Houston Living Costs: Rent, Groceries, Utilities & More

July 26, 2025

Key Takeaways:

- Housing and Property Taxes Add Up Fast: Houston’s home prices are below the national average, but property taxes can quickly raise monthly costs. Renters and buyers should consider both pricing and location to balance affordability.

- Transportation Costs Are Manageable with Smart Planning: Although car ownership is common, lower-than-average gas and public transit fares give commuters room to save.

- Groceries and Utilities Help Keep Living Expenses Low: Grocery prices in Houston are slightly below the national average, and utility bills tend to be more affordable than in other major metros. Thoughtful energy use and meal planning can lead to meaningful savings.

Houston is one of the fastest-growing cities in the country, where glassy high-rises meet mural-covered blocks and tree-lined streets stretch past every freeway bend. The city offers new residents career opportunities, cultural depth, and neighborhood variety. From downtown lofts to tucked-away homes in the Heights, living in Houston looks different for everyone, and so does the price tag.

It’s no surprise that the real cost of living in Houston goes beyond average rent or home prices. As monthly expenses continue to rise, knowing the full scope of living in Houston helps homeowners and future buyers stay ahead of the game. If you’re weighing a move or trying to make sense of rising bills, this guide will help you understand what to expect and what you can do about it.

How Home Prices and Taxes Shape Monthly Budgets

Houston’s housing market plays a major role in its overall affordability. With median prices still lower than large U.S. cities, the city remains accessible to both renters and buyers. According to Payscale, housing expenses in Houston are 20% lower than the national average, making it one of the more cost-friendly metros for building long-term stability.

Renting in Houston: Options Across Neighborhoods

Houston’s rental market offers something for every lifestyle. From compact studios in Midtown to spacious single-family homes near Spring, prices vary by location, layout, and job proximity. As of early 2024, the average rent for a one-bedroom apartment in Houston ranges from $1,250 to $1,450 per month, while two-bedroom apartments average $1,600 to $1,850.

Areas like The Heights, Montrose, and Rice Military often have higher rents due to walkability and nightlife access, while neighborhoods farther out (e.g., Cypress, Pasadena, or Pearland) welcome more square footage at a lower monthly rate. These location-based differences give renters flexibility but also highlight the need for careful budgeting based on commute and lifestyle preferences.

Buying a Home: What to Expect From Price to Square Foot

For homebuyers, Houston’s median sale price hovers around $340,000, though the numbers vary by location, age of the home, and nearby amenities. For example, detached single-family homes in outer-ring suburbs can list for $250,000 to $300,000, while properties in sought-after inner-loop neighborhoods often climb past $500,000.

Additionally, many homes sit on larger-than-average lots, which adds to their homebuyer appeal. However, new construction, historic properties, and communities with HOA amenities tend to drive up prices and raise assessed values, which affects your long-term housing budget.

Property Taxes: A Key Factor in Houston’s Cost of Living

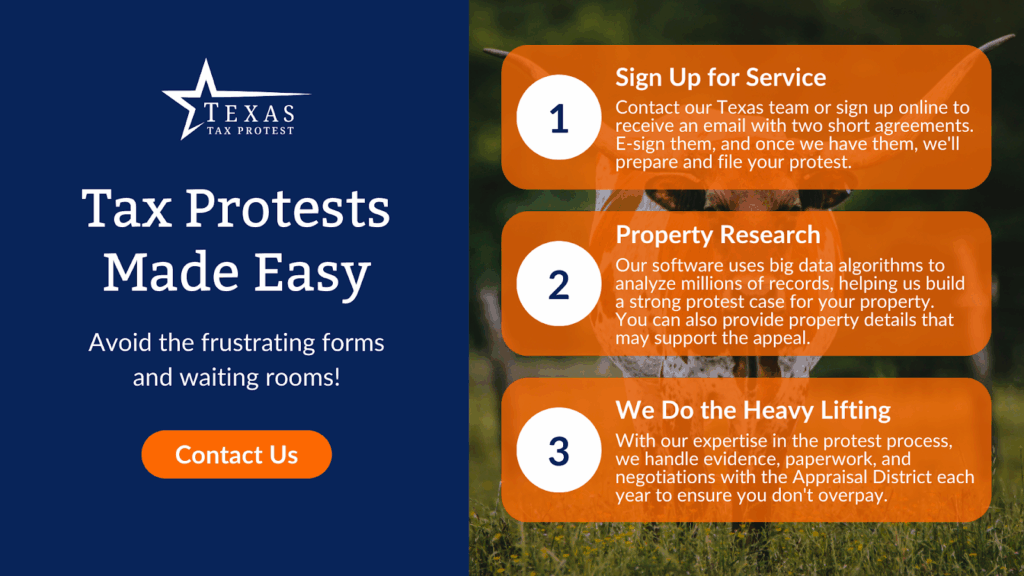

Texas is one of the few states without a state income tax, but homeowners feel the difference in annual property tax bills. In Houston, rates typically fall between 2% and 3% of your home’s assessed value, which can significantly increase your monthly housing cost even for modest properties.

