What to Know Before Buying a Home in Texas: Taxes, Laws, and Costs

July 29, 2025

Key Takeaways:

- Know the Legal Landscape Before You Buy: Texas has its own rules regarding property taxes, ownership laws, and post-closing responsibilities. Learning how these factors shape your costs can help you avoid surprises and plan.

- Explore Exemptions That Can Lower Your Tax Bill: From homestead and senior exemptions to benefits for veterans and individuals with disabilities, filing early for the proper exemptions can lead to meaningful long-term savings.

- Budget for More Than the Listing Price: Property taxes, closing costs, and ongoing expenses often increase faster than expected. Planning for these costs upfront and strategies to lower your valuation can strengthen your financial footing in your new Texas home.

A Texas home can feel like a dream: open skies, thriving neighborhoods, and a fast-moving real estate market that keeps buyers on their toes. Before you settle into your new address, there’s more to consider than price tags and square footage. Buying a home here comes with legal quirks, tax rules, and ownership costs that catch buyers off guard.

Each step carries long-term financial implications from the moment you sign a contract to the day your first property tax bill arrives. That’s why understanding the laws, knowing what affects your home’s taxable value, and preparing for hidden costs can help you make smarter decisions upfront. In this guide, our team at Texas Tax Protest breaks down the key tax rules, exemptions, and financial considerations that shape homeownership across the state.

Key Legal Considerations Before You Buy a Home in Texas

Buying a home in Texas involves more than location and loan approval. Behind every offer letter is a legal framework that shapes what you can do with your property, how ownership is protected, and what responsibilities follow once you sign. From homestead laws to HOA restrictions, these details shape your rights as a homeowner from day one.

Homestead Laws That Protect Your Property and Lower Taxes

Texas homestead laws serve two critical roles for homeowners. First, they help protect your primary residence from certain creditors. While this doesn’t shield you from all debts, it does create legal barriers against most non-mortgage claims. Second, qualifying for the homestead exemption can reduce the taxable value of your home, which may lower your property tax bill year over year.

To qualify, the home must be your primary residence, and you must apply through your county appraisal district. Once approved, the exemption stays in place as long as the home remains your principal residence. For many buyers, this is one of the simplest ways to reduce long-term housing costs.

Titles, Deeds, and Mandatory Property Disclosures

Every Texas home sale requires clear title and deed documentation to transfer legal ownership. Before closing, the seller must also provide a disclosure notice detailing known property issues. That includes structural concerns, past flooding, foundation cracks, roof repairs, etc. These disclosures help you evaluate risk before you commit. Working with a trusted title company helps confirm no liens, boundary disputes, or unresolved claims on the property.

Community Property and Spousal Signatures

Texas follows community property law, which affects how property is treated during and after a marriage. In most cases, if you’re married and buying a home, both spouses must sign off on key documents, even if one person is the primary borrower. This legal structure also matters in divorce, death, or estate planning cases. Property acquired during the marriage is typically considered joint ownership, and decisions involving refinancing, selling, or transferring the home often require written consent.

Property Tax Assessments: What Happens After You Close

After you close on a home, your local appraisal district will assign a value to your property. That number becomes the basis for your annual property taxes, and depending on how the county evaluates your home, it can change year to year.

If your assessment seems high, you’re allowed to challenge it. Homeowners can file a formal protest and use comparable sales data to argue for a reduced valuation. Local appraisal districts take adjustments into account for square footage, upgrades, age, location, and other features that might affect a property’s market value. Working through this process allows you to lower your tax liability early on.

Homeowners Associations: Rules That May Come With the Deed

In many Texas neighborhoods, buying a home also means joining a homeowners association (HOA). These groups regulate various property decisions, from paint colors, landscaping, parking rules, and seasonal decorations. Before you close, review the HOA bylaws, fee schedule, and any ongoing assessments.

