Austin Housing Market Update: Prices, Demand, And Growth

September 9, 2025

Key Takeaways:

- Market Evolution: Austin’s housing market hasn’t cooled, it’s changing. Price movement varies by neighborhood, with demand shifting, not disappearing.

- Growth Patterns: New development zones like East, North, and Southeast Austin are becoming key drivers of residential expansion and rising assessments.

- Tax Impact: Rising home values often lead to higher tax bills, understanding your valuation and protesting overassessments can protect your wallet.

Austin’s housing market has been one of the most closely watched in the country, a magnet for tech, talent, and rapid development. But in 2025, the pace is shifting. While home prices remain elevated in many areas, demand is evolving, and growth is stretching into new corners of the city. For property owners, these changes don’t just affect buying and selling decisions, they directly impact your annual tax burden.

At Texas Tax Protest, we work with property owners every day to challenge overinflated assessments and correct unfair valuations. In this piece, we’ll break down what’s really happening in the Austin housing market and how those changes could influence your next property tax bill.

The Real Story Behind Rising Home Prices In Austin

Austin has long been one of the fastest-growing cities in the country, and its home prices reflect that momentum. But what’s often missing from the headlines is a clear explanation of why prices remain high and what that means for homeowners today.

Supply Constraints Are Still A Major Factor

Despite a wave of new developments, Austin is still playing catch-up on housing supply. Zoning restrictions, labor shortages, and rising construction costs have made it difficult for builders to keep up with demand. This limited inventory continues to push prices higher, especially in central and established neighborhoods.

Buyer Activity Is Evolving, Not Disappearing

After the rapid price spikes of the pandemic years, buyers are more cautious but still active. Relocations from other major cities, particularly those tied to Austin’s growing tech sector, are fueling consistent demand. However, today’s buyers are focused more on long-term value and less on panic bidding.

High Prices Don’t Always Mean High Value

For many Austin homeowners, increased home prices have come with a downside: inflated tax assessments. Market value and taxable value aren’t always aligned, and without a protest, homeowners may end up paying taxes on a number that doesn’t reflect their property’s real, current worth.

What’s Fueling Buyer And Investor Activity In Austin?

Even as the market cools from its pandemic peak, Austin continues to attract both homebuyers and real estate investors. But the motivations behind that activity are shifting and understanding those shifts is key for homeowners trying to make sense of their property values and tax assessments.

Tech Growth Still Anchors The Market

Major tech players like Apple, Tesla, and Google haven’t just brought jobs, they’ve transformed entire submarkets. Areas near tech campuses or major employment hubs continue to see strong demand from relocating employees and investors betting on long-term appreciation.

Lifestyle Appeal Remains A Major Draw

From vibrant culture and outdoor living to top-tier dining and music, Austin still offers what many call the best of Texas living. For remote workers or those leaving pricier cities, Austin feels like a lifestyle upgrade, even at higher home prices.

Institutional Investors Are Watching Closely

Large investment firms continue to explore Austin as a high-growth rental market. While they may not be buying at the same volume as in 2021–2022, their activity keeps certain neighborhoods competitive, particularly for single-family homes in up-and-coming areas.

Tax Implication: More Demand, Higher Assessments

More interest in your neighborhood whether from individuals or investors often results in higher perceived property value, which can lead to higher tax assessments. Even if your own home hasn’t changed, your surroundings may be driving your taxable value up.

Where Austin’s New Housing Developments Are Taking Shape

Austin’s growth is no longer concentrated in just the downtown core. As the city expands outward, new development zones are emerging and they’re reshaping the housing landscape. These growth areas don’t just attract homebuyers and investors; they also play a major role in how nearby property values and tax assessments evolve.

East Austin: From Underrated To In-Demand

Once overlooked, East Austin has transformed into a hotspot for both residential and mixed-use developments. With revitalized neighborhoods, new apartment complexes, and improved infrastructure, this area continues to see rising interest and rising home values.

North Austin And The Tech Corridor

With major campuses like Apple’s billion-dollar complex in North Austin, this area has become a magnet for tech employees. Master-planned communities and new retail centers are popping up along MoPac and Parmer Lane, drawing steady residential growth.