The local appraisal district recalculates these assessments annually based on comparable sales, and mathematical adjustments are made for differences in size, condition, and amenities. For example, a home with an updated kitchen may be valued higher than a nearby property with fewer upgrades. Our team at Texas Tax Protest helps Houston homeowners break down those comparisons and protest inaccurate valuations.

What Gas, Transit, and Commuting Really Cost

Getting around Houston comes with trade-offs. The city’s scale, limited rail coverage, and sprawling highways shape how residents budget for daily movement, whether you’re behind the wheel or on board a METRO bus.

Owning a Car in Houston

Like many other U.S cities, driving is common for most Houstonians. With few walkable districts and long commutes, owning a car often feels necessary. While gas prices in Houston typically sit below the national average thanks to nearby refineries, other costs climb higher. Auto insurance rates in Texas tend to exceed national benchmarks, particularly for younger drivers or those living in dense zip codes.

In addition to fuel, most drivers budget for routine maintenance, registration fees, tolls, and repairs. Monthly parking costs may apply to those working downtown or in busy shopping districts. These recurring expenses add up fast, so car ownership often becomes one of the largest line items in a Houston household budget.

What Public Transit Costs in Houston

For residents looking to cut back on driving, METRO offers citywide buses, light rail, and park-and-ride services at accessible prices.

As of 2024, standard bus and rail fares are $1.25 per ride, with discounted tickets at $0.60 for seniors, students, and qualifying passengers. Frequent riders can also take advantage of the “5 for 50” deal, which adds five free trips for every 50 rides purchased using a METRO Q Fare Card or mobile pass. While METRO coverage doesn’t stretch into every suburb, many riders blend transit with occasional driving to reduce parking stress and stay under budget.

Rideshare, Carpooling, and Smarter Commutes

App-based rideshare services give Houstonians more flexibility. For occasional users, ridesharing offers a convenient alternative, though peak-hour surge pricing can outpace a typical gas bill. Carpooling and vanpool programs, often coordinated through employers or commuter platforms, help cut costs and lower traffic congestion. Since Houston expenses are 6% lower than the national norm, living closer to work or gaining access to employer-subsidized transit passes can reshape how you travel.

Food and Grocery Costs in Houston

Feeding a household in Houston offers more flexibility than you might expect. Grocery prices in the city tend to be slightly below national averages, allowing residents to shape budgets around dietary needs, lifestyle, and where they shop.

Grocery Prices in Houston

Houston’s grocery scene reflects the city’s global roots. Big-box chains like H-E-B and Kroger offer consistent access to pantry staples, while smaller ethnic markets and farmers’ markets make it easy to explore new flavors or shop local.

Recent pricing data shows grocery costs in Houston are about 1% lower than the national average. A gallon of milk runs between $3.00 and $3.50, while prices for fresh produce shift throughout the year based on season and source. Budget-savvy shoppers often gravitate toward store brands, bulk purchases, or weekly circulars to keep their cart totals manageable.

For a family of four, monthly grocery bills often fall between $700 and $950, depending on eating habits and shopping routines. However, singles or couples may spend more than $250 to $400 monthly. Shoppers who meal prep or rotate between stores often find more value week to week.

Dining Out in Houston

Outside the kitchen, dining out in Houston remains relatively affordable. Neighborhood taco stands, pho shops, and Southern barbecue joints regularly serve hearty meals for under $15. Of course, the city’s restaurant scene also includes high-end options for those celebrating or craving a splurge. With so many casual and mid-range spots across the city, eating out doesn’t always derail well-managed budgets.

Monthly Utilities in Houston: What Your Household Might Spend

Housing prices may grab the headlines, but everyday utilities shape Houston’s monthly cost of living. From long summers to regional infrastructure quirks, these ongoing bills require a clear-eyed look before you build out a budget.

Electricity: Cooling Comes at a Cost

In a climate where AC runs most of the year, electricity bills make up a large share of Houston’s monthly expenses. Average costs fall between $130 and $200, with higher totals likely in older homes or those without insulation upgrades. Likewise, properties with modern HVAC systems, LED lighting, and double-pane windows tend to stay closer to the low end of that range.

Many households choose fixed-rate electricity plans to avoid seasonal spikes in per-kilowatt-hour charges. Square footage and thermostat habits affect usage, so tracking usage early can help manage long-term costs.

