How Property Valuations Affect Your Texas Property Taxes

September 5, 2025

As a Texas homeowner, you’ve probably seen your home’s appraised value steadily climbing year after year. But have you ever paused to consider how these property valuations directly impact your tax bill? Understanding the relationship between property valuations and your property taxes in Texas can empower you to take proactive steps in managing your financial obligations.

Understanding Property Valuations in Texas

In Texas, property taxes are based primarily on your property’s assessed value, as determined by your local appraisal district. Every year, appraisal districts evaluate properties based on market conditions as of January 1st. This assessed value becomes the foundation for your annual property tax bill.

The Appraisal Process: Setting Your Home’s Value

Appraisal districts assess your home’s value based on its market value, the price it would likely sell for in the current market. Factors influencing this valuation include:

- Recent sales prices of similar homes in your area

- Improvements or renovations made to your property

- General market conditions

This valuation is crucial because it determines the baseline for calculating your taxes. A higher assessed value typically means higher taxes.

How Your Property’s Valuation Impacts Your Tax Rate

It’s a common misconception that appraisal districts set tax rates. Your local taxing unit, such as school districts, counties, cities, and special districts, sets annual tax rates based on budgetary needs. When multiplied by your property’s appraised value, these rates determine the amount you owe in property taxes.

For example, if your home is valued at $300,000 and your combined local tax rate is 2.5%, your annual property taxes would amount to $7,500.

How Rising Property Values Affect Your Taxes

Texas property values have steadily risen due to economic growth and increasing demand. While rising property values can benefit home equity, they can also significantly impact your tax liability. Even if your local taxing units don’t raise their rates, your property tax bill can still climb because your home’s valuation has increased.

Can You Challenge Your Property’s Valuation?

You should, if you believe your valuation is unfairly high. Property owners receive a Notice of Appraised Value each year, usually in April. This notice details your home’s assessed value and your right to appeal.

Challenging your property valuation can reduce your assessed value, potentially saving you thousands of dollars annually.

Professional vs. DIY Property Tax Protests

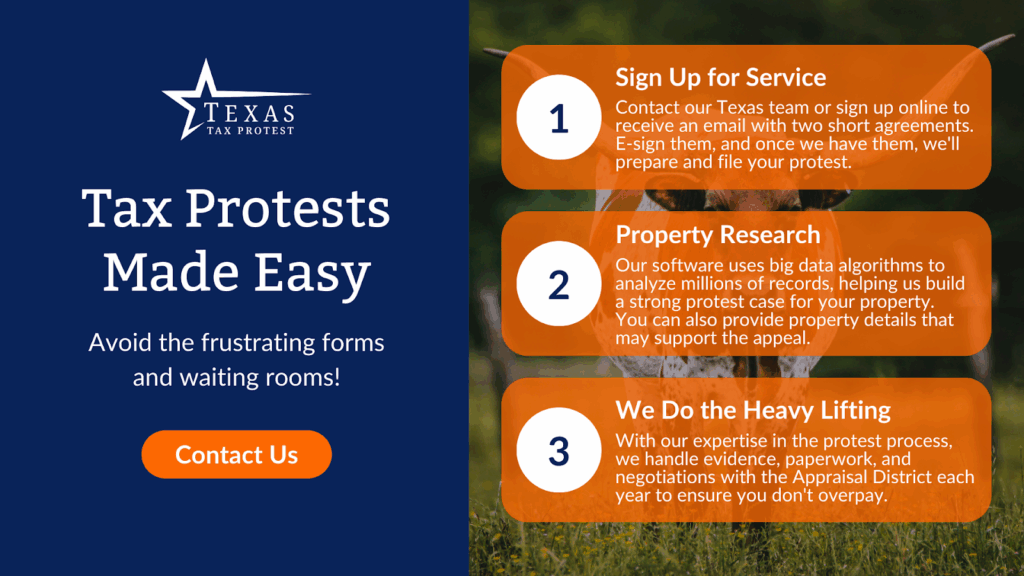

While you can challenge your property’s valuation yourself, many homeowners find the protest process complex and time-consuming. Hiring a professional, like Texas Tax Protest, can significantly simplify this process. Texas Tax Protest leverages proprietary software and big data analytics to ensure your protest is accurate, thorough, and compelling, significantly improving your chances of a successful appeal.

The Texas Tax Protest Advantage

- Over $85 million in property tax savings for homeowners

- 10+ years in the property tax protest business

- Dedicated, Texas-based customer support (no offshore call centers)

- Proprietary software leveraging big data to maximize your protest’s effectiveness

Stay Ahead of the Curve

Understanding how property valuation impacts your property taxes is essential for any homeowner. If your property valuation has increased, don’t automatically assume your new tax bill is inevitable. Consider protesting your property’s assessed value to potentially reduce your tax obligation significantly.

Contact Texas Tax Protest to learn how you can effectively manage your property taxes and keep more of your hard-earned money.