Focus on homes that match your property’s age, square footage, layout, lot size, and condition.

A single-story home built in 1975 with its original kitchen can’t be compared to a recently remodeled two-story home down the street. Adjust the numbers accordingly. For example, if your home is 200 square feet smaller than a comp, subtract the typical price per square foot to create a more realistic comparison. When a comp includes a pool or upgraded features that yours doesn’t, those details should also be factored into the math.

2. Document Condition And Needed Repairs

A pristine home commands a higher value, but if your property requires significant repairs. Photos, contractor estimates, and inspection reports become important leverage. Major needed repairs can justify a lower assessed value, since the assessor must account for those deficiencies compared to turnkey properties nearby.

3. Review The Appraisal District’s Property Record

Check the county’s description of your home for errors. Common mistakes include inflated square footage, additional bathrooms that don’t exist, or incorrect remodel data. Fixing these errors can lead to an immediate adjustment in your assessed value. This part of the process requires clear documentation and a willingness to challenge what’s on record without overcomplicating your case.

4. Explore Exemptions And Special Provisions

Homestead exemptions, over-65 discounts, and veteran exemptions reduce taxable value. Each has specific qualifications and paperwork requirements, so it’s worth checking what your household may be eligible for. These provisions won’t change your market value, but they directly impact how much you pay.

5. File A Timely And Thorough Protest

Once you’ve collected evidence and reviewed the district’s numbers, file your protest before the county deadline. Your submission should include comp-based calculations, photos, records, and a summary that highlights discrepancies. Presenting a clear, well-organized case signals that you’re prepared to challenge overvaluation with facts, not assumptions.

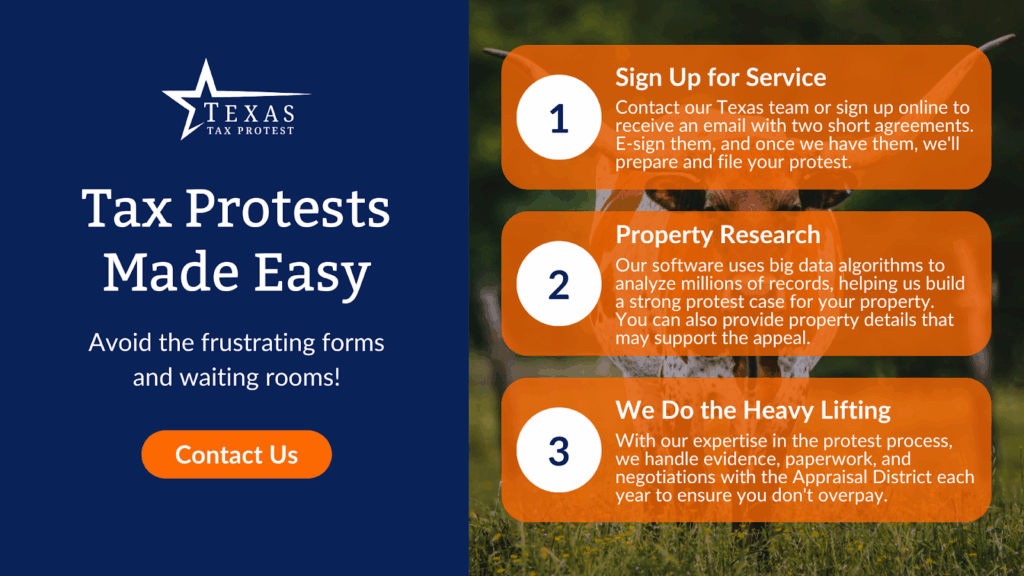

Texas Tax Protest can take care of the entire process for you. Our team gathers the evidence, runs the calculations, files the paperwork, and presents the argument on your behalf. From the first comp to the final deadline, we handle the details so you don’t have to. Let’s take the pressure off and work toward a fairer assessment.

Final Thoughts

At the end of the day, the gap between your property’s market value and assessed value shapes more than a tax notice. It lays the groundwork for a smarter, more strategic approach to what you pay. Your county’s assessment directly impacts your tax bill, but that number doesn’t always reflect what buyers and sellers see in the market. Market value responds to current demand, local trends, and actual sales. Assessed value comes from mass appraisal formulas and state-mandated rules used by the appraisal district.

Texas Tax Protest helps homeowners, veterans, and commercial property owners across the state make sense of the numbers. With a mix of high-tech analysis and hands-on experience, our team simplifies the process. We help you challenge inflated assessments, minimize stress, and avoid paying more than you should. The smartest move? Learn how the system works and lean on us when you’re ready to push for a fairer value.

Read more:

- Texas Property Tax Rates Explained: What Every Homeowner Should Know

- Texas Property Tax Rates by City: Where Does Your Area Rank?

- Texas Disaster Declarations and How They Impact Your Property Taxes

Frequently Asked Questions About Market Value Vs Assessed Value In Texas

Can assessed value be higher than market value?

Yes, assessed value can sometimes surpass market value, usually when the appraisal district’s data lags behind real-world shifts in the housing market. For example, if sales in your neighborhood have stalled but local tax rolls haven’t caught up, your assessed value might sit higher than what you could realistically sell your home for.

Does renovation affect assessed value or market value more?

Renovations can impact both, but in distinct ways. Market value responds directly—upgrading a kitchen or adding a room usually boosts your home’s sale potential. Assessed value might also increase after renovations, especially if changes are significant and reported to the county appraisal district.

Are market value and assessed value the same for new construction?

They can be similar, but matching isn’t guaranteed. New construction often sees a close alignment, since both values originate from the latest sales and construction costs. However, as market conditions shift or exemptions apply, assessed value might diverge from the true market value over time.

Does assessed value affect resale value?

Not directly. Resale (market) value comes down to what buyers are willing to pay, not how much the county thinks the property is worth for tax purposes. Still, a high assessed value could hint at higher property taxes, and that sometimes makes buyers think twice, especially in a competitive market.

Why does it matter if there’s a difference between market and assessed value?

A gap between assessed and market value can mean you’re paying more in taxes than necessary. If your assessed value outpaces local sales data, your tax bill could climb unfairly. That’s why scrutinizing your assessment and protesting when there’s a disconnect is key to lowering your tax burden—and where Texas Tax Protest steps in to simplify the process and advocate for fair treatment.

Does refinancing affect assessed value?

Refinancing itself doesn’t impact assessed value. Lenders might order an independent appraisal for their records, but county assessors don’t change your tax value based on a refinance. Assessment adjustments come from periodic revaluations by the appraisal district, not lender appraisals.

What happens to the assessed value when I buy a property?

Assessed value doesn’t automatically reset to your purchase price. The county appraisal district reevaluates properties on an annual cycle, pulling new sales and comparing properties to adjust values. Details from your transaction might enter the data pool, but buyers aren’t instantly assigned a new assessed value solely due to the sale. When comps are weighed for your new property, mathematical adjustments will be made to account for square footage, age, upgrades, and more, ensuring the valuation reflects objective standards rather than just the selling price.