Water, Sewer, and Natural Gas

Water and sewer services are bundled on the same bill and priced by usage. For a mid-sized home, the monthly charge typically ranges from $60 to $90. Outdoor watering, laundry loads, and pool upkeep may add more. Houston’s natural gas bills are relatively modest, averaging around $25 to $50 per month. Homes that use gas for heating or cooking see the most significant jump during winter.

Trash, Internet, and Other Household Services

Trash and recycling are often billed flatly between $20 and $35 per month. Most neighborhoods receive weekly pickup as part of a city-managed schedule. Expect to pay $50 to $100 for internet access. Some apartment complexes include Wi-Fi in rent, but most homeowners manage their service contracts.

What These Bills Mean for the Cost of Living in Houston

Utility rates in Houston are relatively reasonable compared to other large cities, though individual totals vary widely. Factors like square footage, personal usage habits, and energy efficiency all influence the bottom line. Reviewing past bills, noting seasonal shifts, and selecting the right providers can help shape a sustainable monthly plan that matches your household’s pace without stretching your wallet.

Healthcare Costs in Houston

According to Payscale, Houston’s world-class medical facilities may give the impression of sky-high prices, but average healthcare costs are about 2% lower than the national average. That small margin can have a meaningful impact over time for families or individuals managing recurring appointments, prescriptions, or insurance premiums.

Many options exist across public and private networks, ranging from budget-friendly urgent care clinics to top-tier hospitals like Houston Methodist and MD Anderson. For many residents, employer-sponsored health insurance helps reduce upfront costs, while others shop for plans through the Texas marketplace.

Final Thoughts

Living in Houston is possible and deeply rewarding with the right budgeting strategy. From world-class medical centers and diverse food scenes to tight-knit neighborhoods and a booming job market, the city delivers both opportunity and charm. Still, Houston’s real cost of living runs deeper than rent estimates or utility averages. Homeowners also face shifting property tax assessments that quietly affect monthly spending.

Those increases can cut into even the most careful budgets without a plan. Thankfully, our team at Texas Tax Protest helps take the guesswork out of that process. We advocate for fair valuations through data-backed strategies, local insight, and a hands-on approach. With the proper support, you can hold on to more of your savings and enjoy the whole experience of living in one of Texas’s most dynamic cities.

Read also:

- How to Protest Your Property Taxes in Texas and Actually Win

- Appeal Strategies That Minimize Your Property Taxes

- The Most Effective Ways to Lower Your Property Taxes in Texas

Frequently Asked Questions About the Cost of Living in Houston

What are the most affordable neighborhoods in Houston?

Houston’s wide layout includes several neighborhoods with lower-than-average housing costs. Areas like Alief, Northside, and East End tend to be more budget-friendly for renters and buyers. These neighborhoods still offer access to public amenities and major highways, though commute times and local services may vary.

What is the average cost of healthcare in Houston?

According to data from PayScale, healthcare in Houston costs about 2% less than the national average. Most individuals spend between $350 and $500 monthly on insurance premiums and related out-of-pocket costs. Employer-sponsored plans may reduce those totals, but prices still vary by provider, coverage tier, and family size.

How expensive are childcare services in Houston?

Full-time childcare in Houston typically costs $800 to $1,200 per month per child. In-home options or nanny services may be more expensive, depending on experience and location. Families seeking more flexible arrangements often turn to part-time programs or after-school care. City and state subsidy programs are also available to qualifying families and can help reduce monthly childcare expenses.

What income do you need to live comfortably in Houston?

A single person can usually live comfortably in Houston on $50,000 to $60,000 annually. While actual needs vary by neighborhood and lifestyle, careful budgeting helps stretch your salary further. Our team at Texas Tax Protest also helps homeowners lower their property tax burden, contributing to long-term financial stability.

Can you live in Houston without a car?

Car-free living is possible in specific neighborhoods, though it takes planning. Downtown, Midtown, and the Museum District are walkable and well-connected by METRO’s rail and bus systems. Ridesharing, biking, and carpooling also give residents flexible ways to get around without owning a vehicle. While most Houstonians still rely on personal cars, living without one can work if you stay close to transit lines and employment centers.

How much can education costs be in Houston?

Education costs in Houston can vary widely based on your family’s needs and the type of schooling you pursue. Public schools in the Houston Independent School District (HISD) don’t charge tuition, but families must still budget for supplies, uniforms, extracurricular fees, and transportation.

Those considering private or charter schools should expect a much higher price tag. Private school tuition in Houston often ranges from $10,000 to $25,000 per year. Additional fees may include technology access, meals, field trips, and application deposits.