How Much Can You Save by Protesting Your Property Taxes in Texas?

August 18, 2025

Texas homeowners are facing an unprecedented challenge as property tax burdens continue to climb yearly. These escalating taxes have become a significant financial strain for many families, often rivaling or exceeding monthly mortgage payments. As property values surge across the state, more homeowners ask themselves, “How much can you save by protesting your property taxes?” The answer could mean thousands of dollars in savings for your household.

Why Consider Protesting Your Property Taxes?

The property tax assessment process in Texas, while systematic, often fails to capture the true market value of individual properties. County appraisal districts use mass appraisal techniques that, by their nature, can’t account for every property’s unique characteristics and conditions. This one-size-fits-all approach frequently results in overvaluation, leading homeowners to pay more than their fair share in property taxes.

These inflated assessments create a ripple effect through household budgets. Families find themselves diverting funds from other essential needs to cover rising property tax bills. The financial strain becomes particularly acute for retirees on fixed incomes and young families trying to establish themselves in their communities. However, by understanding your right to protest these assessments and taking action, you can potentially recover thousands of dollars in overpaid taxes.

Understanding Your Property Tax Assessment

Determining your property’s assessed value involves complex factors that county appraisal districts must consider. They examine recent sales of nearby properties, evaluate local market trends, and assess individual property characteristics. However, this process often overlooks critical details that could significantly impact your property’s true market value.

Assessors might miss important factors such as deferred maintenance, outdated systems, or interior conditions that could lower your property’s value. They might also fail to account for negative environmental factors, such as increased traffic noise or proximity to new commercial development. Even seemingly minor errors in property measurements or feature classifications can lead to substantial overvaluation.

Furthermore, market conditions can change rapidly, sometimes faster than assessment models can adapt. This lag time can result in assessments that don’t accurately reflect current market realities, particularly in areas experiencing significant change or development.

Quantifying the Potential Savings

The potential savings from a successful property tax protest can be substantial, varying based on several key factors, including your property’s location, current assessed value, and local tax rates. Let’s explore a detailed example to illustrate these potential savings.

Consider a typical Texas home valued at $400,000 with a tax rate of 2.5%. Without protesting, the annual property tax burden would be $10,000. However, through a successful protest, homeowners might achieve various levels of reduction:

A modest 10% reduction in assessed value would lower the property’s taxable value to $360,000, resulting in annual taxes of $9,000 – a $1,000 yearly savings. A more substantial 15% reduction would bring the assessed value down to $340,000, with annual taxes of $8,500, saving $1,500 each year. In cases where significant evidence supports a larger reduction, a 20% decrease could reduce the assessed value to $320,000, resulting in annual taxes of $8,000 – a remarkable $2,000 annual savings.

Understanding Your Potential Tax Savings: A Practical Example

Imagine a home in an established Austin neighborhood initially valued at $550,000 by the county appraisal district. Through careful documentation of the property’s condition, including foundation issues requiring repair, an outdated HVAC system, and evidence of similar homes in the area selling for less, a successful protest resulted in a reduced assessment of $467,500. This 15% reduction translated to annual tax savings of $2,062, which could be redirected toward home improvements, savings, or other family priorities.

This example illustrates how a well-prepared property tax protest, supported by thorough documentation and market evidence, can lead to significant savings for Texas homeowners. The key to success lies in identifying legitimate factors affecting your property’s value and presenting them effectively during the protest process.

Steps to Maximize Your Savings

Building a strong case for property tax reduction requires thorough preparation and attention to detail. Success often hinges on the quality and comprehensiveness of your evidence. Collect recent sales data from comparable properties, particularly those sold for less than your assessed value. Document any issues affecting your property’s value – from foundation problems to outdated systems – with detailed photographs and repair estimates. A professional appraisal can also support your case, offering an independent expert’s opinion of your property’s true market value.

Local market conditions can significantly impact your property’s value, so gather evidence of any negative factors affecting your neighborhood. This might include increased traffic, commercial development, or other changes that could decrease residential property values. Keep detailed records of any maintenance issues or repairs that might affect your home’s market value.

While homeowners can handle property tax protests independently, professional representation often leads to better outcomes. Tax protest experts bring years of experience and deep knowledge of the appeals process to your case. They understand the nuances of different appeal strategies and know which approaches are most likely to succeed in different situations. Their expertise in presenting evidence effectively to appeal boards can make the difference between a successful protest and a denied claim.

