Do You Qualify for a Property Tax Protest? Here’s What You Need to Know

August 22, 2025

Each year, thousands of Texas homeowners receive their property tax appraisal notices; and many of them wonder the same thing: Can I protest this? If you’re questioning whether your property has been overvalued or if you’re paying more than your fair share in property taxes, you’re not alone.

Fortunately, Texas law allows homeowners to protest their property tax appraisals. But knowing whether you qualify, how the process works, and what common misconceptions to avoid is key to making informed decisions.

Here’s what you need to know about the eligibility for tax protest in Texas and how it could benefit you.

Understanding the Basics: What Is a Property Tax Protest?

A property tax protest is a formal challenge of the appraised value your local appraisal district assigns to your home. This value determines how much you owe in property taxes each year. If the value is too high, you’re likely overpaying.

Homeowners can protest for various reasons, but the most common is that the appraised value doesn’t reflect current market conditions or isn’t in line with similar properties.

Who Can Protest? Key Eligibility Criteria

Wondering if you qualify for a property tax protest? In Texas, the qualifications are fairly straightforward:

1. You must be the property owner

Only the legal owner of the property—whether an individual, trust, or business entity—is eligible to file a protest. If you’ve recently purchased the property, ensure your name has been updated in the appraisal district’s records before filing.

2. Your property must be taxable

Most residential homes are considered taxable unless specifically exempted (such as properties owned by religious or charitable organizations). You likely qualify if you live in the home, and it’s not fully exempt.

3. You must meet the deadline

Texas homeowners typically have until May 15 or 30 days after the appraisal notice is delivered, whichever is later, to file a protest. Missing this deadline can disqualify your protest for the year, regardless of merit.

4. You must have grounds to protest

The most common legal grounds for a protest include:

- The appraised value is too high

- The property is unequally appraised compared to similar homes

- The appraisal contains errors (e.g., square footage, features, or condition)

- The property suffered damage that reduced its value (e.g., storm or fire damage)

Property Tax Reduction Qualifications in Texas

While there’s no income or age requirement to protest your taxes, some exemptions may strengthen your case or offer additional relief:

- Homestead Exemption: If you live in the home as your primary residence, you may already receive a homestead exemption. This caps the amount of your appraised value, which can increase yearly.

- Over-65 or Disabled Exemption: Additional exemptions are available for homeowners over 65 or those with qualifying disabilities, which can reduce your overall tax burden.

- Veteran’s Exemptions: Disabled veterans or their surviving spouses may be eligible for significant reductions.

Keep in mind: receiving these exemptions doesn’t disqualify you from protesting. In fact, many homeowners with exemptions still choose to protest their appraised value annually.

Common Misconceptions About Protesting

Many homeowners don’t take advantage of the protest process because of misunderstandings. Let’s clear up a few:

“It’s not worth it unless the value increases a lot.”

Even a small reduction in appraised value can lead to meaningful tax savings over time. And if your neighbors’ homes are appraised lower, you might have a strong case for unequal appraisal.

“I don’t need to protest if I already got a homestead exemption.”

The exemption helps, but it doesn’t guarantee a fair market value. You can and should still protest if you believe the appraisal is too high.

“It’s too complicated or risky.”

The process is more accessible than many people realize. And there’s no penalty for protesting—your property value cannot be raised as a result of a protest unless you initiate the challenge yourself.

Why Protest? The Potential Benefits

- Lower annual property taxes: The most direct benefit of a successful protest is reduced taxes for the year.

- Cumulative savings: Because future appraisals often build on previous values, a reduction this year can lead to lower taxes down the line.

- Accountability: Protesting helps ensure appraisal districts are transparent and fair in their assessments.

Know Your Rights and Take Action

Understanding Texas’s property tax reduction qualifications can make a big difference in how much you pay—and how confident you feel about your home’s assessed value. If you own a home, meet the deadline, and have legitimate grounds for disagreement, you likely qualify for a property tax protest.

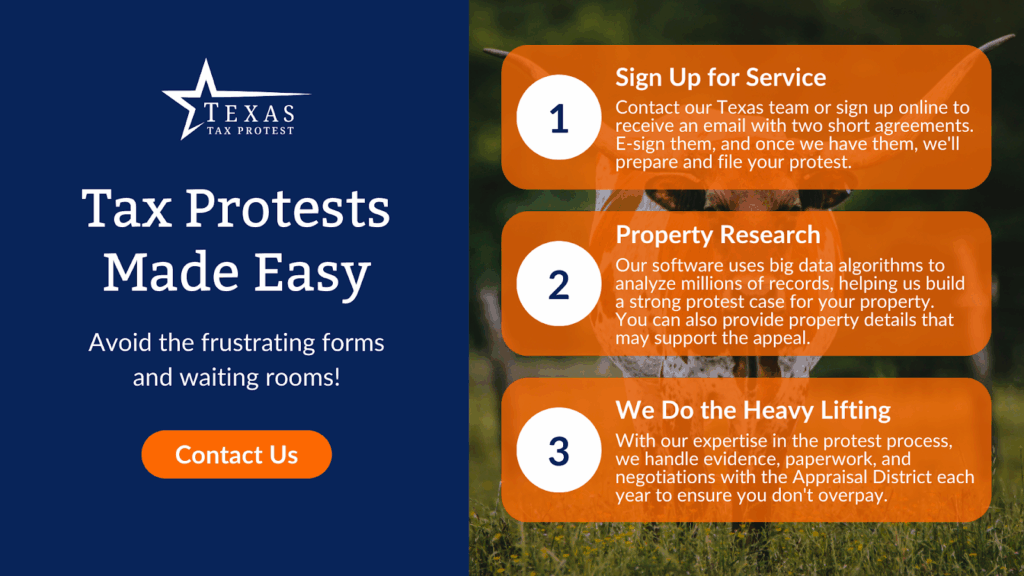

Still not sure if you’re eligible or how to build a strong case? Contact Texas Tax Protest to discuss your property and explore your options. Our team is here to help homeowners like you understand the process and potentially save on their annual tax bill.