Southeast Austin And Beyond: Affordability Drives Expansion

Affordability is pushing buyers further southeast, into areas like Del Valle and beyond. With infrastructure projects such as highway expansions and improved transit options in the pipeline, this region is becoming more attractive to first-time buyers and long-term investors alike.

What This Means For Homeowners

If you live near one of these growth corridors, your property may be increasing in value whether or not you’ve made any changes to it. That can mean higher appraised values from the county and, in many cases, larger tax bills. Texas Tax Protest can help you determine whether your assessment reflects real market value or if it’s time to push back.

Why Higher Home Values = Higher Property Tax Bills

As home values in Austin continue to climb, many homeowners are learning the hard way that appreciation isn’t always good news, at least when it comes to property taxes. Whether or not you plan to sell, rising market values can directly impact how much you owe each year.

How Appraised Value Impacts Your Tax Bill

Every year, county appraisal districts determine the market value of your property. That figure forms the basis of your property tax bill. If your home’s appraised value increases even if you haven’t renovated or sold, you could see a significant jump in what you owe.

You’re Taxed On Value, Not Profit

It’s important to understand that property taxes aren’t based on your income, mortgage payment, or actual profit, they’re based on what the county thinks your home is worth. So even if your financial situation hasn’t changed, your tax burden might.

When Value Increases Outpace Reality

Sometimes, assessed values increase faster than the market justifies. This is especially common in rapidly growing areas of Austin where nearby sales or large developments drive up “comparable” values. In those cases, you may be paying taxes on a number that doesn’t accurately reflect your home’s true worth.

If That Tax Bill Feels Too High, You’re Probably Right

If your property tax bill seems higher than it should be, it might not be your imagination. Many Austin homeowners are discovering that their county’s assessed values have increased dramatically and not always in a way that reflects real market trends. The good news? You don’t have to accept it without question.

Review Your Assessment Carefully

Start by examining your Notice of Appraised Value from the appraisal district. Look at how the county has valued your property and compare that number to recent sales of similar homes in your neighborhood. In many cases, especially in areas with rapid development, the county’s estimate may be significantly higher than what your home could realistically sell for.

Gather The Right Evidence

To challenge your assessment effectively, you’ll need documentation that supports your position. This might include comparable home sales, photographs showing your home’s condition, or even an independent appraisal. Anything that clearly demonstrates a gap between your home’s actual market value and the county’s assigned value can strengthen your protest.

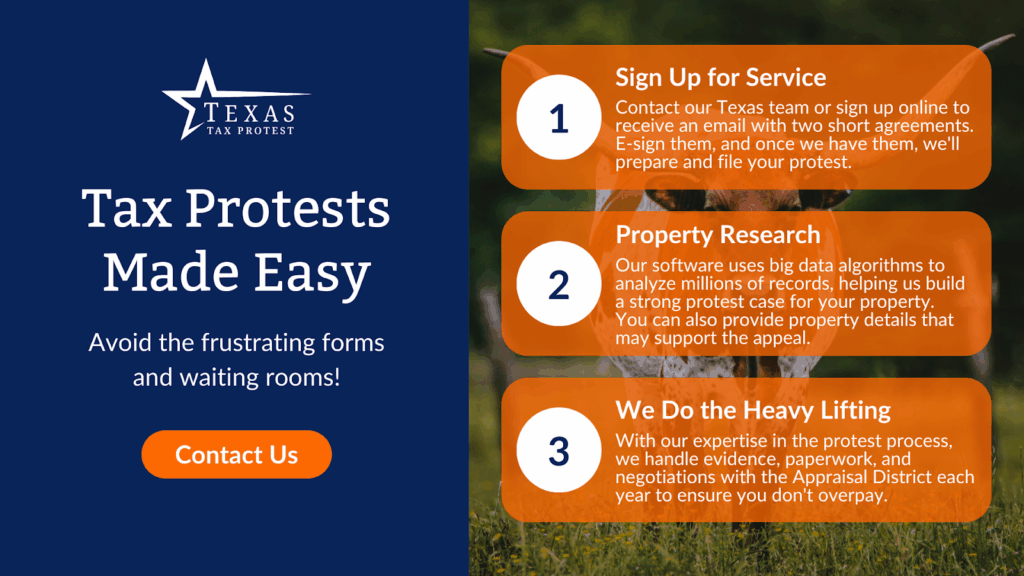

File A Formal Protest

Texas law gives you the right to protest your property’s assessed value. While the process is free and homeowners can file on their own, many choose to work with professionals like Texas Tax Protest who understand how to navigate local appraisal systems and build compelling protest cases.