The Long-Term Financial Impact

The financial benefits of a successful property tax protest extend far beyond the immediate annual savings. Consider how these reductions compound over time: A homeowner who secures a $1,500 reduction in their annual property taxes doesn’t just save that amount once. Over five years, they’ve kept $7,500 in their pocket rather than paying it to the tax assessor. Extend that to a decade, and the savings grow to $15,000 – a significant sum that could impact a family’s financial well-being.

These savings create numerous opportunities for homeowners to strengthen their financial position. Many families reinvest their savings into home maintenance and improvements, which can help maintain or increase their property’s value while improving their quality of life. Others direct the extra funds toward long-term financial goals like retirement savings or their children’s education funds. Some use the savings to build emergency funds or pay down existing debt, improving their financial security.

When weighing whether to protest your property taxes, consider the long-term perspective. Even a modest reduction in your assessment can result in substantial savings over the years you own your home. The effort invested in preparing and presenting a strong protest case typically pays for itself many times over through years of reduced tax bills.

Maximizing Your Property Tax Savings

Timing plays an important role in the success of your property tax protest. Texas law sets strict deadlines for filing protests, and missing these deadlines typically means losing your right to appeal until the next tax year. Understanding and meeting these deadlines is essential for preserving your right to challenge your assessment.

The strength of your evidence can make or break your protest case. Tax appeal boards are more likely to approve reductions when presented with clear, compelling evidence of overvaluation. This means gathering comprehensive documentation, organizing it effectively, and presenting it in a way that clearly supports your argument for a reduced assessment.

Professional experience can significantly impact the outcome of your protest. Tax protest professionals understand the technical aspects of property valuation, know how to identify assessment errors, and have experience presenting cases effectively to appeal boards. Their expertise can help you avoid common pitfalls and maximize your chances of securing a meaningful reduction.

Take Action Today

Reducing your property tax burden through a formal protest represents one of the most significant financial opportunities for Texas homeowners. While the process requires careful preparation and attention to detail, the potential long-term savings make it well worth the effort. Whether you’re facing financial strain from rising property taxes or simply want to ensure you’re paying your fair share, taking action to protest your property tax assessment could result in substantial savings for years to come.

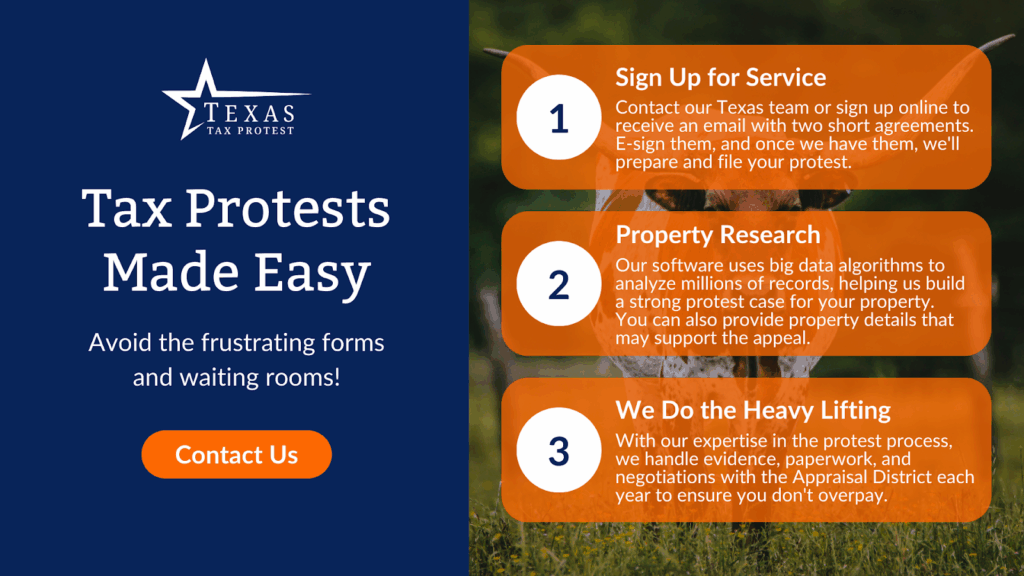

At Texas Tax Protest, we understand the complexities of the property tax system and the challenges homeowners face in navigating it. Our team of experienced professionals is ready to help you evaluate your assessment and build a strong case for reduction. Let us put our expertise to work for you, allowing you to join the thousands of Texas homeowners who have successfully reduced their property tax burden through strategic protests.

Don’t leave money on the table. Contact us for a comprehensive evaluation of your property tax assessment and discover how much you could save. Through professional representation and strategic advocacy, we’re here to help you secure the fair property tax assessment you deserve. Your potential savings are waiting – let’s work together to unlock them.