How Property Taxes Can Affect Your Mortgage Payment

Property taxes in Texas directly influence what you’ll pay monthly for your mortgage. As your home’s assessed value changes, so can the total cost of your loan. Here’s how property taxes work behind the scenes:

- Your Mortgage Payment Includes More than Loans: Lenders typically calculate your monthly payment using PITI, which refers to principal, interest, taxes, and insurance. That “T” for taxes is based on your home’s appraised value, which local appraisal districts update yearly.

- Taxes are Held in Escrow: Most lenders set up an escrow account to collect property taxes gradually throughout the year. When your tax bill comes due, the lender sends payment directly to the appraisal district using your collected monthly payments.

- Rising Property Values Can Trigger Higher Payments: Your county’s appraisal district often reassesses the property after a home purchase. If your appraised value increases, your lender recalculates how much to collect for taxes, raising your monthly mortgage even if your interest rate stays the same.

- Local Taxing Entities Drive How Much You Pay: Texas doesn’t collect a state property tax. Instead, counties, cities, and school districts each set their tax rates. In places like Tarrant County (TAD), rates and schedules may vary, but the result is the same: higher valuations generally mean higher monthly payments.

- Comparable Sales Determine Assessed Values: Appraisal districts evaluate recent home sales to estimate market value. They don’t stop at listing prices; they apply adjustments based on square footage, age, lot size, upgrades, and less desirable features.

- Comp Adjustments Between Affect Taxes: If a neighboring home sold for more because of an added bedroom or modern kitchen, your appraiser may subtract value when comparing it to your home. The final number directly affects your tax bill, influencing how much your lender collects through escrow.

Property Tax Exemptions for Homeowners, Veterans, Seniors, and More

Texas offers a range of property tax exemptions that can lower your taxable home value and reduce your annual bill. These exemptions are beneficial for homeowners facing steep assessments after a recent purchase. From veterans and seniors to homeowners with disabilities, these savings can add up over time. Here’s a closer look at the most common exemptions:

General Homestead Exemption

Homeowners who use their property as a primary residence may qualify for a homestead exemption. This exemption lowers the home’s taxable value and often results in annual savings. To apply, you must live in the house as of January 1 of the tax year and submit the required paperwork to your county appraisal district.

Senior Exemption

Texans 65 or older can apply for an additional exemption that reduces school district taxes. In most cases, this exemption also freezes the school portion of the tax bill, keeping that amount stable year after year unless significant improvements are made to the property.

Disability Exemption

Homeowners with qualifying disabilities may be eligible for a separate exemption. This can be used in addition to the general homestead exemption and, in many cases, works similarly to the senior exemption by locking in the school tax amount and providing added relief on the overall tax bill.

Veteran Exemption

Texas offers significant tax relief for disabled veterans. The exemption amount depends on the veteran’s disability rating, with higher ratings qualifying for larger deductions. In some cases, veterans with a 100% disability rating may receive a full exemption from property taxes on their primary residence. Surviving spouses and families of service members killed in action may also qualify for meaningful reductions.

Surviving Spouse Benefits

In cases where a homeowner passes away, certain exemptions may transfer to a surviving spouse. This applies to disabled veterans and individuals who qualified for the age 65+ or disability exemption before their passing, as long as the spouse continues to occupy the home as a primary residence.

Common Fees and Closing Costs in Texas

Closing on a home in Texas means more than finalizing a sales price. From title insurance to prepaid taxes, each fee plays a role in completing your purchase and securing legal ownership. Here’s what to anticipate as you approach the closing table:

- Property Taxes: Texas property taxes are among the highest in the country. At closing, buyers typically reimburse the seller for prepaid taxes through a prorated calculation.

- Title Fees: These charges cover the title search and insurance, which help protect against claims of ownership or legal disputes. Title insurance is a one-time fee set by the state, and if you’re financing the purchase, you’ll likely see two separate charges—one for the lender’s policy and another for your own.

- Loan Origination Fees: Mortgage lenders often charge an origination fee to process your loan. This cost typically ranges from 0.5% to 1% of the loan amount, though it can vary by lender or loan type.

- Appraisal and Survey Fees: An independent appraisal is usually required to confirm the home’s market value. In Texas, appraisal fees often fall between $400 and $700.

