How Local School Districts and Governments Impact Your Property Taxes

September 15, 2025

Most Texas homeowners know that their annual property tax bill depends on the value of their home. But here’s something many people overlook: your appraisal is only half the equation. The other half? School districts, city councils, counties, and other taxing entities set local tax rates.

If your home’s value went up this year, you may be bracing for a bigger bill, but understanding how these local governments contribute to the total can help you see the big picture and protest more effectively.

Appraised Value vs. Tax Rate

Your property tax bill is based on two core numbers:

- Appraised value – Determined by your county’s appraisal district, this is what the government thinks your home is worth.

- Tax rate – Set by local taxing entities like school districts, cities, counties, and special utility or hospital districts.

The tax rate is expressed in dollars per $100 of property value. So even if your appraisal stays flat, your taxes can still rise if local entities raise their rates.

Why School Districts Matter So Much

Public school districts typically account for the largest portion of a Texas homeowner’s tax bill. That’s because education funding in Texas relies heavily on local property taxes.

Each year, your school board sets a Maintenance & Operations (M&O) tax rate and sometimes an Interest & Sinking (I&S) rate to repay bonds; these account for a significant share of your total tax rate, often more than half.

You may not realize that school boards have some flexibility in adjusting rates within state-mandated limits. A growing student population or new campus construction can increase rates, even if appraisals hold steady.

How Local Governments Affect Your Bottom Line

In addition to school districts, other taxing entities can impact your final bill:

- City governments fund police, fire, parks, and local infrastructure.

- County governments handle roads, courts, and public health.

- Special districts may charge taxes for utilities, flood control, or hospitals.

Each entity sets its rate, which is added to calculate your total property tax liability. Even small increases across multiple districts can add up quickly.

Tax Rate Setting Season

Tax rates are typically set between August and September after local budgets are finalized. During this time, taxing entities hold public hearings and adopt rates for the upcoming year.

If you ever wondered why your final bill doesn’t arrive until fall, it’s because the appraisal district has to wait for all the rates to be locked in. That’s also why challenging your property’s value happens earlier in the year, usually in the spring.

Why Protesting Your Appraisal Still Matters

While you can’t directly change the tax rates set by local governments, you can dispute the appraised value of your property. The lower your appraisal, the less taxable value each rate is applied to.

For example:

- Home A is appraised at $450,000 and taxed at a combined rate of 2.5% = $11,250 in taxes.

- If that appraisal is successfully lowered to $400,000 = $10,000 in taxes.

That’s a $1,250 savings, even if tax rates remain unchanged.

Navigating a Complicated System

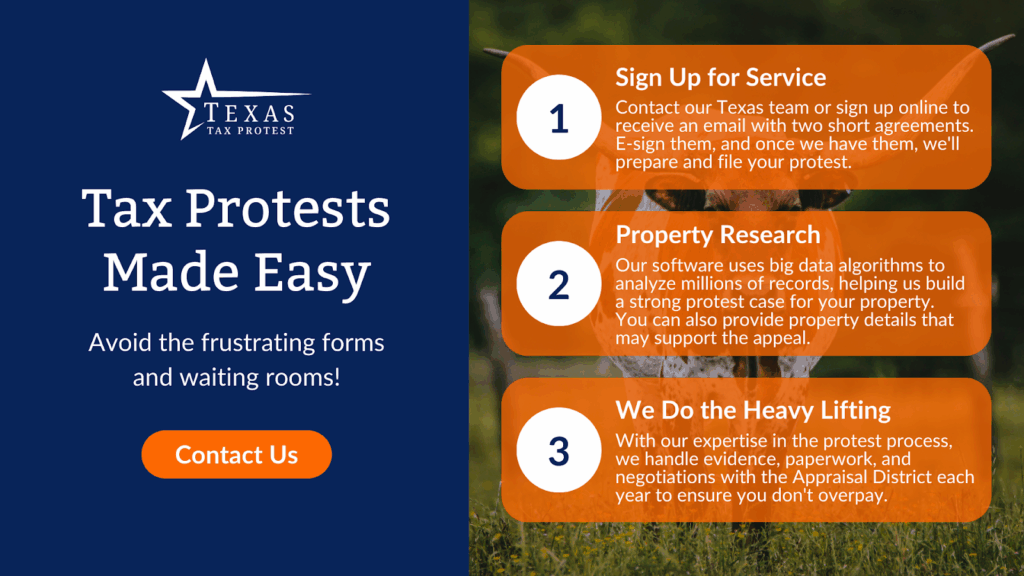

Texas property taxes aren’t just about one number or one entity. They’re the result of multiple systems working at once. That complexity is why homeowners turn to Texas Tax Protest. With over $85 million in savings and 10+ years of experience, we help Texans challenge their appraisals using big data, local knowledge, and a personalized approach.

We understand how local governments impact your final bill, and we know how to target your protest for maximum effect. Our Texas-based support team ensures you never deal with offshore call centers.

Want to Take Control of Your Property Taxes?

Don’t let rising tax rates or inflated appraisals catch you off guard. Texas Tax Protest is here to help you challenge your valuation and reduce what you owe. Contact us to get started.