Don’t Let It Slide

If you don’t protest, your assessed value becomes the default for this year and likely the baseline for future assessments. That can lead to higher tax bills for years to come, even if your home’s value stabilizes or declines. Taking action now protects not just your wallet today, but your long-term financial stability as well.

How We Make The Protest Process Work For You

At Texas Tax Protest, we understand how overwhelming property tax assessments can feel especially when your home or commercial property has been overvalued. That’s why our team is dedicated to making the protest process as smooth and effective as possible for Texas property owners.

Expertise That Works For You

We stay on top of Austin’s rapidly changing market and understand the valuation methods used by local appraisal districts. With this knowledge, we can identify when a property’s assessed value is off-base and build a strong, data-backed case to challenge it.

A Streamlined, Stress-Free Process

You don’t need to navigate confusing paperwork, deadlines, or appeal procedures on your own. From filing your protest to representing you before the Appraisal Review Board, we handle the entire process so you can focus on your life, not your tax bill.

Proven Results For Texas Property Owners

We’ve helped thousands of Texans reduce their property tax burdens, often saving clients hundreds, sometimes thousands, of dollars per year. Whether it’s your first time protesting or you’ve been through it before, Texas Tax Protest will advocate for your property’s fair treatment every step of the way.

Final Thoughts

Austin’s housing market continues to evolve, bringing both opportunity and uncertainty for property owners. Whether prices are rising rapidly or leveling out, one thing remains constant: your property tax bill is directly tied to how your home is valued, not by you, but by the county.

That’s why it’s so important to stay informed, review your assessment carefully, and take action when something doesn’t add up. You don’t have to be an expert in Texas property tax law to stand up for your rights, you just need to know when to ask for help.

At Texas Tax Protest, we’re here to guide you through that process, simplify the system, and advocate for the fair, accurate valuation your property deserves. In a market as dynamic as Austin, having a knowledgeable partner by your side can make all the difference, not just this year, but every year.

Frequently Asked Questions About Austin Housing Market

What makes the Austin housing market different from other Texas cities?

Austin’s housing market is heavily influenced by the tech industry, a younger population, and a culture-driven economy. Unlike many other Texas cities, Austin attracts a high number of remote workers and out-of-state buyers, which creates sustained upward pressure on housing demand.

Is it a good time to buy a home in Austin in 2025?

It depends on your goals. While the pace of price increases has slowed, demand remains strong in key neighborhoods. If you’re planning to stay long-term and have a stable financial situation, 2025 may offer more negotiating room compared to peak frenzy years.

How are interest rates affecting the Austin housing market in 2025?

Higher interest rates have tempered some buyer enthusiasm, but Austin’s strong job market continues to offset that effect. In fact, many buyers are using higher rates as leverage for price reductions or seller concessions, particularly in less competitive areas.

Are property tax increases affecting investor interest in Austin?

Yes, rising property taxes are part of the cost calculus for investors, especially in single-family rental markets. However, Austin remains attractive due to long-term appreciation potential and rent growth, keeping institutional and private investors in play.

Which types of properties are seeing the most growth in Austin right now?

Multi-family developments, especially in outer-ring neighborhoods and transit-accessible corridors, are seeing notable growth. There’s also strong demand for energy-efficient and smart-tech-equipped homes across price ranges.

How are infrastructure projects influencing the housing market in Austin?

New highways, transit expansions, and utility upgrades are opening up previously overlooked areas for development. These infrastructure improvements are driving new growth corridors and gradually redistributing demand outside the urban core.