- Recording Fees and Local Filing Costs: After the sale, official documents must be filed with the county to make the transaction public. While Texas does not charge a state transfer tax, counties may collect modest recording or document fees.

- Homeowners Association (HOA) Fees: If the home is part of an HOA, you may owe prorated dues at closing and a one-time transfer or setup fee.

- Escrow Fees: Escrow agents or title companies manage the final transfer of funds. In most cases, escrow fees are split between the buyer and seller, with total costs depending on the property’s purchase price.

Ways to Lower Your Property Tax Bill in Texas

In Texas, where assessments shift with the market, knowing how to approach your valuation can lead to meaningful savings. Whether you’ve just closed on a home or have owned property for years, these practical strategies can help reduce your tax burden and protect your bottom line.

Know Your Exemptions

Texas law includes several exemptions that reduce a home’s taxable value. The general homestead exemption is the most widely used, and it applies to primary residences and can significantly lower your annual bill. Additional exemptions are available for seniors over 65, veterans, and homeowners with qualifying disabilities. These benefits vary by category, but they can be stacked in many cases. Once you’re eligible, submit your application to the county appraisal district as early in the year as possible.

Gather the Right Comps

Appraisal districts rely on recent sales data to determine market value. To build a strong case, focus on properties that share similar size, age, and location. From there, make adjustments for square footage, condition, or upgrades. For example, if a comp has a larger footprint or a remodeled kitchen, document those differences and subtract the estimated value accordingly. These calculations help create a more accurate comparison and support a lower assessment.

Highlight Unique Property Characteristics

Every property has features that don’t always appear in basic square footage. Homes near busy intersections, commercial zones, or flood-prone areas may be overvalued if those factors aren’t properly weighed. If your home needs significant repairs or has design elements that limit appeal, use inspection reports, repair estimates, or photos to explain why your valuation should come down.

Double-Check the District’s Details

Data errors happen more often than most homeowners realize. Sometimes, appraisal records reflect the wrong number of rooms, incorrect square footage, or outdated renovation details. Review your home’s profile through your county’s appraisal district website and flag anything that doesn’t match. Providing corrected information can reduce the appraised value and potentially lower your tax bill.

Track Market Fluctuations

The real estate market can shift quickly. Drops in neighborhood sales prices, foreclosures, or cooling demand spikes can influence your home’s assessed value. Focus on comparable sales in the months leading up to January 1 – the date most districts use for valuation purposes. Showing the market has softened in your area can help justify a lower number.

File a Timely Protest

Texas gives property owners a short window to challenge their assessment each spring. Prepare a well-documented case that includes adjusted comps, sales data, photos, contractor quotes, and repair records. If your protest doesn’t result in a reduction during the informal phase, you still have the option to present your case to the Appraisal Review Board. Being thorough and organized can strengthen your position.

Final Thoughts

Texas property tax laws can feel complex, particularly when valuations vary from one county to the next. There’s much to keep track of between legal rules, exemption options, and shifting assessments during and after your home purchase.

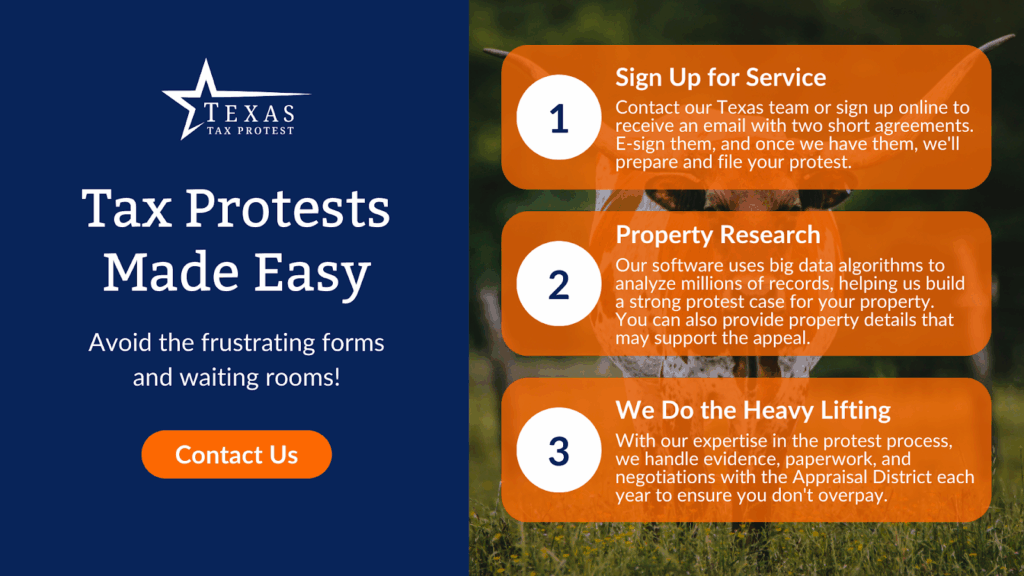

Every dollar saved through a successful property tax protest adds long-term value to your investment – and that’s where our team at Texas Tax Protest comes in. We combine deep knowledge of local tax codes with hands-on service and powerful data tools to help you make informed, strategic moves. From exemption filings to formal appeals, we’re here to simplify the process and help you protect what matters most: your home.

Read more:

- When Is the Time to Protest Your Property Taxes in Texas?

- Delinquent Taxes: What Happens If You Don’t Pay on Time?

- Tax Sale: What It Means and How to Prevent Losing Your Property

Frequently Asked Questions About Buying a Home in Texas

Are there specific laws about home inspections in Texas?

Texas law doesn’t require home inspections when buying a home, but most lenders and savvy buyers consider them essential. Inspections help you spot problems with structure, systems, or pest issues before closing. Licensed inspectors in Texas are regulated by the Texas Real Estate Commission (TREC), with minimum standards for what inspectors must review. Always read your inspection report carefully and ask questions about anything you don’t understand.

Is it mandatory to have a real estate attorney in Texas?

Texas doesn’t require buyers or sellers to hire a real estate attorney to complete a home purchase. Real estate agents and title companies handle most transactions. However, consulting an attorney can protect your interests for complex sales, inherited properties, or unusual contract clauses.

Are there any first-time homebuyer programs in Texas?

Texas offers several state-sponsored and local programs for first-time homebuyers, including down payment assistance, below-market interest rates, and tax credits. Programs like the Texas State Affordable Housing Corporation (TSAHC) and My First Texas Home can be good starting places. Each program has its own rules on income, purchase price limits, and property eligibility.

How does the Texas homestead exemption work?

A homestead exemption helps lower the taxable value of your primary residence, reducing your annual property tax bill. Qualifying homeowners apply with their county appraisal district. Several exemptions exist, including standard, over-65, disabled, and veteran options. Texas Tax Protest helps clients navigate these filings and maximize all possible savings.

Is homeowners’ insurance required in Texas?

Homeowner’s insurance isn’t required by Texas law, but mortgage lenders almost always make it a condition of your loan. Even if you pay cash or have no loan, insurance protects against fire, storm damage, and liability. Compare policies and coverage limits—costs can be higher in some parts of Texas, which are prone to severe weather.

Do property tax rates vary by county in Texas?

Yes, property tax rates are set locally and can differ significantly across Texas counties and cities. School districts, hospital districts, and special taxing authorities may add to your bill. For example, the Tarrant Appraisal District (TAD) in Tarrant County has its own rates and processes. Texas Tax Protest helps clients understand their local rates, uncover tax-saving exemptions, and appeal assessments.

What should I know about Texas’s non-disclosure state status?

Texas is a “non-disclosure” state. That means home sale prices aren’t published publicly or required on county records. Appraisal districts estimate your property’s value using public data, private sales, and comparable property analysis. Texas Tax Protest’s expertise helps make sure your home’s valuation is fair. This specialized knowledge allows homeowners to present a strong, data-backed tax protest.